Gerenme

People see and hear what they want. Chairman Powell spoke calmly at Wednesday’s press conference, but his message was that it would take longer for rate cuts to materialize in 2024, and that the longer they last, the fewer rate cuts will be made.

Mr. Powell He was never one to say harsh words. Moreover, market dynamics often give false optics that he is dovish. But in reality, this is not the case.

The Fed purposely included a note of the statement in the third sentence of the opening paragraph.

There has been no further progress towards the Committee’s 2% inflation target in recent months.

This is a pretty clear statement and not a dovish one.

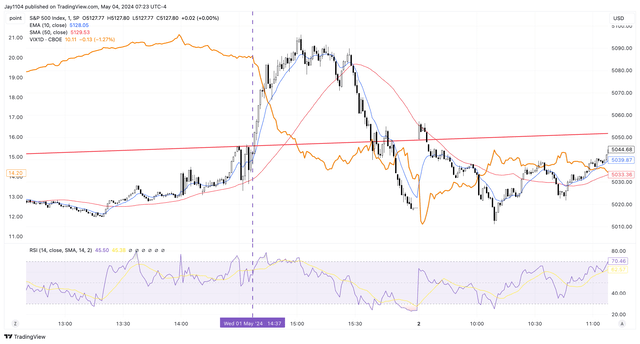

However, as the stock market “rose” during Powell’s press conference, the media projected the idea that Powell was making dovish statements. To the masses. That didn’t cause the stock market to rise at all. What drove the market rally was the mechanical force of lower implied volatility as put hedges were unwound.

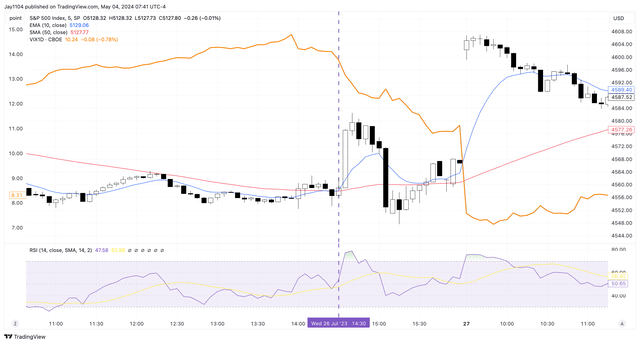

This event risk unwinding happens so often that in a free comment to all SA followers on Tuesday, the day before the Fed meeting, a 2 minute and 35 second volatility crash occurred and the stock market rose. I pointed out that it would.

Once we pass the Fed, we will likely see the usual volatility crash around 2:35pm ET. Typically, this is the time when the S&P 500 index rises and everyone starts commenting on the market, and Mr. Powell struck a dovish tone. Although I know this rally has nothing to do with Mr. Powell and nothing to do with anything other than the passing of event risk as the VIX 1 Day drops like a stone and heads down.

TradingView

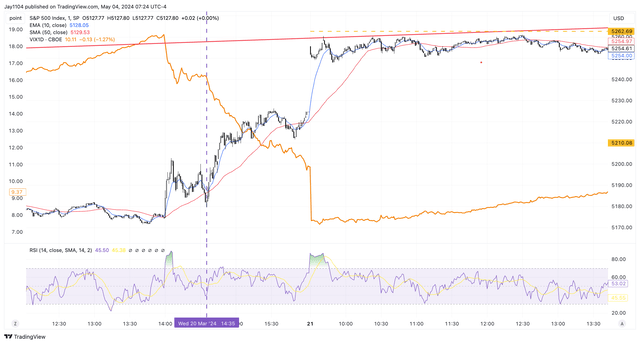

This event happens at almost every press conference, and the same thing happened at the March 20th press conference.

TradingView

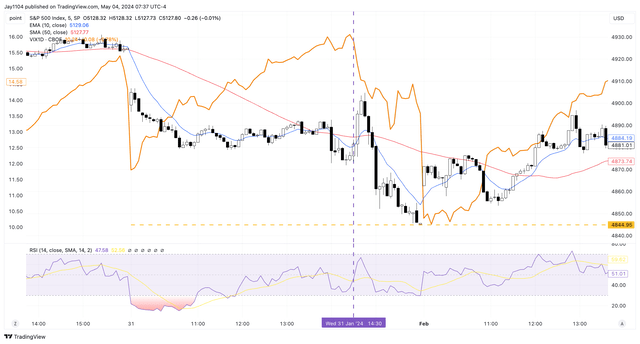

A similar thing happened at the FOMC press conference in January, but it didn’t last as long and had less overall impact.

