Is a weak currency good for the Japanese stock market? it’s complicated.

Is a weak currency good for the Japanese stock market? it’s complicated.

A weaker yen is traditionally seen as a positive for Japanese stocks, as it increases the competitiveness of exports. And this is certainly still true to some extent. According to Bank of America, more than half of the companies included in the TOPIX index are exporters. The brokerage estimated that each dollar-to-yen rise in the exchange rate could push up the operating profits of companies included in the TOPIX 500, which tracks Japan’s largest companies, by 0.5%. In fact, this week Toyota and Honda announced record profits for the fiscal year ending in March, due in part to the weaker yen.

Hello! You are reading a premium article! Subscribe now to read more.

Subscribe now

Premium benefits

35+ Premium daily articles

specially selected Newsletter every day

access to Print version for ages 15+ daily articles

Subscriber-only webinars by expert journalists

E Articles, Archives, Selection Wall Street Journal and Economist articles

Access to subscriber-only benefits: Infographics I Podcast

Well-researched to unlock 35+

daily premium articles

Access to global insights

100+ exclusive articles from

international publications

Free access

3 or more investment-based apps

trendlin

Get 1 month of GuruQ plan for just Rs.

finology

Get one month of Finology subscription free.

small case

20% off all small cases

Newsletter exclusive to 5+ subscribers

specially selected by experts

Free access to e-paper and

WhatsApp updates

A weaker yen is traditionally seen as a positive for Japanese stocks, as it increases the competitiveness of exports. And this is certainly still true to some extent. According to Bank of America, more than half of the companies included in the TOPIX index are exporters. The brokerage estimated that each dollar-to-yen rise in the exchange rate could push up the operating profits of companies included in the TOPIX 500, which tracks Japan’s largest companies, by 0.5%. In fact, this week Toyota and Honda announced record profits for the fiscal year ending in March, due in part to the weaker yen.

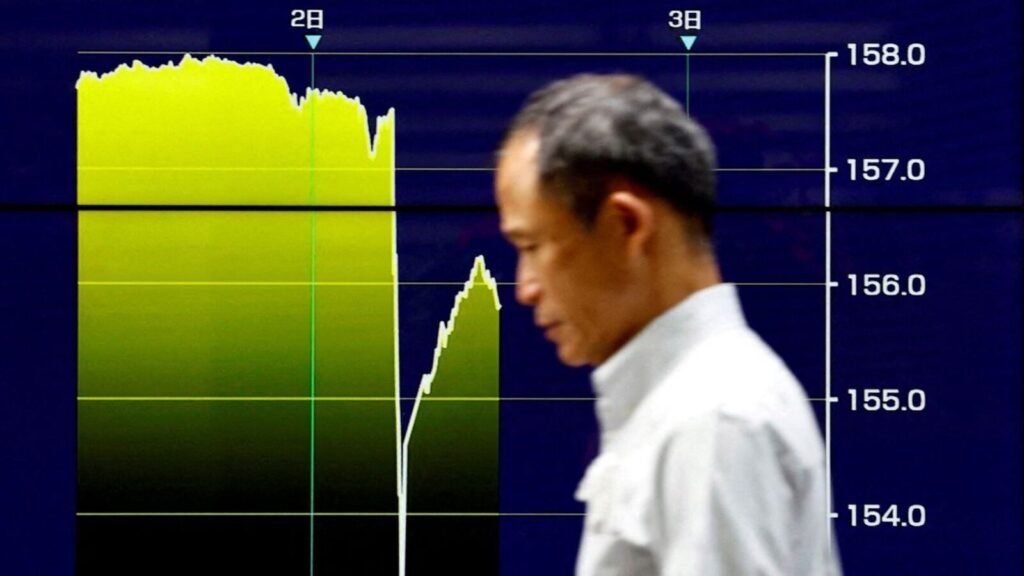

However, the currency’s recent sharp decline doesn’t seem to be boosting the stock price. The TOPIX index has fallen 1.5% since the end of March, despite the sharp decline in the yen. The yen exchange rate briefly reached 160 yen to the dollar in April, but the exchange rate returned to normal due to suspicions of interference by the Japanese government. It is currently trading at $156 against the dollar, nearly 10% lower than at the beginning of the year.

An even more rapid depreciation of the yen (4% against the dollar in April alone) will pose two risks to the market.

First, the cost of importing food, energy, and other goods will rise, potentially hindering growth in real wages and personal consumption. JPMorgan has calculated that a weaker yen will have a positive effect on the stock market up to the break-even point of 157 yen to the dollar, at which expected wage increases are offset by inflation. Japan’s real wages in March fell 2.5% year-on-year, but the results of this year’s annual salary negotiations raised expectations that real wages could rise in the second half of the year. Domestic-focused companies are likely to fare worse than exporters, given rising costs and the potential hit to consumption.

Another is currency risk for foreign investors, who are increasingly active in the Japanese stock market. The TOPIX index rose 16% this year on a local basis, but only 5% on a dollar basis. Investors who have not hedged their currency risks may be hesitant to jump into the market given the risks.

The reasons why the Nikkei Stock Average hit a 34-year high earlier this year still exist, including improved corporate governance and increased shareholder returns. However, we cannot expect further boost from the weaker yen.

Email Jacky Wong at jacky.wong@wsj.com.