- Ten years ago, the top 10 U.S. companies made up 14% of the S&P 500 stock index. Today, they account for more than a third of it.

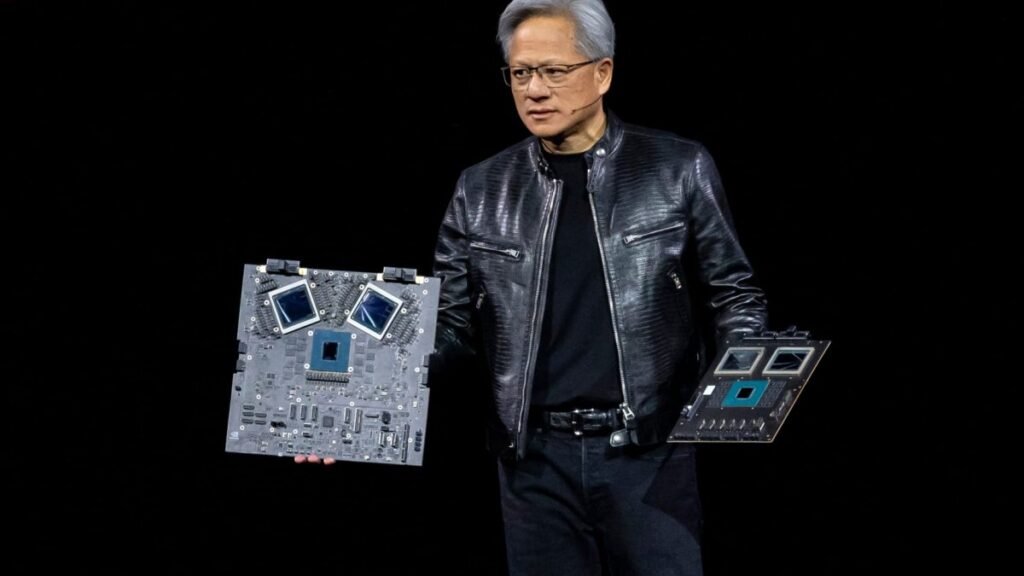

- The tech frenzy has helped boost the shares of the “Magnificent Seven” — Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla.

- Some experts worry that this concentration poses risks to investors, while others don’t think it’s a big deal.

In recent years, the U.S. stock market has become so dominated by a few companies that some experts have questioned whether this “concentrated” market poses risks to investors, but others say those concerns are likely overblown.

Let’s look at the S&P 500, the most popular benchmark for U.S. stocks, as an example of what’s happening.

According to a recent analysis by Morgan Stanley, the S&P 500’s 10 largest stocks by market capitalization will account for 27% of the index at the end of 2023, nearly double the 14% they held a decade ago.

In other words, for every $100 invested in the index, roughly $27 is funneled into just 10 stocks, up from $14 a decade ago.

According to Morgan Stanley, this is the fastest increase in concentration since 1950.

That number is set to grow even more in 2024, with the top 10 stocks accounting for 37% of the index as of June 24, according to FactSet data.

The so-called “Magnificent Seven” — Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla — make up about 31% of the index, according to the firm.

“It’s a little bit more risky than people realize.”

Some experts worry that large U.S. companies have too much influence in investors’ portfolios.

For example, the Magnificent Seven stocks accounted for more than half of the S&P 500’s gains in 2023, according to Morgan Stanley.

As much as these stocks have helped drive overall returns, some have noted that a drop in one or many of them could put a lot of investor capital at risk. Nvidia, for example, lost more than $500 billion in market value during a three-day selloff in June and dragged the S&P 500 down for several straight days. (Its shares have since recovered somewhat.)

Charlie Fitzgerald III, a certified financial planner based in Orlando, Florida, said the S&P 500’s concentration is “a little bit riskier than people realize.”

“Almost a third [the S&P 500] “I have seven stocks,” he says. “That kind of concentration doesn’t give me diversification.”

Why share concentration is not a concern

The S&P 500 tracks the stock prices of the 500 largest publicly traded companies, based on market capitalization, meaning the higher a company’s stock valuation, the higher its weight in the index.

The craze for tech stocks has helped drive concentration at the top, especially among the “Magnificent Seven.”

As of market close on June 27, the Magnificent Seven’s shares had collectively risen about 57% over the past year, more than double the 25% gain for the S&P 500 as a whole. Shares of chipmaker Nvidia alone have tripled in that same period.

More information on personal finance:

Americans are having a hard time breaking away from the “Vibesession”

Retirement “super savers” have the largest 401(k) plan balances

Household purchasing power is increasing

Despite the sharp increase in equity concentration, some market experts believe the concerns may be overblown.

For one thing, many investors are diversifying beyond the U.S. stock market.

For example, a recent analysis by John Reckenthaler, vice president of research at Morningstar, found that it’s “rare” for 401(k) investors to hold only U.S. stock funds.

Many people invest in target date funds.

The Magnificent Seven accounts for about 8% of Vanguard TDFs aimed at investors nearing retirement, compared with 13.5% for TDFs aimed at younger investors looking to retire in about 30 years, Reckenthaler wrote in May.

There is precedent for this market concentration

Moreover, Morgan Stanley’s analysis shows that the current concentration is not unprecedented, either historically or globally.

According to a study by finance professors Eloy Dimson, Paul Marsh, and Mike Stanton, the top 10 stocks accounted for about 30% of the U.S. stock market from the 1930s to the early 1960s, and about 38% in 1900.

Reckenthaler, who has studied the market since 1958, said the stock market in the late 1950s and early 1960s, for example, was similarly (or even more) concentrated and “stocks did well.”

“We’ve been here before,” he said, “and when we were here before, the news wasn’t particularly bad.”

He added that when there have been major market crashes, they generally don’t seem to be related to equity concentrations.

Compared to the world’s 12 largest stock markets, the U.S. market will be the fourth most diversified as of the end of 2023, ahead of Switzerland, France, Australia, Germany, South Korea, the United Kingdom, Taiwan and Canada, according to Morgan Stanley.

“Sometimes it’s a surprise.”

Experts say big U.S. companies generally appear to have the profits to support their high valuations today, unlike at the peak of the dot-com bubble in the late 1990s and early 2000s.

A recent report from Goldman Sachs Research found that today’s market leaders “generally have higher profit margins and returns on equity” than they did in 2000.

Fitzgerald, president and founding member of Moisand Fitzgerald Tamayo, said the Magnificent Seven are “not pipe dreams” and have generated “enormous” returns for investors.

“It’s just a question of how much more profit can we make,” he added.

Reckenthaler said concentration could become a problem for investors if the largest companies have related businesses that are adversely affected at the same time, at which point stock prices could fall in tandem.

“It’s hard to imagine anything hitting Microsoft, Apple and Nvidia at the same time,” he said. “They’re on different sides of the technology market.”

“To be fair, sometimes it takes you by surprise and you think, ‘I never saw that coming,'” he added.

Fitzgerald said a well-diversified stock portfolio would include stocks of the biggest companies in the S&P 500 index, as well as smaller and mid-sized U.S. companies and international companies. Some investors might also include real estate, he said.

For the average investor, he says, a good, simple approach is to buy a target-date fund, which is a well-diversified fund that automatically switches asset allocations based on an investor’s age.

The firm’s average 60/40 stock/bond portfolio currently allocates about 11.5% of its total holdings to the S&P 500 index, Fitzgerald said.