The market recovery from the 2022 bear market was not only unexpected, but also larger than expected. S&P 500 It’s still up 60% from the bear market lows, even though a recovery wasn’t clearly in sight at the time, and it’s likely you missed out on at least part of this current rally.

If so, don’t beat yourself up. You’re in good company, and you’re far from financially ruined. You can’t go back and recapture missed opportunities, but there is potential for even greater gains ahead for long-term investors.

But if you don’t want to miss out on the next big bull market, you might want to change your strategy a bit: buy fewer stocks this time and focus instead on exchange-traded funds (ETFs), which often offer an easier way to stay invested when the broader market turns volatile.

So let’s take a closer look at three very different ETFs you should consider buying that can, overall, make your portfolio perfect.

Let’s start with the basics: Dividend growth

Naturally, most investors prioritize growth and choose growth stocks to achieve this goal. And this strategy usually works. But what most true long-term investors don’t realize is that the same kind of net income can be achieved with boring dividend stocks that are available in the stock market. Vanguard Dividend Growth ETF (NYSE:MKT:VIG) this is S&P US Dividend Growth Index.

As the name suggests, this Vanguard fund and its underlying index hold stocks that not only pay regular dividends but also have a track record of regularly growing their dividends. To be included in the S&P U.S. Dividend Growth Index, a company must have increased its dividend every year for at least the past 10 years, but most have been doing so for much longer than that.

The ETF’s current dividend yield of just under 1.8% is certainly unattractive. In fact, the yield is so low that investors may wonder whether the fund will ever be able to keep up with growth stocks, let alone the market as a whole. What’s greatly underestimated here is the sheer magnitude of dividend growth for these stocks: Over the past decade, dividends per share have nearly doubled and more than tripled from what was paid 15 years ago.

The reason is that stocks with stable dividends are generally do They outperform companies that don’t pay dividends. According to a Hartford analysis of the numbers, since 1973, S&P 500 stocks with the longest dividend growth rates have boasted average annual gains of just over 10%, while non-dividend paying companies have posted a much lower annual return of 4.3%, and an equal-weighted version of the S&P 500 index has averaged just 7.7%. The numbers underscore the importance of reliable, steady income.

Also include capital appreciation through technology.

That being said, there’s no real reason why you can’t include stocks in your portfolio that have the potential to explode in value more than your dividend-focused holdings, assuming you can tolerate the volatility that’s likely to continue. Invesco QQQ Trust (Nasdaq: QQQ).

This Invesco ETF (also known as the “Cube” or Triple Q) Nasdaq 100 Generally, this index is calculated as Nasdaq Composite IndexIt is the largest list of non-financial stocks in the world at the time. The index is updated quarterly, but unscheduled rebalancing of the index is subject to change in the event of extreme imbalances.

But that alone doesn’t make the fund a must-have for many investors, and most of the fastest-growing tech companies are Nasdaq Stock Exchange More than other exchanges New York Stock Exchange or American Stock ExchangeNames like . apple, Microsoftand NVIDIA It’s not just stocks listed on the Nasdaq, it’s also the primary holding of this ETF. Amazon, Meta Platformand Google’s parent company alphabetOf course, these are many of the stocks that have generated the most gains in the market over the past few years.

This isn’t always the case – just as companies like Nvidia and Apple have pushed other stocks out of the index to make room for their own shares, the current top stocks may eventually be replaced by others (though it will likely take a while for that to happen). This is truly a market cycle.

But this replacement will likely come from and thanks to technology companies that create innovative products and services. Holding shares in the Invesco QQQ Trust is a simple, hassle-free way to invest in at least most of the stock market at the ideal time.

Don’t forget to index, let’s try another method

Finally, while Triple Q and Vanguard Dividend Appreciation Fund are smart ways to diversify a long-term portfolio, good old-fashioned indexing strategies still work: instead of trying to outperform the market and risking underperforming it, be content to simply match the long-term performance of a broad market index.

