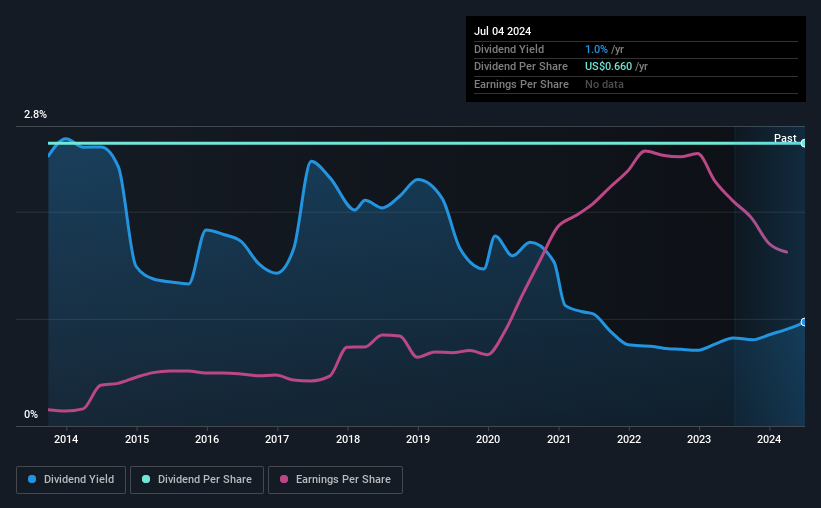

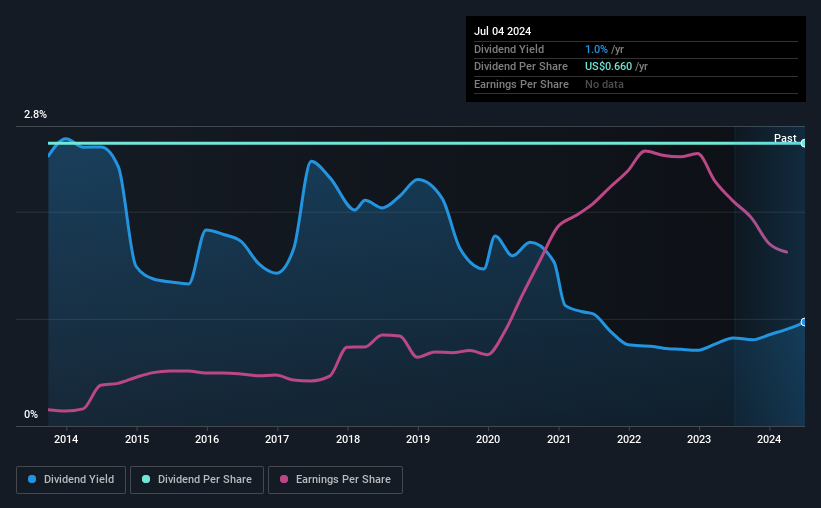

Board of directors Ingles Market Co., Ltd. (NASDAQ:IMKT.A) announced a dividend payment on July 18. Investors will receive $0.165 per share. The payment brings the dividend yield to 1.0%, below the industry average.

Check out our latest analysis for Ingress Markets

Ingles Markets’ dividends are well covered by profits.

The dividend yield is a bit low, and dividend sustainability is also an important factor when evaluating an income stock. However, Ingles Markets’ profits more than cover the dividend, and as a result, the majority of profits are reinvested in the business.

Looking ahead, if the trends of the past few years continue, earnings per share could grow 18.6% next year. If the dividend continues on this trajectory, the dividend payout ratio could be 6.0% by next year, which we believe is quite sustainable going forward.

Ingles Market has a proven track record

The company has a consistent track record of paying dividends with little fluctuation. The most recent annual payment was $0.66, roughly the same as the annual payment 10 years ago. While the consistency of dividend payments is impressive, the relatively slow growth rate makes it less attractive in our opinion.

Dividends are likely to increase

Some investors may be keen to buy the company’s shares based on its dividend history. It’s encouraging to see that Ingles Markets has grown its earnings per share at 19% per year over the past five years. With its earnings on an upward trend and a low payout ratio, Ingles Markets certainly has the potential to increase its dividend in the future.

Ingles Market looks like a great dividend stock.

Overall, I think this is a great income investment and maintaining the dividend this year may have been a conservative choice. The dividend is easily covered by earnings, and earnings convert to cash flow. Considering all these factors, I think this has solid potential as a dividend stock.

It is important to note that a company with a consistent dividend policy will likely gain more investor confidence than one with an unstable dividend policy. At the same time, there are other factors that readers should be aware of before putting their money into a stock. For example, 1 warning sign for Ingles Market What investors should know before investing in this stock. If you’re a dividend investor, our A carefully selected list of high dividend stocks.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com