So-called “meme stocks” are making waves again after taking the stock market by storm in 2021. Shares of video game retailer GameStop saw wild swings after one of the 2021 meme stock trend leaders, Roaring Kitty, went live on YouTube last week in the middle of the company’s early earnings report. With this latest investment surge, how interested are investors in meme stocks?

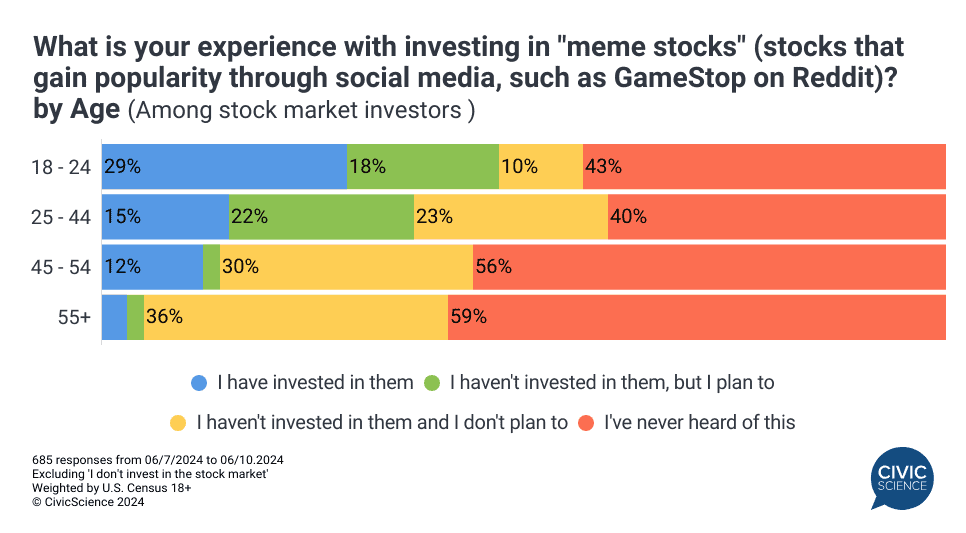

According to CivicScience data, 11% have invested in meme stocks, while 10% haven’t yet but plan to. Still, nearly half (48%) of stock investors have never heard of the concept of memes, and 31% say they are aware of them but aren’t interested. Gen Z adults are more likely to have invested, while millennials are more likely to be interested in investing.

Weighs: Do you think “meme stocks” will continue to feature prominently in the stock market?

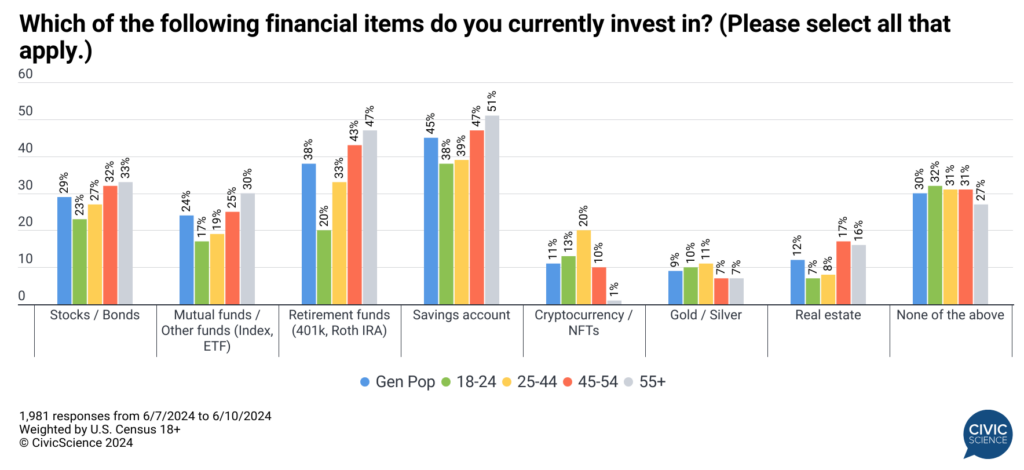

Although investment is declining, retirement funds and savings accounts continue to lead the way.

