Important points

- Berkshire Hathaway, Third Point and other institutional investors are expected to file their first-quarter 13F forms by Wednesday.

- Berkshire has already announced that it has reduced its position in Apple and exited its position in Paramount in an effort to shore up cash reserves.

- AI is once again a major trend to watch, and investors will be watching for changes in their holdings in AI-focused tech companies, chipmakers, and other companies related to emerging technologies. .

- Nvidia will be another company to watch as an investment, along with filing positions in stocks like Arm and SoundHound.

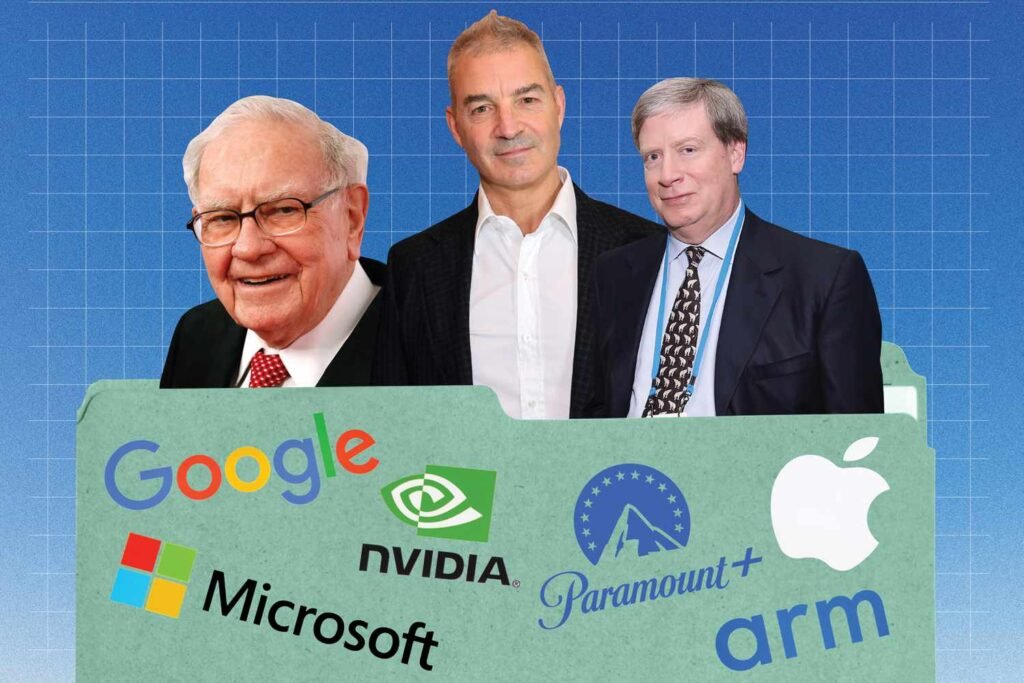

If you’re looking for investment wisdom from major investors like Warren Buffett and Dan Loeb, you’ll want to pay close attention to this week’s 13F filings. This will reveal how their stock positions changed from the beginning of the year to the end of the year. The end of March.

Most large investors with more than $100 million in assets under management are required to report their stock holdings quarterly on the SEC’s Form 13F. The deadline for filing these for the March quarter is his May 15th.

However, keep in mind that the 13F filing is only a snapshot of the portfolio at the end of the March quarter and does not provide any insight into the price at which the investments were made or the gain or loss on sale. Additionally, transactions since March are not considered in these returns, so they may not accurately represent your current portfolio.

Will Buffett make further changes following Apple and Paramount?

At the recent Berkshire Hathaway (BRK.A, BRK.B) annual shareholder meeting. Warren Buffett has revealed that he has made two changes to his company’s portfolio, and investors will be curious to see if there are any more changes. The company will especially want to know details about a mysterious stock investment that it has kept under wraps for nearly two filing cycles.

The company has shed its stake in Apple (AAPL) for two consecutive quarters, but it remains Berkshire’s largest holding. Berkshire’s Apple position was worth $135.4 billion at the end of the first quarter, compared to $174.3 billion at the end of 2023, according to Berkshire’s filing. This is a decrease in value of about 22%, while Apple’s price ultimately fell by only about 11%. March trading day compared to December’s last trading day.

The sale is tied to Buffett’s desire to add to the company’s already huge $189 billion cash reserves, which he expects to grow to more than $200 billion by the end of the second quarter. Expect. Investors may want to note whether Buffett sold shares in other companies to raise cash last quarter.

But there was one investment that didn’t work out for Berkshire, and it was a rare mistake on Buffett’s part. He acknowledged at the annual meeting that Berkshire had sold its entire position in Paramount Global (PARA) at a significant loss. The company purchased Paramount stock in the first quarter of 2022 and held 63.3 million shares at the end of last year.

Loeb falls back in love with the alphabet on AI’s potential

Dan Loeb’s Third Point Capital sold all of its shares in Alphabet (GOOG) (GOOGL) in the fourth quarter of 2023. But Loeb appears to have changed his mind.

In a recent letter to investors, Loeb said that Third Point made a “significant investment” in Alphabet in the first three months of this year, and that artificial intelligence benefits for the company will continue to grow as AI becomes a core business. He added that the risks may outweigh the risks posed.

Alphabet has “significant distribution and technology advantages over its competitors and is well positioned to leverage its AI capabilities to integrate and enhance its entire product suite and increase monetization.” writes Loeb.

Of course, investors will want to know how big Loeb’s new position at Alphabet is, but they’ll also want to know details about his other AI-related investments, which currently make up about half of his overall portfolio.

Third Point ups its holdings in Taiwan Semiconductor Manufacturing (TSM), and Loeb specifically points to legacy technology companies like Microsoft (MSFT) and Amazon (AMZN) as key players in the AI race, and likely suggested that these companies are worthy of attention in the AI competition. Future 13F filing. The fund sold stakes in all three companies in the fourth quarter.

Nvidia: Investments and Investors

No conversation about AI-related stock investing would be complete without mentioning Nvidia (NVDA). But prominent investors have very different views on investing in tech giants that provide hardware for AI platforms.

For example, Buffett didn’t own a single Nvidia stock as of December, and given his views on AI expressed at the company’s annual meeting, that stance probably hasn’t changed much.

But Ray Dalio’s Bridewater Associates bought a large stake in Nvidia late last year, increasing its holdings nearly sixfold. Investors will want to know whether the fund remains bullish on the chipmaker, or if it has changed its mind like Stanley Druckmiller has.

Mr. Druckenmiller’s Duquesne Family Office sold a stake in Nvidia that more than tripled in 2023, he said. CNBCadded that AI trends are “a little overhyped now, but underestimated over the long term.”

But NVIDIA is more than just an investment; it filed its first 13-F last quarter to reveal the companies it invests in.

As of December, Nvidia had positions in AI-focused companies such as Arm (ARM), SoundHound AI (SOUN), Nanox Imaging (NNOX), and Recursion Pharmaceuticals (RXRX). Some of the stocks included in the 13F saw their stock prices rise after the disclosure.

Given Nvidia’s preeminent position in the AI space, changes in holdings revealed in upcoming 13F filings could prompt further market movement for these companies.