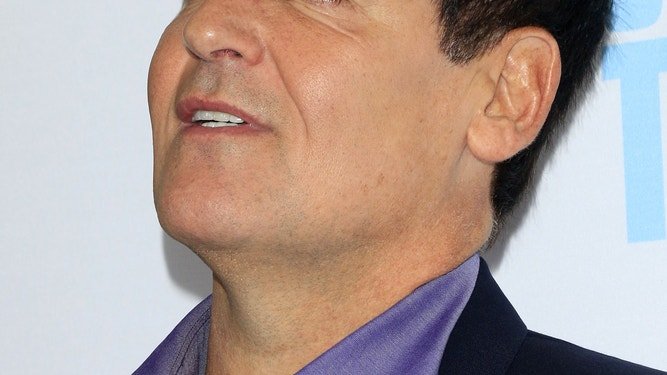

In a WSJ podcast, famous serial entrepreneur Mark Cuban talked about the Mavericks, “Shark Tank,” and even Elon Musk. He also shared some interesting tips for entrepreneurs and investors.

When asked for advice on starting a business, Cuban stressed the importance of preparation: “Preparation is key. It’s not about your dreams. The market doesn’t care about your dreams, right? The market doesn’t care if you think you’re special. The market cares about your product or service and how well you sell it and how happy you are with your customers.”

do not miss it:

In other words, Cuban suggests focusing on what you can control: The market only cares about your product quality, your selling skills, and your customer satisfaction.

Cuban’s suggestion echoes Warren Buffett’s advice on investing in the stock market: “There are all kinds of emotions that come up. The stock doesn’t know that you own it. It’s just there. It doesn’t matter how much you paid for it. It doesn’t care if you own it or not. So any emotions that I have towards the market are not reciprocated. What we’re talking about here is the ultimate callousness.”

Perhaps one of Cuban’s best investments has been the Dallas Mavericks, which he bought in 2000 for about $285 million and agreed late last year to sell 73% of the team for $3.5 billion, with Cuban planning to retain a 27% stake.

However, he can’t seem to remember exactly how many companies he invested in during his time on the TV show “Shark Tank.” “I have no idea. I think it was 23, 24, 25, 20… maybe it was 29 million, but I owned a bunch of companies with market caps of $100 million, $200 million, and I owned 10, 20, 30 percent of them. So even if I only invested 29 million in total, I made a lot of money.”

trend: Warren Buffett once said, “Unless you find a way to make money while you sleep, you’ll be working until you die.” Boasting yields between 7.5% and 9%, these high-yield real estate bonds make earning passive income easier than ever.

When asked about pitching to investors and whether giving a long backstory is a bad idea, Cuban responded: “When you start talking about your grandparents and how they came to this country and how your dog died when you were 6 and it scarred you forever and things that aren’t specific to your business, potential investors just listen. What they want to know is what you are today and what you can do, what your company is today and what your company can do.”

Of course, there are many other pieces of advice for aspiring entrepreneurs, such as: “Funding is not an achievement, it’s an obligation.” Securing funding may seem like a big win, but in reality, you have an obligation to use it wisely and deliver results. Investors expect you to grow your business and spend their money well. So true success is about how well you manage and spend your money, achieve your goals, and keep your promises to your investors.

He also said that the most important advice he would give to someone starting a business for the first time is that “sales solves everything.” In other words, if you could just focus on making sales and generating revenue, a lot of your problems would be solved.

Read next:

Up your stock market game with Benzinga Pro, the #1 “News and Everything Else” trading tool in the “Active Investor’s Secret Weapon” – Start your 14-day trial now by clicking here.

Want the latest stock analysis from Benzinga?

The article Mark Cuban Warns Entrepreneurs: ‘It’s Not Your Dream, Because the Market Doesn’t Care’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.