Indonesia was poised to become a major manufacturer of semiconductor components, but Jakarta’s restrictions had shifted investor attention to Malaysia, Airlangga claimed, without elaborating. As a result, Indonesia must work to recoup “lost” semiconductor investment, he said.

One of Indonesia’s potential targets for semiconductor growth is China, which has expressed interest in producing chip components in a Beijing-backed special economic zone planned for the Indonesian island of Rempang, near Batam.

The plans have sparked outrage among civil society and non-governmental groups, as the project is expected to displace thousands of the island’s residents.

The Coordinating Ministry for Economic Affairs said in April that it would step up efforts to develop the semiconductor industry as a key growth driver in line with Indonesia’s vision of becoming a developed country by 2045, the 100th anniversary of its independence.

Too little, too late?

The fiercest competition to attract semiconductor giants is expected to come from Indonesia’s two neighbors.

“We propose to be the most neutral and non-aligned hub for semiconductor production to help build a safer and more resilient global semiconductor supply chain,” Anwar said, adding that under a new national semiconductor strategy, Malaysia aims to secure at least 500 billion ringgit (U.S.$106 billion) of new semiconductor investment.

Malaysia’s semiconductor industry is a major contributor to the country’s economy, accounting for approximately 25% of the country’s gross domestic product, while assembly, packaging and testing operations supply 13% of global demand.

Singapore’s semiconductor production accounts for about 11% of the global market.

Global semiconductor companies such as America’s Globalfoundries, Germany’s Siltronic and Taiwan’s United Microelectronics Corp have invested billions of dollars in Singapore in recent years.

Singapore’s Deputy Prime Minister Heng Swee Kit said earlier this month that the semiconductor industry accounts for nearly a quarter of the country’s value-added manufacturing activity, and that manufacturing overall accounts for 20 percent of Singapore’s economy.

Ronald Tundang, a researcher specializing in international economic law at the Chinese University of Hong Kong, said Airlangga’s claim that Malaysia and Singapore were obstructing Indonesia’s semiconductor development “reflects geopolitical tensions and competitive pressures in the region”.

“However, without substantial evidence, these claims could be seen as political rhetoric intended to galvanize support for domestic efforts,” he said.