Most investors would choose something like this: SPDR S&P 500 ETF Trust (NYSE: SPY)This, of course, mirrors the S&P 500 large-cap index. If you already own it, keep holding it.

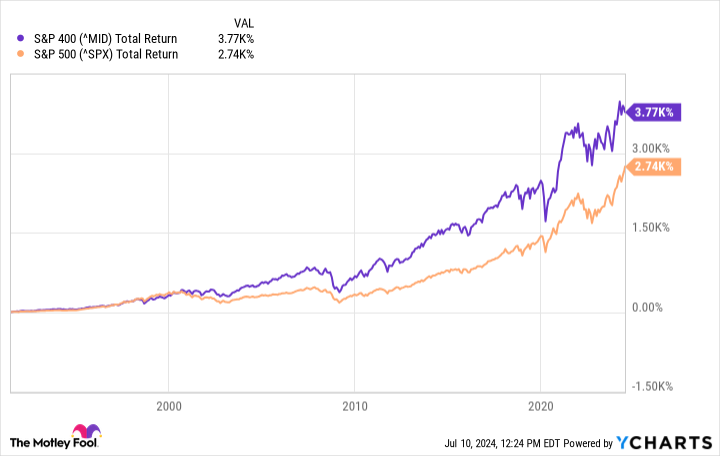

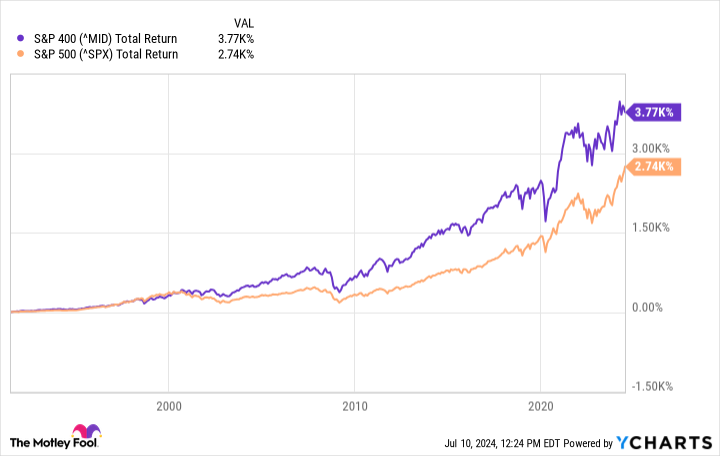

However, if you have some spare cash to put to work, you may want to consider investing in a mid-cap fund. iShares Core S&P Midcap ETF (NYSE: IJH) Instead, I recommend this ETF. Why? Because it is more likely to perform better than a large-cap index fund. Over the past 30 years, S&P 400 Mid-Cap Index It has significantly outperformed the S&P 500.

The varying degrees of profitability actually make sense. There’s no arguing that most S&P 500 companies are built on solid foundations, but in many ways they are victims of their own size. It’s hard to get bigger when you’re already big. This contrasts with the mid-sized companies that make up the S&P 400 Mid Cap Index. These companies have just entered a period of rapid growth after a difficult and shaky early period. Not all companies survive this stage, but the majority are. Advanced Micro Devices and Super Microcomputer that do Survival will be a huge win for patient shareholders.

Should I invest $1,000 in iShares Trust – iShares Core S&P Mid-Cap ETF right now?

Before purchasing shares of iShares Trust – iShares Core S&P Mid-Cap ETF, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy now… and iShares Trust – iShares Core S&P Mid-Cap ETF was not among them. The 10 stocks selected have the potential to generate big gains over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That works out to $791,929.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of July 8, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. James Brumley owns shares of Alphabet. The Motley Fool owns shares of and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Vanguard Specialized Fund – Vanguard Dividend Appreciation ETF. The Motley Fool recommends Nasdaq and recommends buying Microsoft’s January 2026 $395 calls and selling Microsoft’s January 2026 $405 calls. The Motley Fool has a disclosure policy.

Missed the bull market recovery? 3 ETFs that will help you build wealth for decades. Originally published by The Motley Fool