Amna Nawaz:

President Joe Biden is fully committed to the campaign today, and he has made multiple appearances today to stress that he has no plans to withdraw from the race, despite urgings from some Democrats and supporters. We’ll have more on this later in the show.

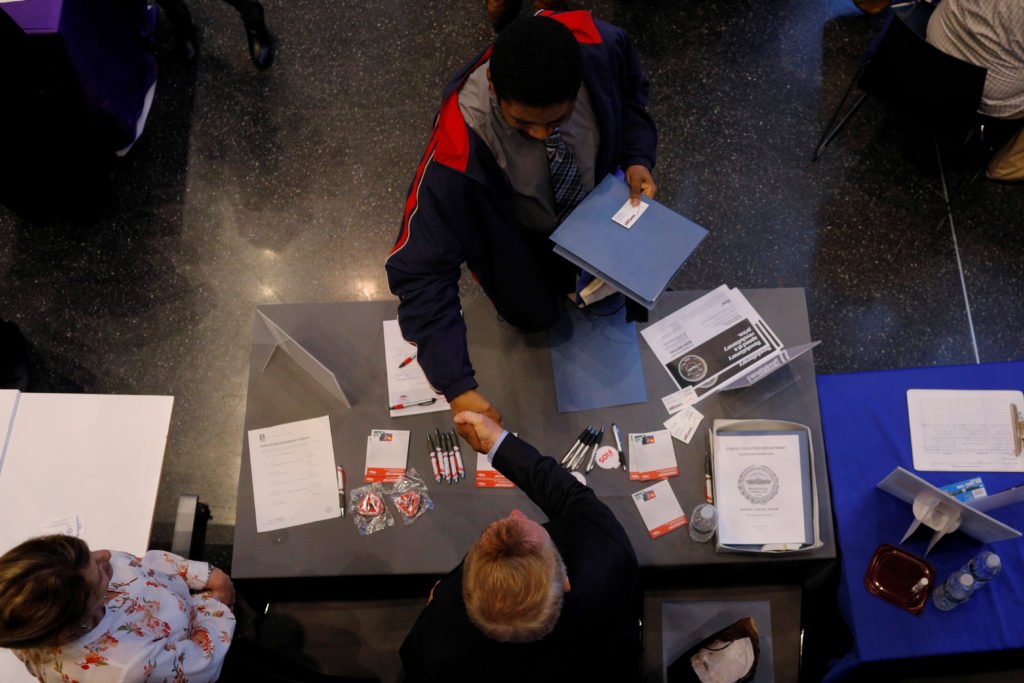

Meanwhile, the U.S. economy recorded a stronger-than-expected increase in payrolls last month, marking the 42nd consecutive month of job growth. 206,000 new jobs were added in June, with government employment accounting for more than a third of those, followed by health care, social assistance, and construction. The unemployment rate also rose to 4.1%, the first time it has risen above 4% in more than two years.

There were other signs of a cooling labor market: Job gains in April and May were revised down by more than 100,000.

To take a deeper look at what this means for the economy, I’m joined by Robben Farzad, host of the public radio show “Full Disclosure.”

Robben, always good to see you.

So what do these numbers mean to you? Are they a sign of an economy cooling off?

ROBEN FARZAD, “FULL DISCLOSURE” HOST: Certainly, market watchers and economic watchers have been expecting that for a long time, because the Fed was forced to raise rates after coming out of the pandemic and the error of leaving interest rates low for so long, so I think they’re still in the process of suppressing inflation.

But it’s weird. Do you root for good news? If you’re the White House, yes. Do you root for bad news? Maybe if you’re an investor or a trader. And yet, the market is at an all-time high. Real estate is at an all-time high. Crypto is on the rise.

That’s the real debate on Wall Street: Do we really need to cut rates? Maybe the Fed just needs an excuse to cut rates a little and see what happens.