(Bloomberg) — Japanese shares rose in Asia and a benchmark Japanese stock index neared a record high, as financial shares rose on the prospect of higher lending rates.

Most read articles on Bloomberg

Japanese bank and insurance stocks were the biggest contributors to the Topix gains as the country’s 10-year government bond yield continued to climb above 1% on expectations the central bank will raise interest rates. The MSCI AC Asia Pacific Index hit its highest since late May amid gains in Hong Kong-listed property stocks and electric vehicle makers.

Most other regional indexes fluctuated in narrow ranges as traders considered the possibility of Donald Trump becoming president again following last week’s debate with Joe Biden. Australian and South Korean shares were lower. U.S. stocks were lower in Asian trading despite Wall Street posting modest gains on Monday on the back of gains in big tech shares.

“Japan’s financial sector is strong, with the domestic 10-year government bond yield approaching 1.1 percent,” said Sohei Takeuchi, senior fund manager at Sumitomo Mitsui DS Asset Management Co. Japanese stocks have generally lagged emerging and European markets, but rising demand globally could be a factor, he said.

The 10-year Treasury yield narrowed some of a 7 basis point rise Monday, approaching 4.5%, on expectations that a Trump presidency would lead to a larger U.S. budget deficit and faster inflation.The Bloomberg Dollar Spot Index rose 0.1% as the dollar strengthened against all 10 major G10 currencies.

Expectations that the Bank of Japan will raise interest rates later this month have risen after a gauge showed confidence among the country’s largest manufacturers rose from three months ago. Vanguard sees the yen at risk of weakening toward 170 to the dollar if the BOJ’s policy changes this month don’t boost government bond yields.

Demand for Chinese government bonds has surged amid pessimism about the domestic economy, and the central bank said it would borrow them from primary dealers, a possible sign the bank is considering selling them to quell soaring bond prices.

Yields on China’s benchmark bonds hit record lows on Monday as investors worried about long-term economic growth.

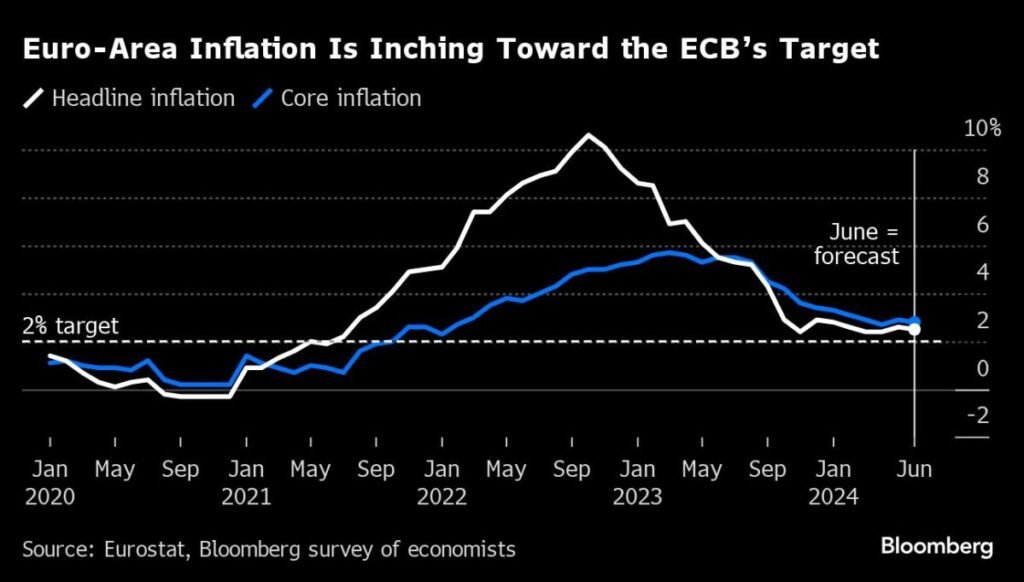

In Europe, European Central Bank President Christine Lagarde said there wasn’t enough evidence to show the threat of inflation had passed, raising hopes that authorities would pause on interest-rate cuts this month. The euro was little changed after the French election results suggested more extreme policies from the far right were unlikely.

After last week’s debate damaged Biden’s reelection chances, Wall Street strategists from Goldman Sachs Group Inc. to Morgan Stanley and Barclays Plc are taking a fresh look at how a Trump victory could affect the bond market, urging clients to position for higher inflation and rising long-term yields.

Meanwhile, Biden called on voters to “pass the verdict” on Trump after the Supreme Court ruling potentially allowed the presumptive Republican presidential nominee to avoid prosecution for his role in the January 6 attack on the U.S. Capitol.

“The sell-off in government bonds continued overnight as interest rate markets began to price in a Trump election victory, raising the prospect of continued federal budget deficits and higher inflation,” said Tony Sycamore, market analyst at IG Australia. “Higher Treasury yields will encourage a stronger US dollar, both of which will be problematic for many Asian stock markets.”

In commodities, crude oil traded near a two-month high as tensions in the Middle East rose and concerns over the Atlantic hurricane season were heightened after Hurricane Beryl was classified as a Category 5 storm. Elsewhere in the commodity market, gold was little changed.

Major events this week:

-

Eurozone CPI, unemployment rate on Tuesday

-

U.S. job numbers Tuesday

-

Jerome Powell and Christine Lagarde speak at an ECB forum in Portugal on Tuesday

-

China Caixin Services PMI, Wednesday

-

Eurozone S&P Global Eurozone Services PMI, PPI, Wednesday

-

Fed minutes, ADP employment, ISM services, factory orders, initial jobless claims, durable goods, Wednesday

-

Fed President John Williams to speak Wednesday

-

UK general election on Thursday

-

US Independence Day holiday, Thursday

-

Eurozone retail sales on Friday

-

US jobs report, Friday

-

Fed President John Williams to speak Friday

Some of the key market developments:

stock

-

S&P 500 futures were down 0.2% as of 1:10 p.m. Tokyo time.

-

Nasdaq 100 futures fell 0.3%

-

Japan’s TOPIX rises 0.8%

-

Australia’s S&P/ASX 200 fell 0.6%

-

Hong Kong’s Hang Seng Index rose 0.6%

-

The Shanghai Composite Index was little changed

-

Euro Stoxx 50 futures fell 0.2%

currency

-

The Bloomberg Dollar Spot Index rose 0.1%.

-

The euro was little changed at $1.0733.

-

The Japanese yen was almost unchanged at 161.61 yen to the dollar.

-

The offshore yuan was little changed at 7.3056 per dollar.

Cryptocurrency

-

Bitcoin fell 0.2% to $63,100.61.

-

Ether fell 0.3% to $3,452.95.

Bonds

-

The yield on the 10-year Treasury note fell 2 basis points to 4.45%.

-

Japan’s 10-year government bond yield rose 1 basis point to 1.075%.

-

Australia’s 10-year government bond yield rose 5 basis points to 4.43%.

merchandise

-

West Texas Intermediate crude rose 0.2% to $83.55 a barrel.

-

Spot gold fell 0.3% to $2,325.42 an ounce.

This story was produced with assistance from Bloomberg Automation.

–With assistance from Jason Scott and Yasutaka Tamura.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP