The stock market is booming, with the S&P 500 index soaring about 9% since the beginning of the year, and that’s after a 24% rise in 2023.

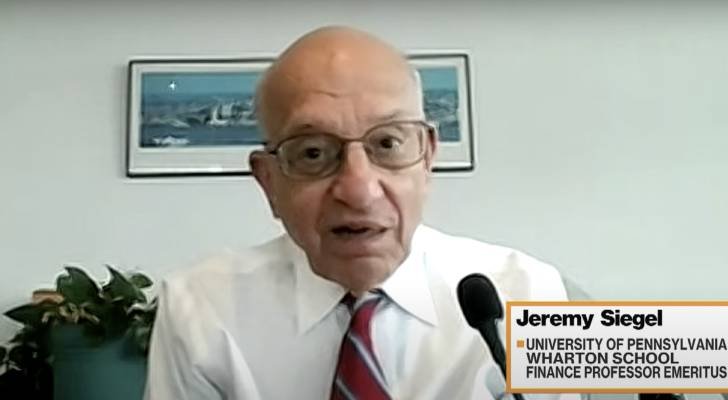

Jeremy Siegel, an economist and finance professor at the Wharton School at the University of Pennsylvania, said the upward trend in stock prices is likely to continue.

Do not miss it

“The momentum in this market is very strong,” he said in a recent interview with Bloomberg. “I don’t think this bull market is over yet. I think we still have work to do.”

The technology sector has been a highlight of the market, particularly due to the extraordinary performance of the super-sized tech giants group last year, which earned them the nickname ‘The Magnificent Seven’. This elite group includes Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), Meta Platform (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA).

Recently, Amazon, Meta, Microsoft, and Nvidia have continued to perform well, leading strategists to refer to them as the “Fabulous 4.”

Is the market overvalued?

Given the prolonged rise in stock prices, host Romaine Bostic asked Siegel whether the overall market is overvalued. His answer was negative.

“No, I mean, if you call it the Magnificent Seven, or the Fabulous Four, or just look at the tech sector, it’s 25 to 30 times earnings,” Siegel said. ) was explained. Key metrics used for stock valuation.

Tech is one of 11 sectors in the stock market, and Siegel emphasizes the importance of considering valuations in sectors other than tech.

“Excluding this technology sector, there are 10 other sectors that have forward P/E ratios of around 17 times, which is a very reasonable valuation level and about the same as the historical average,” he said. said.

read more: These 5 Magic Money Moves Will Climb America’s Net Worth Ladder in 2024. Each step can be completed within minutes.Here’s how to do it

A “pocket” of opportunity

To be sure, valuation is not the only metric strategists use to identify opportunities. But if you’re looking for value, Siegel believes there is one group that has significant upside potential.

“When we talk about reasonable valuations, and even some of the lower valuations, as you can see when you get to mid-cap and small-cap stocks, we’re talking about mid-teens, even low teens, for many of those averages. “We’re talking about,'” he said. “So if you widen your scope here, there could still be a lot of ways to get into a lot of these stocks.”

Mid-cap and small-cap stocks represent companies with medium and small market capitalizations, respectively. Mid-cap stocks are typically defined as having a market capitalization between $2 billion and $10 billion, and are often considered a middle ground between the growth potential of small-cap stocks and the stability of large-cap stocks. Small-cap stocks with a market capitalization of less than $2 billion are typically considered riskier, but they also have higher growth potential.

Both categories can diversify your investment portfolio, but they come with different risk profiles and potential rewards than large-cap stocks.

For investors who don’t want to pick individual stocks, investing in ETFs can be a strategic way to gain access to a group. For mid-cap stocks, the SPDR S&P Midcap 400 ETF Trust (MDY) and iShares Core S&P Midcap ETF (IJH) are popular options. For small-cap stocks, names like iShares Russell 2000 ETF (IWM) and Vanguard Small-Cap ETF (VB) may be a good starting point for further research.

What to read next

This article is for information only and should not be construed as advice. PROVIDED WITHOUT WARRANTY OF ANY KIND.