Most readers would already know that the Sliguro Food Group (AMS:SLIGR) share price has increased by 5.4% over the past three months. Considering that stock prices are typically in line with a company’s financial performance over the long term, we decided to investigate whether a company’s financial health is influencing recent stock price movements. Did. In particular, I would like to pay attention to Suriguro Food Group’s ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder as it indicates how effectively their capital is being reinvested. More simply, it measures a company’s profitability in relation to shareholder equity.

Check out our latest analysis for Sligro Food Group.

How do you calculate return on equity?

Return on equity can be calculated using the following formula:

Return on equity = Net income (from continuing operations) ÷ Shareholders’ equity

So, based on the above formula, Sligro Food Group’s ROE is:

1.3% = €6 million ÷ €461 million (based on the trailing twelve months to December 2023).

“Return” is the annual profit. This means that for every €1 of shareholders’ equity, the company generated his €0.01 in profit.

Why is ROE important for profit growth?

It has already been established that ROE serves as an indicator of how efficiently a company will generate future profits. Depending on how much of these profits a company reinvests or “retains”, and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, companies with high return on equity and profit retention will have higher growth rates than companies without these attributes.

A side-by-side comparison of Sligro Food Group’s earnings growth and ROE of 1.3%.

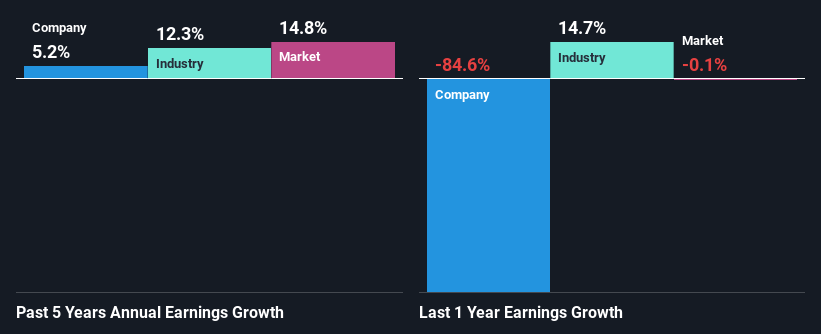

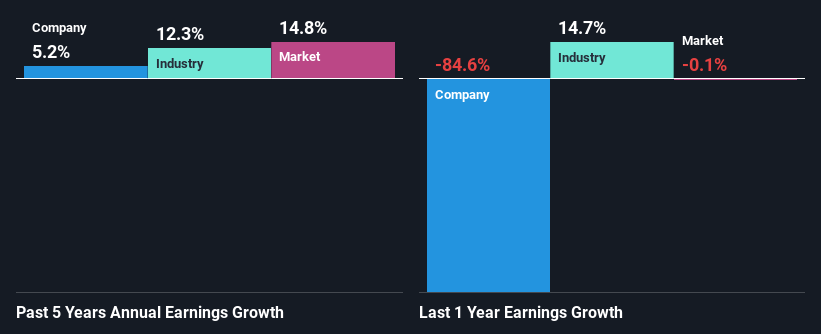

It’s hard to argue that Srigro Food Group’s ROE itself is very good. Even compared to the industry average ROE of 13%, the company’s ROE is quite pathetic. Sligro Food Group has been able to achieve a decent net profit growth of 5.2% over the past five years. We believe there may be other aspects that are positively impacting the company’s earnings growth. Maintaining high profits and efficient management, etc.

Next, when we compare it to the industry’s net income growth rate, we find that the growth rate reported by Sligro Food Group is lower than the industry’s growth rate of 12% over the past few years. This is what we don’t want to see.

The foundations that give a company value have a lot to do with its revenue growth. It’s important for investors to know whether the market is pricing in a company’s expected earnings growth (or decline). This can help you decide whether to position the stock for a bright or bleak future. Is Surigro Food Group valued significantly compared to other companies? These 3 valuation metrics can help you decide.

Is Sligro Food Group using its profits efficiently?

Sligro Food Group’s median three-year dividend payout ratio is 44%, which means it retains the remaining 56% of its profits. This suggests that the dividend is well covered, and given the company’s healthy growth, it appears that management is reinvesting earnings efficiently.

Moreover, Sligro Food Group is determined to continue sharing its profits with shareholders, as inferred from its long history of paying dividends for at least 10 years. Researching the latest analyst consensus data, we found that the company’s future dividend payout ratio is expected to rise to 57% over the next three years. However, despite the expected increase in the dividend payout ratio, Sligro Food Group’s future ROE is expected to rise to 18%. We speculate that there may be other factors driving the expected growth in the company’s ROE.

summary

Overall, there appear to be some positive aspects to Sligro Food Group’s business. Specifically, we’re talking about a fairly high earnings growth rate, which is undoubtedly backed up by the company’s high earnings retention rate. Still, a low ROE means that reinvestment isn’t providing much benefit to investors. That said, the latest analyst forecasts suggest that the company’s revenue will continue to grow. Are these analyst forecasts based on broader expectations for the industry, or are they based on the company’s fundamentals? Click here to be taken to the page with analyst forecasts for the company .

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.