If you want to find potential multi-baggers, there are often underlying trends that can give you clues. In an ideal world, you want to see companies investing more capital into their business and the returns they earn on that capital are also increasing. When you see this, it usually means it’s a company with a good business model and lots of profitable reinvestment opportunities. So, when you look at ROCE trends, Intabina Group (KLSE:INTA), we were pleased with what we saw.

Understanding Return on Invested Capital (ROCE)

For those new to ROCE, it measures the “return on investment” (profit before tax) a company generates from the capital employed in its business. Analysts use the following formula to calculate Inta Bina Group Berhad’s ROCE:

Return on Invested Capital = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

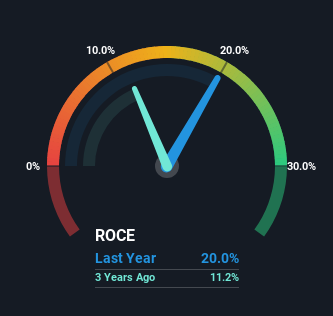

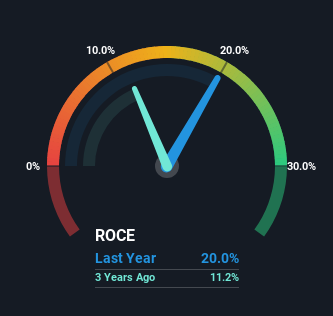

0.20 = RM37m ÷ (RM474m – RM289m) (Based on the trailing 12 months ending March 2024).

therefore, Inta Bina Group Berhad has an ROCE of 20%. In absolute terms, this is an excellent return and better than the construction industry average of 7.7%.

Check out our latest analysis for Inta Bina Group Berhad

Above we can see how Inta Bina Group Berhad’s current ROCE compares to its prior returns on capital, but the history can only tell us so much, and if you want to see what analysts are predicting going forward you can take a look at this free analyst report on Inta Bina Group Berhad.

ROCE Trends

Inta Bina Group Berhad’s ROCE history is very impressive. The company has deployed capital at over 34% over the past five years, and its return on that capital has remained steady at 20%. That kind of return would be the envy of most companies, and it’s even better when you consider that it has been repeatedly reinvesting at this rate. If Inta Bina Group Berhad can keep up this trajectory, we’ll be very optimistic about its future.

On a separate but related note, it’s important to note that Inta Bina Group Berhad has a current liabilities to total assets ratio of 61%, which we consider to be quite high. This effectively means that suppliers (or short-term creditors) are funding a large part of the business, so be aware that this may introduce some element of risk. While not necessarily a bad thing, a lower ratio could be an advantage.

The conclusion is…

Inta Bina Group Berhad has demonstrated its ability to generate strong returns on increasing invested capital, which gets us excited. On top of that, the stock has delivered an impressive return of 106% to shareholders who held it over the past five years. Investors seem to be aware of these encouraging trends, but we still think the stock is worthy of further investigation.

Finally, we 2 warning signs for Inta Bina Group Berhad This is something you should know about.

Intabina Group Berhad is not the only stock generating high returns. Find out more. free A list of companies with solid fundamentals and high return on equity.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Please contact us directly. Or email us at editorial-team@simplywallst.com