Rae Wee looks ahead to European and global markets

European stocks got off to a rocky start on Friday, rocked by escalating tensions in the Middle East, with futures posting their steepest daily decline in months.

Comments by Israeli Prime Minister Benjamin Netanyahu that his country would harm “those who harm us or who plan to harm us” stoked fears of a wider war. Israel is bracing for possible retaliatory strikes for what appears to be Israel’s airstrike on the Iranian embassy on Monday.

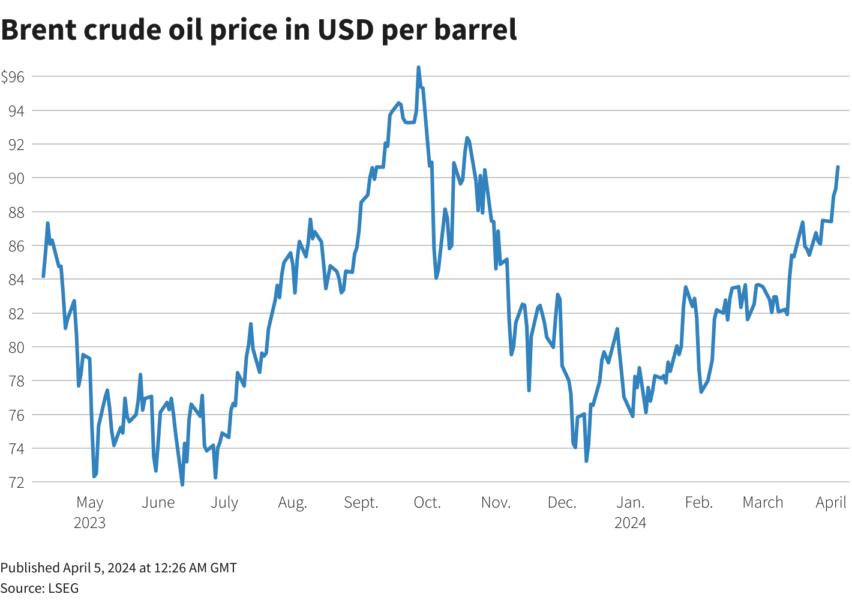

That took the shine off Wall Street’s late-autumn run on Thursday, sending Asian stocks into the red and sending oil prices soaring.

Europe is unlikely to be spared either, thanks to Euro STOXX50 Index futures. FESX1! It has already fallen more than 1.5%, which is a big price movement in Asian time.

UK FTSE futures Zwan! It also fell by more than 1.4%.

The risk of a protracted war between Israel and Hamas, once overshadowed by global support for interest rate cuts, has resurfaced. This is proving to be a wild card for central bankers as markets reassess expectations for the Federal Reserve to cut interest rates this year.

Neel Kashkari, the famously hawkish Minneapolis Fed president, has gone so far as to say that there may not even be a need for rate cuts this year if inflation continues to stagnate.

brent futures BRN1! Levels above $90 per barrel are also probably not grounds for easing.

All of this comes ahead of important U.S. jobs data later on Friday, which could make or break the Fed’s first rate cut in June, and appears to be a cat-and-mouse game.

A surprise increase in U.S. manufacturing earlier in the week pushed the dollar to a four-month high as traders exited bets on an impending Fed easing cycle, but days later the U.S. services sector’s The government retreated after a lackluster investigation.

Friday’s figures showed non-farm payrolls expected to rise by 200,000 jobs in March, providing preliminary evidence that labor market conditions in the world’s largest economy are easing, albeit at a slower pace. There are also signs to be expected.

Key developments that may affect the market on Friday:

– Eurozone retail sales (February)

– German import prices (February)

– Resumption of 1-month, 3-month and 6-month UK government bond auctions

– U.S. non-farm payrolls (March)