Key Insights

-

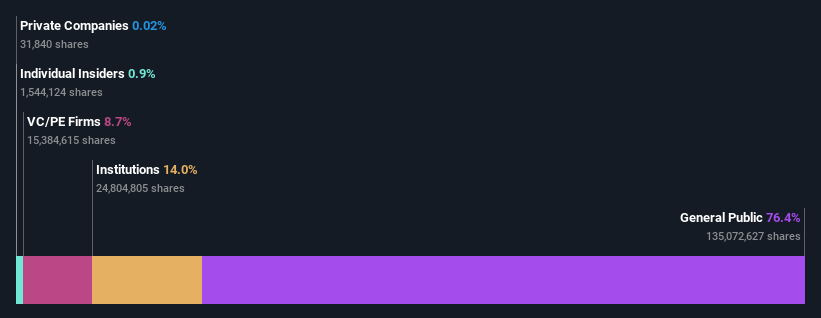

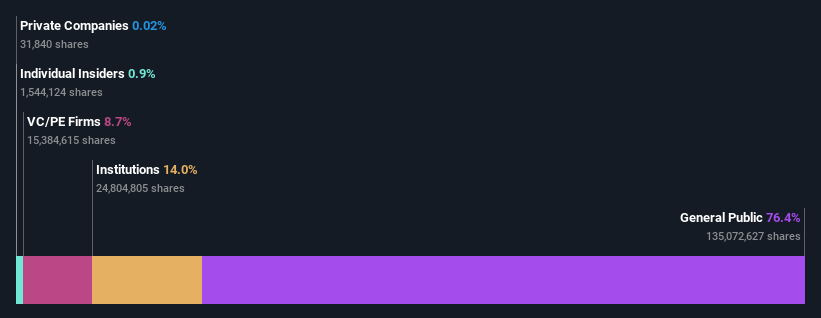

The significant control that individual investors have over Vaxart means that the general public has more power to influence management and governance-related decisions.

-

22% of the business is owned by the top 25 shareholders

-

Insiders have recently purchased

To understand who really controls Vaxart, Inc. (NASDAQ:VXRT), it’s important to understand the company’s ownership structure. With 59% ownership, we can see that retail investors own the vast majority of the company’s stock, meaning that this group stands to gain the most if the share price rises (or lose the most if the share price falls).

Retail investors benefited the most as the stock’s market capitalization hit $163 million last week, but institutions, who hold 11%, also benefited.

Let’s take a closer look to see what the different types of shareholders can tell us about Vaxart.

Check out our latest analysis for Vaxart

What does institutional ownership say about Vaxart?

Many institutions measure their performance against an index that approximates the local market, so they usually pay particular attention to companies that are included in major indexes.

As you can see, institutional investors have a fair amount of stake in Vaxart. This may suggest that the company has a certain degree of trust in the investment community. However, it’s best to be careful about relying on the approval of institutional investors – they can be wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop sharply. It’s therefore worth checking Vaxart’s earnings history below. Of course, it’s the future that really matters.

We note that hedge funds don’t have a significant investment in Vaxart. The company’s largest shareholder is RA Capital Management, LP, owning 8.7%. Vanguard Group, Inc. is the second largest shareholder owning 4.8% of common stock, and Geode Capital Management, LLC holds about 1.2% of the company’s stock.

After examining the ownership data, we found that the top 25 shareholders collectively own less than 50% of the share register, with no single individual holding a majority of the shares.

While studying institutional ownership for a company can add value to your research, it is also a good idea to research analyst recommendations to get a deeper understand of a stock’s expected performance. There are plenty of analysts covering the stock, so you can look into forecast growth fairly easily.

Insider Ownership of Vaxart

The definition of a company insider can be subjective and varies between jurisdictions. Our data reflects individual insiders, and includes, at a minimum, directors. Company management should report to the board of directors, which should represent the interests of shareholders. Notably, top-level management may themselves sit on the board.

Insider ownership can be a positive if it signals management are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company, which can be a negative in some circumstances.

Our data indicates that Vaxart, Inc. insiders own less than 1% of the shares in their own names. The company has a market capitalization of just US$163m, and the board of directors owns just US$1.1m worth of shares in their own names. Many would prefer to see a higher board ownership. Your next step might be to take a look at this free summary of insider buying and selling.

General public property

The general public, usually retail investors, own 59% of Vaxart shares, indicating that the stock is fairly popular. This level of ownership gives general public investors the power to influence key policy decisions such as board composition, executive compensation, and dividend payout ratios.

Private Equity Ownership

Private equity firms own 6.8% of Vaxart’s stock, suggesting that these firms may have influence over important policy decisions. Some investors may be encouraged by this, as private equity may be able to encourage strategies that help the market recognize the value of the company. Alternatively, these holders may exit their investments after the company goes public.

Next steps:

It’s always worth thinking about the different groups who own shares in a company. But to understand Vaxart better, there are many other factors to consider. For example, 3 warning signs for Vaxart (Number 1 is a bit annoying but it’s something to be aware of.)

But in the end That’s the futureIt is the present, not the past, that will determine how successful the owners of this business will be, so we therefore recommend you take a look at this free report which shows whether analysts are predicting a brighter future.

Note: The figures in this article are calculated using data from the last 12 months, which refers to the 12-month period ending on the last day of the month in which the financial statements are dated, which may not match the figures in the annual report.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Please contact us directly. Or email us at editorial-team@simplywallst.com