The funding will be used to support early-stage businesses, particularly entrepreneurs who don’t have access to traditional funding avenues.

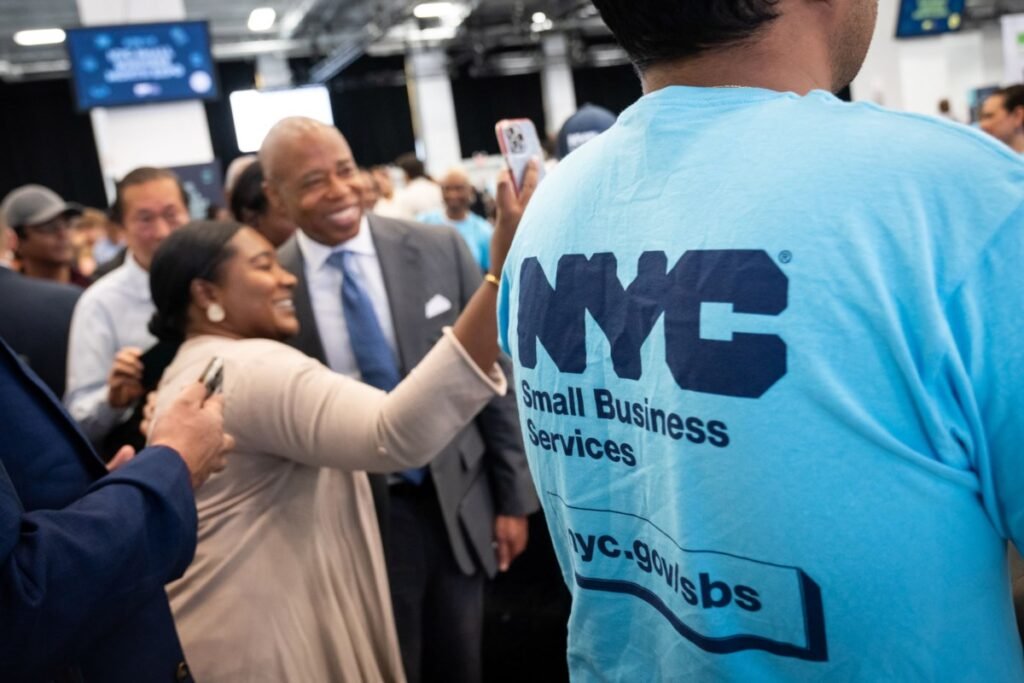

New York City Mayor Eric Adams and New York City Department of Small Business Services (SBS) Commissioner Kevin D. Kim announced that the City will invest $10 million into the City’s next Large Small Business Lending Fund.

According to a news release, the NYC Future Fund will accelerate the growth of hundreds of new small businesses in New York City by addressing disparities in access to affordable capital faced by small business owners, particularly early-stage businesses, as well as Black, Indigenous, People of Color (BIPOC) and women entrepreneurs, who often lack access to traditional bank financing.

According to a new report on small business growth in New York City, New York City is currently home to more small businesses than at any time in recorded history. As of 2023, there are 183,000 small businesses in the city, more than 1,000 more than pre-pandemic levels. Additionally, the report found that 62,000 small businesses were created in the past two years alone, accounting for one-third of the city’s small businesses.

While new business formation remains concentrated in Manhattan’s central business districts, including Midtown Manhattan, northern Brooklyn continues to lead the city’s small business recovery, adding 1,000 small businesses since 2019.

“When we create an environment where small businesses can succeed, our entire city wins,” Adams said. “By focusing on three core principles of our vision — protecting public safety, rebuilding our economy and making our city more livable for working class New Yorkers — the number of small businesses has reached an all-time high under my Administration. As we close out NYC Small Business Month with a $10 million commitment to create a new fund to help small business owners access capital, we will continue to support the city’s 200,000 small businesses that are the lifeblood of our economy.”