Despite the meme stock boom, a look at American investment portfolio data shows that the percentage of people invested in stocks and bonds has fallen by five percentage points since 2022. In fact, the data shows that the number of Americans with most types of investments has also declined over the past two years. The most common types of investments Americans have are savings accounts and retirement accounts, with retirement accounts declining by eight percentage points since 2022. This is happening at a time when Americans have recently become less optimistic about the prospects for both short-term savings and retirement. Cryptocurrencies and NFTs are the least popular investments, but they stand out as one of the few investment types that have increased over the past two years.

How Americans invest varies considerably depending on their age. For Gen Z adults, retirement may still feel like a long way off, or they may not yet have a job with a retirement account, so they may be much less likely to invest in retirement. The second most common type of investment after savings accounts is stocks and bonds. Millennials are most likely to invest in cryptocurrencies, gold, and silver. Gen X leads the way in terms of real estate investments, while Baby Boomers lead the way with stocks, savings, and, naturally, retirement accounts.

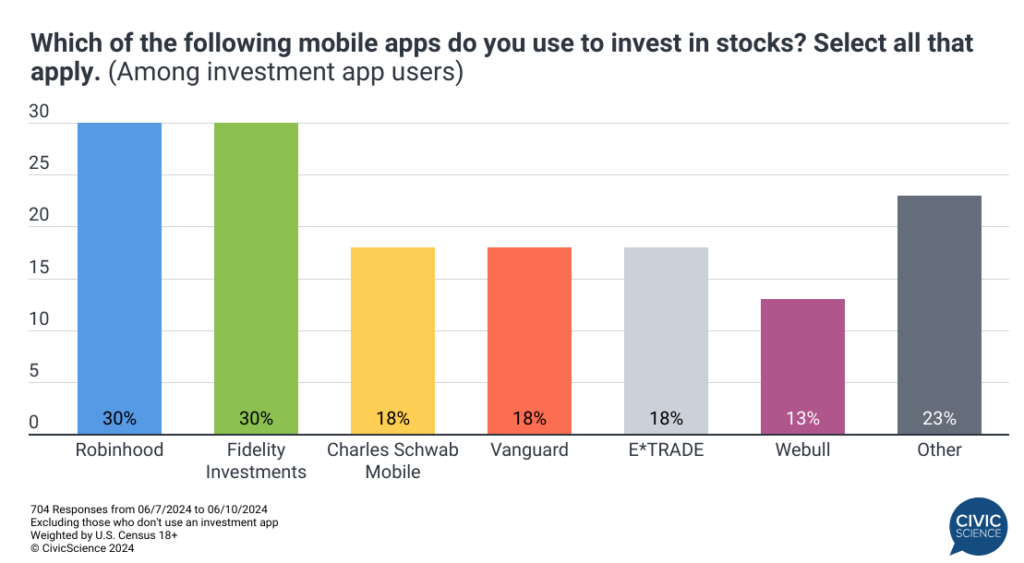

Robinhood and Fidelity stand out as the leading mobile investing apps.

Despite his potentially rocky relationship with the company, chief meme stock trader Keith Gill is an E*Trade user, which raises the question: which apps are investors using to invest? CivicScience data shows that 35% of investors report using mobile apps to invest. Among these users, Fidelity Investments (30%) and Robinhood (30%) are the most common choices. Outside of that, investors are about evenly split across a variety of high-profile options.

Please take our survey: Do you use Robinhood or a similar investing app?

Where do investors go when they need advice on how to invest?

- Despite being a driving force in the meme stock trend, Among advice-seeking investors, only 6% say social media is their primary source of advice – this jumps to 23% among Gen Z adults ages 18-24.

- Most people who seek advice prefer to talk to a financial professional (30%), friends or family (23%), or a bank or other financial institution (15%).

- 14% of people seeking investment advice report relying on online sources other than social media, with those over 45 years old being the most likely to use this method for investment advice.

While meme stocks have captured the attention of younger investors and sparked market excitement, for now they appear to be only a niche interest within the overall investing landscape. Despite near-universal investing, traditional investments like retirement funds and savings accounts remain mainstream among Gen Pop. Still, the case of stocks like GameStop shows the power and influence that social media has, as younger Americans have easy access to mobile apps like Robinhood, easing their entry into the stock market.

Want deeper consumer insights that we don’t expose? CivicScience clients have access to our InsightStore™ database of over 500,000 crossable polling questions to see trends emerge in real time. Contact us today to discover your insights.