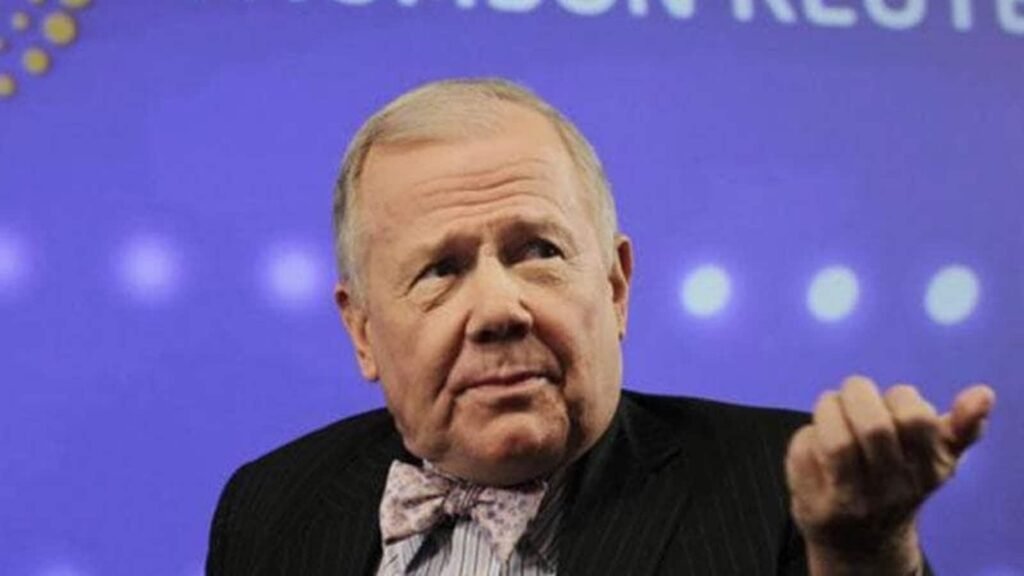

US investor Jim Rogers, reflecting on the Indian stock market crash, said US stocks are on the brink of a “big correction” later this year. “When good news comes, the (usual) expression is ‘buy the rumour, sell the news’. We knew this (the general election result) was coming so a lot of people bought in advance. Now it has come true and the market is selling, as is often the case. My inclination right now is a classic ‘buy the rumour, sell the news’,” the market veteran said.

He praised Prime Minister Modi and said, “If Prime Minister Modi acts as he has said and focuses on domestic manufacturing in India, it will bring about dramatic change not only in India but also in the world.”

Speaking of commodities, Jim Rogers said, “Silver (price) is down about 30 to 40 percent from its all-time high. I would buy silver at current prices, in fact I bought some yesterday. I am bullish on silver over gold. I own both, but at current prices I prefer silver.”

On the global situation, he said U.S. stocks could experience a “very large correction” later this year.

“The US market has been on a 14-year rally, the longest streak in US history. There are signs that the rally may end later this year. When that happens, we will see a massive correction in the US because debt is incredibly high. There was a problem in 2008 and debt has been skyrocketing since then,” he said.