Every investor on the planet makes bad decisions from time to time. However, problems arise when you are faced with huge losses from time to time. So please take a moment to sympathize with long-term shareholders. Materialize NV (NASDAQ:MTLS) stock has soared 78% in three years. That may, to say the least, raise serious questions about the merits of the initial decision to buy the stock. More recent buyers have also struggled, with stocks down 39% last year.

It’s worth assessing whether the company’s economic performance is keeping pace with these overwhelming shareholder returns, or if there are any discrepancies between the two. So let’s just do that.

Check out our latest analysis for Materialize

To paraphrase Benjamin Graham, in the short term the market is a voting machine, but in the long term it is a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can learn how investor attitudes to a company have changed over time.

During five years of stock price growth, Materialize went from a loss to a profit. Typically, the expectation is that stock prices will rise as a result. So it might be worth checking out other metrics given the share price drop.

In fact, the share price decline doesn’t seem to be driven by earnings, either, as earnings are up 13% over three years. It may be worth investigating materialization further. This analysis may be missing something, but there may be an opportunity.

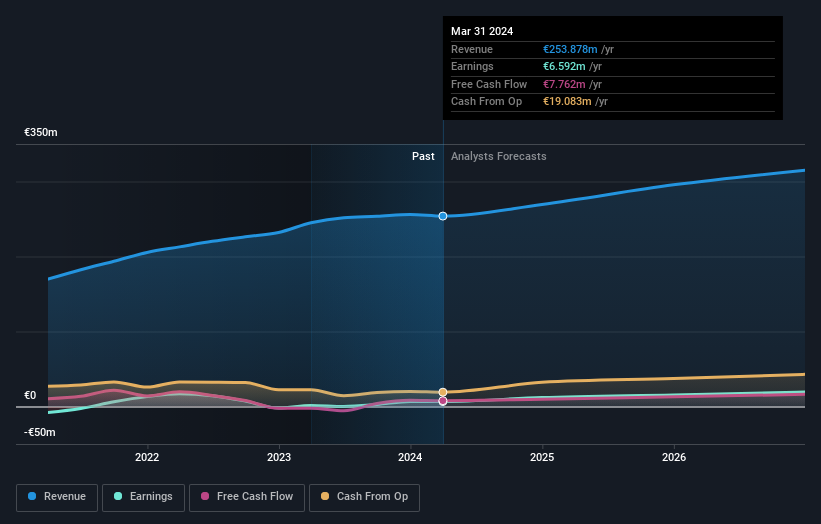

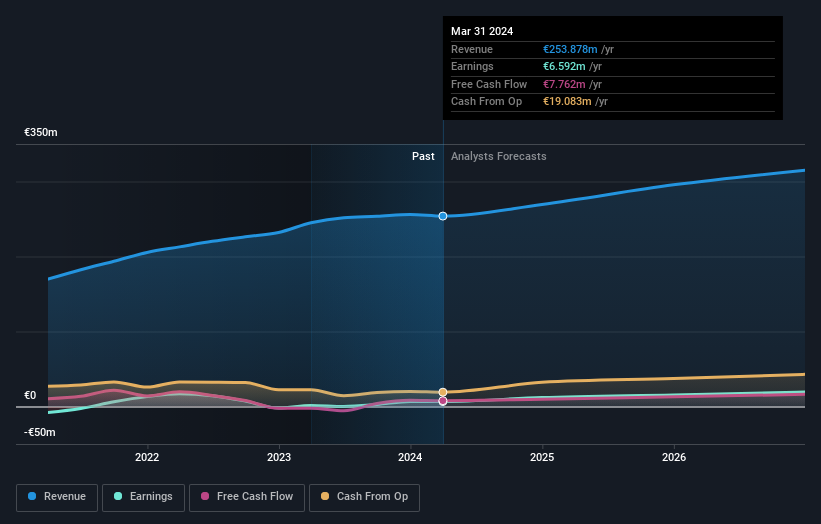

The company’s earnings and revenue (long-term) are depicted in the image below (click to see the exact numbers).

We know that Materialize’s earnings have improved recently, but what does the future hold? If you’re thinking of buying or selling Materialize stock, read on. free A report showing analyst profit forecasts.

different perspective

Investors in Materialize have had a tough year, with a total loss of 39% versus a market gain of around 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year’s performance ended on a down note, with shareholders facing a total annual loss of 11% over five years. Generally speaking, long-term stock price weakness can be a bad sign, but contrarian investors may want to research the stock in hopes of a turnaround. It’s always interesting to track stock performance over the long term. However, to better understand materialization, many other factors need to be considered. For example, consider the ever-present fear of investment risk. We’ve identified 1 warning sign Understanding these should be part of your investment process.

of course Materialize may not be the best stock to buy.So you might want to see this free A collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.