This year marks an important milestone for the financial world.Number The anniversary of the founding of the investment trust.

These multipurpose investments have made it much easier and more economical for Americans, especially those in the middle class, to invest in areas such as stocks, bonds, real estate, commodities, and foreign markets.

These funds have stood the test of time, weathering recessions, wars and other turmoil, and have been a mainstay in retirement accounts, especially since the first fund, Massachusetts Investors Trust, was founded in 1924.

“Mutual funds have played a pivotal role in democratizing investing, enabling 116 million Americans to participate in financial markets,” Sean Collins, chief economist at the Investment Company Institute, a trade group for the fund industry, said in a statement. “The growth and evolution of mutual funds over the past century is a testament to their enduring appeal and the confidence investors place in them.”

How popular are mutual funds?

If you’re a middle-class investor, you probably own one or more funds.

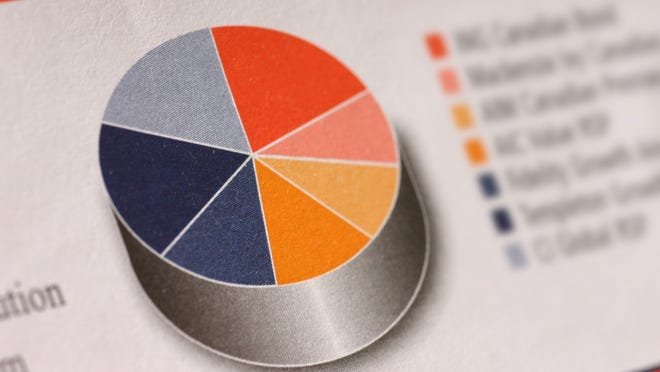

More than 71 million households, or 54% of the total, own at least one fund, according to the institute. The institute tracks a wealth of data on the industry in its 2024 Factbook at icifactbook.org. Retirement accounts, especially 401(k) programs, are a popular way for younger investors to get familiar with them. A typical 401(k) plan offers around a dozen options. The average investment for a household with a fund is $125,000, spread across three options.

Alan Norris, a Phoenix-based certified financial planner and certified investment fiduciary, agreed that the market has become more accessible: “It’s opened up the door for people (in the Midwest) to benefit from a broader range of investments.”

They also have a major influence on financial markets. According to the institute, the funds hold about 33% of U.S. stocks, 22% of U.S. and foreign corporate bonds, and 27% of municipal bonds. The funds make these purchases with relatively small investments from millions of people.

Investment Details:Whether it makes sense to combine pensions and mutual funds.

Are funds popular in other countries?

Although the fund industry is global, the popularity of these investments is not as pronounced in other countries as it is in the U.S. Americans are more open to these investments than people in most other countries.

For example, Americans have almost twice as much invested in mutual funds as they have in bank accounts or currency holdings, while in Japan the ratio is 53 to 5. Citizens of the European Union have about three times as much in bank accounts and currency holdings as they have in funds.

As of the end of 2023, Americans will hold $33.6 trillion in fund assets, compared with $35.3 trillion held by citizens of all other countries combined. Households, which are individual investors rather than corporations or institutions, hold 88% of U.S. fund assets.

Have mutual funds become more profitable?

Generally speaking, yes.

The most striking evidence of this is the dramatic decline in costs borne by investors: today, the majority of funds are sold without commission or fees paid to brokers.

In past decades, it was common for funds to charge fees of up to 8.5%, but no-load funds have become the norm: About 92% of long-term funds are now sold without a sales charge or associated fees called 12b-1 fees, double the 46% that were there in 2000.

There has also been a decline in ongoing fees charged by fund companies to pay portfolio managers and oversee shareholder services.

In 2000, the typical expense for a stock fund was 0.99 percent, or about $9.90 for every $1,000 invested; today it’s 0.42 percent, or $4.20 for every $1,000 invested. Bond funds have declined as well, dropping from 0.76 percent in 2000 to 0.37 percent last year. Investor costs have fallen as funds have gotten bigger and there’s more competition, Norris says.

The figures above are for regular, or “open-end,” funds. Another type of fund called an ETF, or exchange-traded fund, reduces costs even further. In 2023, a typical stock ETF cost 0.15%, and a typical bond ETF cost 0.11%. ETFs have lower costs because they tend not to be as actively managed as regular mutual funds.

Another category, called index funds, are regular funds or ETFs and tend to have lower ownership costs: Index funds buy and hold the same stocks that are included in a market index, such as the Standard & Poor’s 500 or S&P 500, but have lower trading and management costs.

Are mutual funds risky?

Yes, in the sense that it can result in losses for investors.

When the prices of stocks or bonds fall, the mutual funds that hold them quickly fall as well. But because a fund may hold dozens, hundreds, or even thousands of stocks or bonds, this diversification significantly reduces risk: the failure of one or a few companies will not wipe out the entire fund.

Money market funds are a separate category, and don’t offer the same deposit insurance as bank accounts. But even here, the safety record is nearly perfect. Money funds usually hold short-term debt issued by corporations, banks, the U.S. Treasury, or various state and city governments. The IOUs held by the funds tend to be of high credit quality and have very short maturities, reducing risk because the issuers have less time to get into trouble.

The fund industry, including money funds, has thrived for a century without any direct support from the federal government, which may be its greatest achievement at a time when everyone seems to be looking to the U.S. government for help.

Contact the author at russ.wiles@arizonarepublic.com.