TradingView

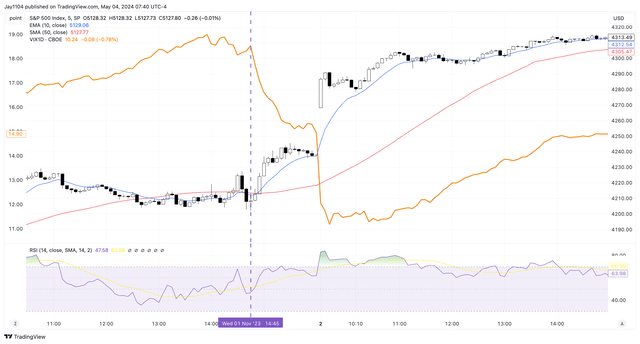

A similar thing happened at the November 1st FOMC meeting, which started about 10 minutes later at 2:45pm ET.

TradingView

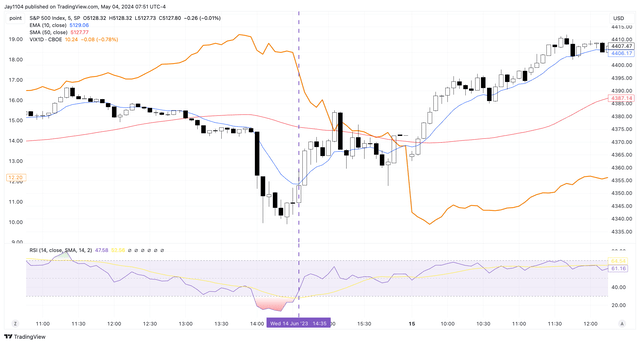

This crash in implied volatility was also demonstrated at the July 26th FOMC meeting, which began at 2:30pm ET.

TradingView

It occurred again on June 14, 2023 between 2:30 and 2:35 ET.

TradingView

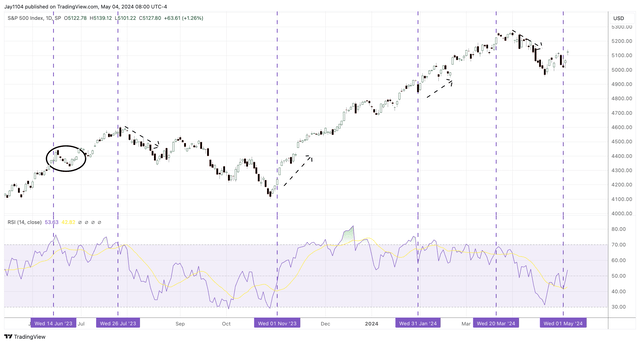

So while this implicit volatility crash did not occur at every Fed meeting, which contributed to the rally in stock indexes and gave the impression that “Mr. Powell is a dovish”, it started in June 2023. This has happened in six of the past eight meetings, with no crashes. In September or December 2023.

Furthermore, stock market movements a week later often did not reflect the “dovish” tone of the meeting results. In two of his meetings, despite an initial rally, the market fell in subsequent weeks, in two it rose, and in one it remained sideways. We are still waiting to see what happens after this meeting.

This 2:35 pm (ET) volatility crash has been occurring consistently for some time, even before mid-2023, so you can use it to assess market direction in the moments after a meeting or price action during a meeting. It is a waste of time to do so. It has nothing to do with the general direction of the market over the next few weeks.

TradingView

The wise thing to do, at least based on experience, is not to pay attention to market movements on the day of the Fed meeting, or even in the days immediately following. Much of the initial price movement likely has to do with positioning around such an event. Large institutional investors may not be able to “push the button” to unwind failed trades or lock in profits. It may take 1-2 days for the transaction to fully resolve.

This, combined with the rise in implied volatility ahead of Friday’s jobs report and the fall in implied volatility after the jobs report, suggests that the market is reacting positively to a dovish Fed and the “Goldilocks” jobs report. It looks like there are. But Wednesday saw the classic 2:35 volatility crash, and Friday saw the jobs data crash. This is even why stocks are rising after a better-than-expected CPI report.

Again, this is why the day before the April jobs report makes it easier to predict the likely price movement that will follow.

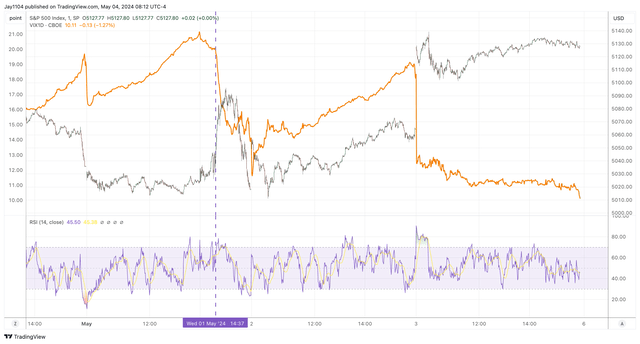

VIX1D and S&P500 rose today. But after tomorrow’s employment report, VIX1D will likely crater again. So, regardless of the data, it seems very likely that the S&P 500 will rise given the required implied volatility reset. Once the IV is reset, the market will trade “normally” again.

