As global markets navigate complex conditions marked by fluctuating interest rates and uneven economic indicators, investors are closely monitoring developments that could impact their portfolios. In this environment, growth companies with high insider ownership can be particularly attractive, as high insider ownership often indicates confidence from the people who know best about a company’s future prospects.

Top 10 growing companies with high insider ownership

|

name |

Insider Ownership |

Revenue Growth |

|

Arctec Solar Holdings (SHSE:688408) |

38.6% |

25.8% |

|

Medley (TSE: 4480) |

34% |

28.7% |

|

Gaming Innovation Group (OB:GIG) |

26.7% |

36.9% |

|

Sojin System Co., Ltd. (KOSDAQ: A178320) |

27.9% |

48.1% |

|

Clinuvell Pharmaceuticals (ASX:CUV) |

13.6% |

26.6% |

|

Plenty Group (ASX:PLT) |

12.8% |

106.4% |

|

CREDO Technology Group Holdings (NasdaqGS: CRDO) |

14.7% |

60.9% |

|

Caliditas Therapeutics (OM:CALTX) |

11.6% |

52.9% |

|

UTI (KOSDAQ: A179900) |

34.1% |

122.7% |

|

EHang Holdings (NasdaqGM:EH) |

32.8% |

74.3% |

To see the complete list of 1,451 stocks from our “Fastest Growing Companies with High Insider Ownership” screener click here.

Let’s select some of the screener results and explore them.

Simply Wall St Growth Rating: ★★★★★☆

overview: Nam Long Investment Corporation operates in Vietnam’s real estate sector and has a market capitalisation of around Rs 16.93 billion.

operation: The company derives its revenue primarily from real estate operations and development, which totals about N3.15 billion.

Insider Ownership: 21.9%

Despite a recent net loss of VND76.85 billion and a reduction in quarterly sales from VND235.13 million to VND204.64 million, Nam Long Investment is expected to see strong growth, with profits and revenues expected to increase by around 29% annually over the next three years. This growth is above the overall Vietnamese market forecast of 18.2% for profits and 16.8% for revenues, signaling potential recovery and expansion in the coming years. However, expected return on equity remains low at around 7.3%.

Simply Wall St Growth Rating: ★★★★☆☆

overview: Kossan Rubber Industries Bhd is a Malaysia-based investment holding company specialising in the manufacturing and international distribution of latex disposable gloves, with a market capitalisation of approximately RM6.28 billion.

operation: The company generated revenue from three main segments: latex disposable gloves generated RM1.35 billion, cleanroom products generated RM102.09 million and technical rubber products generated RM197.38 million.

Insider Ownership: 14.2%

Kossan Rubber Industries Bhd has seen strong revenue growth of 61.6% over the past year and is expected to maintain a strong growth rate of 38.68% per year. Despite large one-off items impacting the financial results, revenue is expected to outperform the Malaysian market with an annual increase of 18.5%. However, expected return on equity is relatively low at 5.5%. Recent developments include the determination of dividends and a significant improvement in quarterly net profit and sales from last year’s losses.

Simply Wall St Growth Rating: ★★★★☆☆

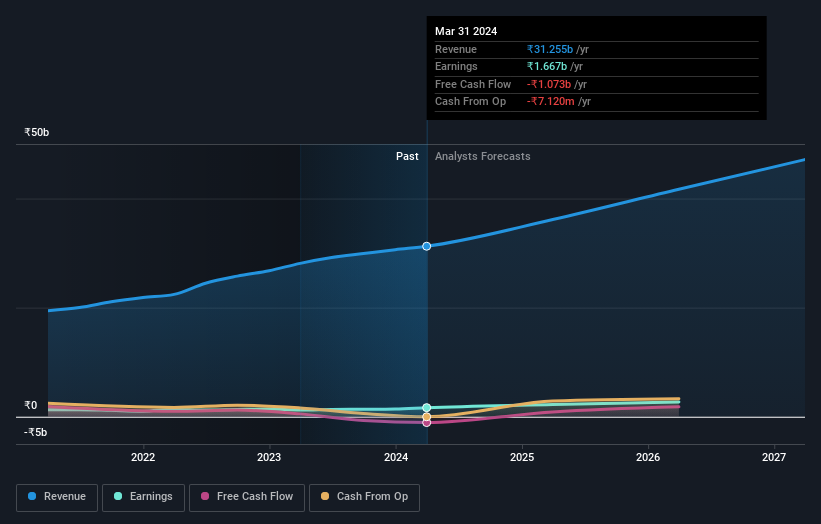

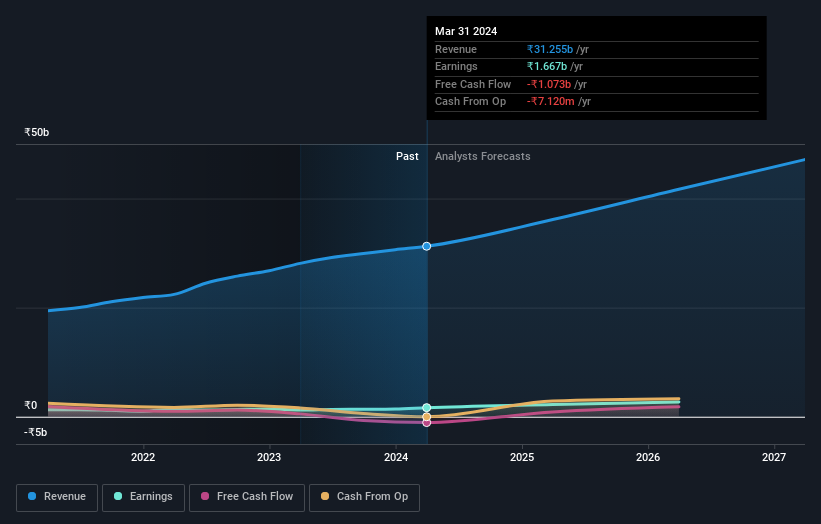

overview: Dodla Dairy Limited is engaged in the production and sale of milk and dairy products in India and abroad and has a market capitalisation of approximately Rs 674 crore.

operation: The company derives its revenue primarily through the sale of milk and dairy products, which totals around Rs 31.25 billion.

Insider Ownership: 26.7%

Dodla Dairy Limited has seen significant insider trading recently, signaling promising growth prospects for the future. The company has reported a strong revenue increase of 36.4% over the past year and expects this trend to continue with a projected annual revenue growth rate of 23.86%. While return on equity is low at 17.2%, recent strategic moves such as the opening of a new production facility indicate potential for sustained expansion. Insider activity and consistent financial performance underscore the company’s position in the market, balancing some financial metrics that are lagging benchmarks with growth potential.

Next steps

Looking for other investments?

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Please note that our analysis may not factor in the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned. This analysis only considers shares directly held by insiders. It does not include shares indirectly owned through other vehicles such as corporations or trust companies. All forecast revenue and profit growth rates quoted are expressed as 1-3 year annualized growth rates.

Companies featured in this article include HOSE:NLGKLSE:KOSSANNSEI:DODLA.

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com