Japanese data center market

DUBLIN, May 21, 2024 (GLOBE NEWSWIRE) — The Japan Data Center Market – Investment Analysis and Growth Opportunities 2024-2029 report has been added. ResearchAndMarkets.com Recruitment.

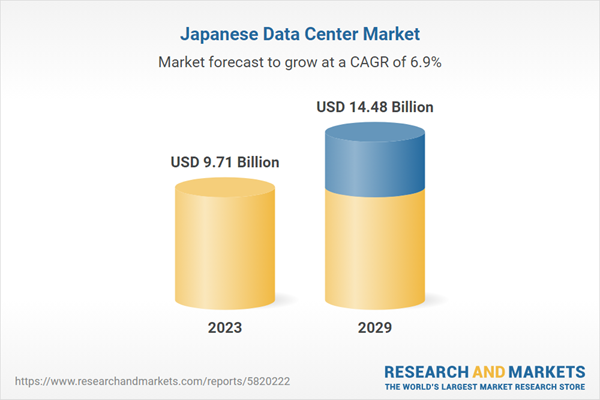

The Japanese data center market is expected to see investments of $14.48 billion by 2029, up from $9.71 billion in 2023, growing at a CAGR of 6.88%.

This report analyzes the data center market share in Japan. In-depth analysis of existing and upcoming facilities and investments in IT, electrical, mechanical infrastructure, general construction and tier standards. It also covers market size and investment estimates for various segments.

Major investors in the Japanese data center market include AirTrunk, AT TOKYO, Colt Data Center Services, Digital Edge, Equinix, Goodman, Princeton Digital Group, MC Digital Realty, NTT Communications, Vantage Data Centers, and ST Telemedia Global Data Centers. , STACK Infrastructure, etc.

Hyperscalers are partnering with real estate developers to build their own self-built data centers, which is estimated to have an impact on the colocation provider industry. For example, Google announced the launch of its first self-built data center facility in the Inzai region of the greater Tokyo area in March 2023. Amazon Web Services announced in January 2024 that it plans to invest $15.2 billion in Japan by 2027 to strengthen its cloud computing infrastructure. The company is looking to expand its data center facilities in both Tokyo and Osaka.

There are approximately 107 colocation data centers operating in Japan, most of which are developed according to Tier III standards. The Japanese data center market has local and global operators such as AirTrunk, AT TOKYO, Colt Data Center Services, Digital Edge, Equinix, Fujitsu, IDC Frontier, Internet Initiative (IIJ), MC Digital Realty, and NTT Communications. To do. , SCSK Corporation (NETXDC), Telehouse, etc.

Japan’s Ministry of Economy, Trade and Industry announced that more than 100 local governments have expressed interest in hosting new data centers and data center decentralization plans. Areas that will be provided as new data center locations include Uki City, Yoshinogari Town, Tottori City, and Nogata City.

The average construction cost per watt in Japan ranges from $10 to $11. Costs will be between $10 million and $11 million per MW, likely an increase of 5% to 7% year over year. GLP, a logistics real estate company based in the APAC region, is one of the new entrants to the Japanese data center market. The company launched a new data center platform, Ada Infrastructure, and planned to invest more than $10 billion (1.5 trillion yen) over the next five years to expand data centers across Japan.

The rollout of 5G networks will boost the region’s digital economy and lead to increased demand for high-bandwidth networking infrastructure. Smart city initiatives undertaken by government agencies are likely to increase the adoption of Software-Defined Networking (SDN).

Why should you buy this study?

-

Market size is available in terms of investment, area, power capacity, and Japan Colocation Market revenue.

-

Assessing data center investments in Japan by colocation, hyperscale, and enterprise operators.

-

Investments in total area (square feet) and power capacity (MW) of the nation’s cities.

-

Detailed study of the existing Japan Data Center market status, thorough market analysis and insightful forecasts on the industry size during the forecast period.

-

Snapshot of existing and upcoming third-party data center facilities in Japan

-

Target facilities (existing): 107

-

Identified facilities (future): 41

-

Coverage: 17+ cities

-

Existing and future (area)

-

Existing and future (IT load capacity)

-

-

Japanese data center colocation market

-

Colocation Market Revenue and Forecast (2023-2029)

-

Wholesale and Retail Colocation Revenue (2023-2029)

-

Retail colocation pricing

-

wholesale colocation pricing

-

-

Investment in the Japanese data center market is categorized into IT, power, cooling, and general construction services, with size and forecast provided.

-

This report comprehensively analyzes the latest trends, growth rates, potential opportunities, growth constraints, and prospects of the industry.

-

This section provides business overviews and product offerings of the industry’s prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors.

-

Transparent research methodology and analysis of industry demand and supply aspects.

Answers to key questions

-

What are the factors driving the Japanese data center market?

-

How many MW of power capacity will be added across Japan between 2024 and 2029?

-

What is the growth rate of the Japanese data center market?

-

How many existing and upcoming data center facilities are there in Japan?

-

How big is Japan’s data center market?

-

Who are the key investors in the Japan data center market?

Key attributes:

|

report attributes |

detail |

|

number of pages |

173 |

|

Forecast period |

2023-2029 |

|

Estimated market value in 2023 (USD) |

$9.71 billion |

|

Projected market value to 2029 (USD) |

$14.48 billion |

|

Compound annual growth rate |

6.8% |

|

Target area |

Japan |

Vendor scenery

IT infrastructure provider

Data center construction contractors and subcontractors

supporting infrastructure provider

Data Center Investors

-

air trunk

-

alibaba cloud

-

Amazon Web Services

-

at tokyo

-

Colt Data Center Services

-

digital edge

-

Equinix

-

Fujitsu

-

a good man

-

Google

-

IDC Frontier

-

Internet Initiative (IIJ)

-

MC Digital Realty

-

microsoft

-

NTT Communications

-

SCSK Corporation (NETXDC)

-

telehouse

-

Tencent Cloud

-

TIS INTEC Group

new entrant

Existing vs. Future Data Center

Existing facilities in the area (area and power capacity)

List of future facilities in the area (area and power capacity)

Report scope

IT infrastructure

-

server

-

storage system

-

network infrastructure

electrical infrastructure

mechanical infrastructure

Cooling System

-

CRAC and CRAH units

-

chiller unit

-

Cooling towers, condensers, dry coolers

-

Economizer and evaporative cooler

-

Other cooling units

General construction industry

-

Core and shell development

-

Installation and commissioning service

-

engineering and architectural design

-

Fire detection and extinguishing system

-

physical security

-

Data Center Infrastructure Management (DCIM)

Tier Standard

-

Tier I and Tier II

-

Tier III

-

Tier IV

geography

For more information on this report, please visit: https://www.researchandmarkets.com/r/xz7bwe

About ResearchAndMarkets.com

ResearchAndMarkets.com is a leading global source of international market research reports and market data providing up-to-date data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900