This came as the S&P 500 rebounded on Friday and was flat for the rest of the trading day after the VIX 1-Day halted its decline following the April jobs report.

TradingView

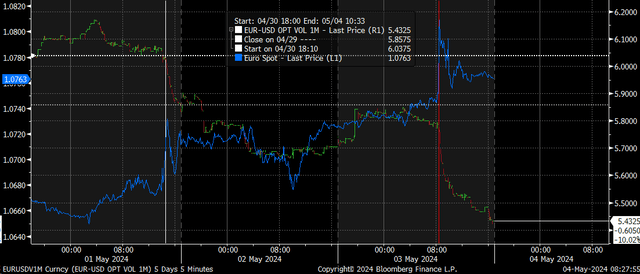

Unfortunately, this doesn’t just happen in the stock market. The implied volatility reset occurred across asset classes such as the EUR/USD currency pair, with volatility plummeting on May 1st at 2:35pm ET, and on May 3rd following the employment report. Volatility plummeted again.

bloomberg

This shows us that we should not jump to conclusions as if macro events mean something important. It simply resets the implied volatility level as hedges and bets on the direction of the market are unwound, resulting in flows shifting around those events. This means that the outcome of these events is likely to be known within weeks.

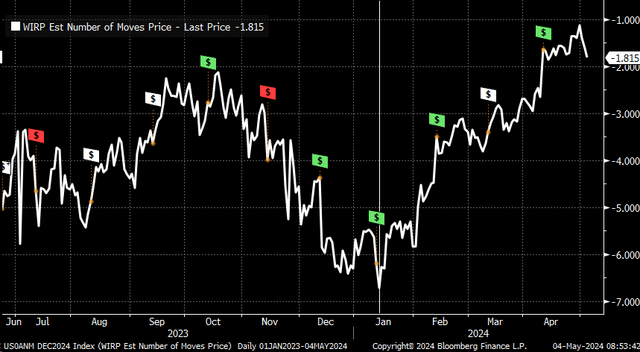

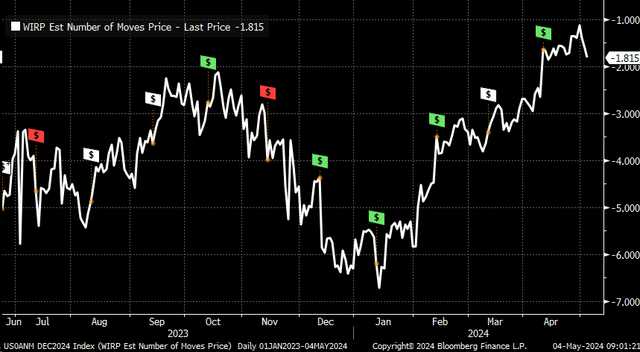

That’s when we realized that the December CPI report had shocked the market and marked a turning point in the expected number of rate cuts.

bloomberg

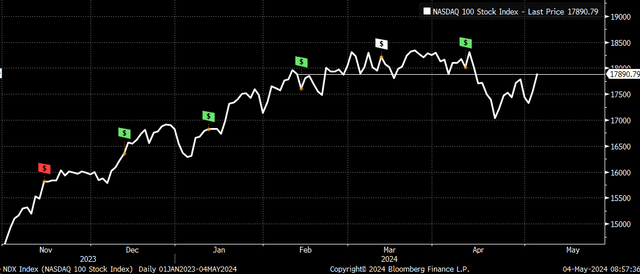

The stock market has been flat since mid-February as January’s Consumer Price Index (CPI) report got even hotter.

bloomberg

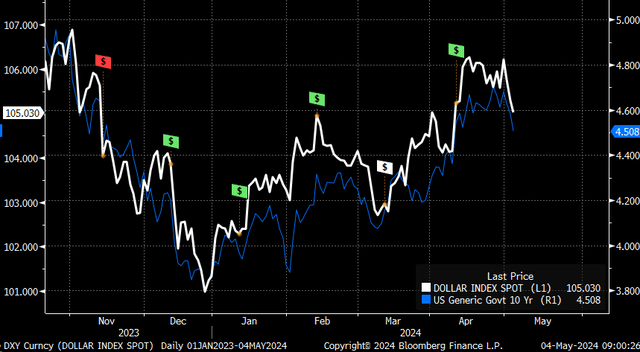

Since the Consumer Price Index (CPI) was released in February, interest rates and the dollar soared in March, but a stronger dollar and higher interest rates caused stock markets to struggle.

bloomberg

Or maybe the swap market has dropped less than twice since the March CPI report.

bloomberg

Yes, please tell me more about that.

It is not a wise idea to judge the outcome of an event immediately afterward. This market is much more complex than it appears on the surface, and ad hoc market reactions often tell us nothing about long-term trends that may develop. That’s what most of us long-term investors care about. About most.