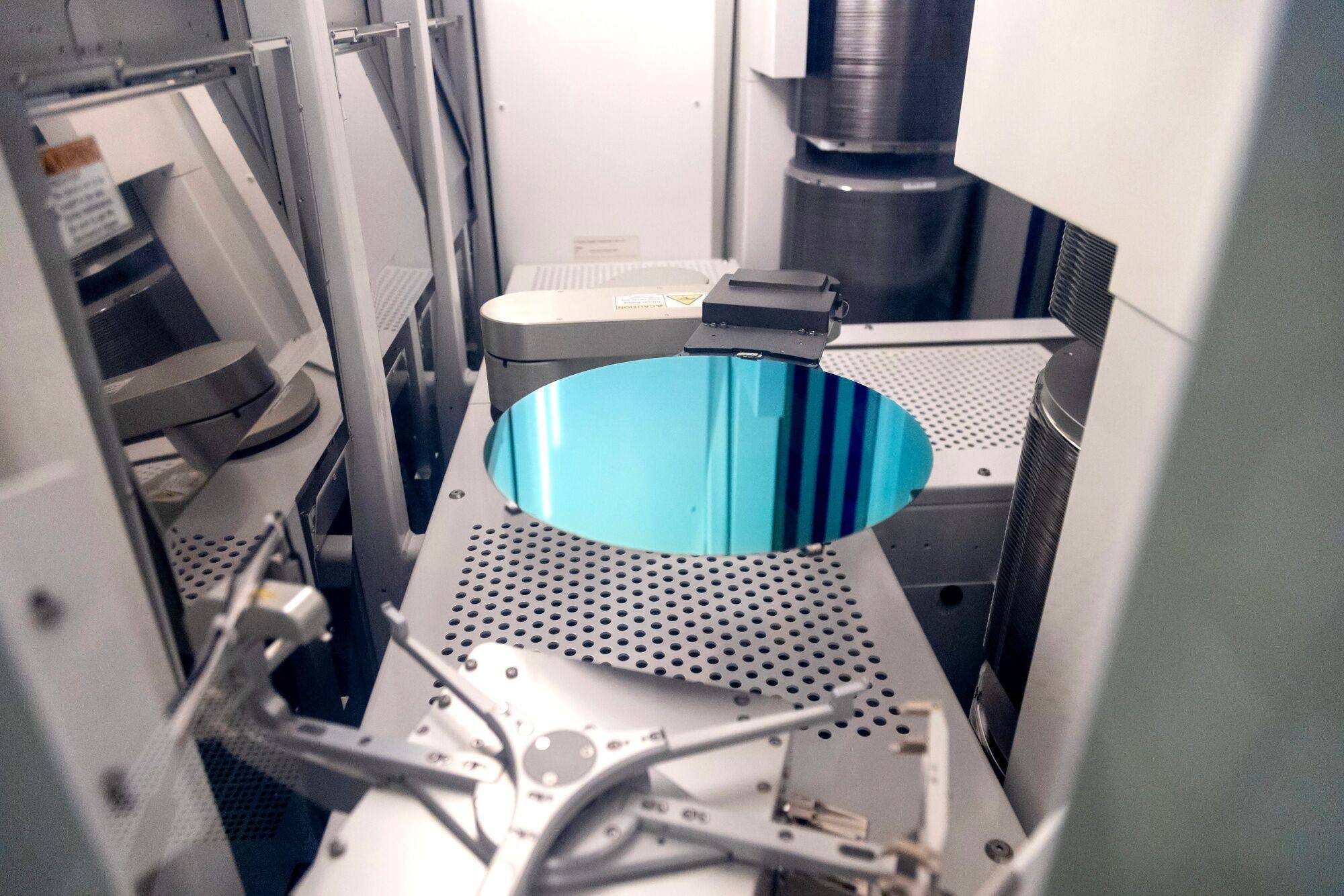

Indonesia said in September it had begun drawing up a roadmap to develop its silica industry, a key raw material needed to make silicon wafers, a key building block of semiconductors, to kickstart its semiconductor manufacturing strategy.

But analysts say these efforts may be too little, too late.

Kim Kyung-hoon, an associate research fellow specializing in industrial policy at the Korea Institute for International Economic Policy, said Indonesia did not appear to have a “coherent strategy” for developing its semiconductor industry.

“Without experience in semiconductor production, Indonesia will have to inject financial resources to attract investment,” he said.

This could be a challenge as Indonesia has maintained fiscally conservative policies since the 1997 Asian financial crisis, Kim added.

Although Indonesia has abundant silica resources, observers say they may not give Indonesia a competitive advantage because silica is widely available around the world and other countries in the region have more established semiconductor manufacturing facilities.

Major U.S. chipmakers such as Intel, Micron and Texas Instruments, as well as Dutch chip-making equipment maker ASML, are already present in Southeast Asia but have been excluding Indonesia from their regional expansion for many years, Kim said.

“In terms of back-end operations, Malaysia and Singapore are already very efficient so it will be very difficult for Indonesia to compete,” he said.

As the third-largest U.S. semiconductor partner in Asia after South Korea and Taiwan, Vietnam has emerged as a formidable competitor to Indonesia as the United States seeks to relocate its semiconductor production out of China.

“Malaysia has an advantage in terms of human resources, and Vietnam’s trade policy regime is well-suited for highly complex global value chains due to its stronger linkages with major trading partners around the world,” said Dandi Raphitrandi, an economic researcher at the Center for Strategic and International Studies in Jakarta.

Regulatory challenges

Despite Indonesia’s ambitions to expand its semiconductor capacity, it has struggled to attract significant new investments and expansion plans from major global chipmakers. The only exception is Germany’s Infineon Technologies, which announced it would expand its back-end manufacturing operations at an existing facility on Batam island in 2022.

To be more competitive in the semiconductor industry, analysts say Indonesia needs to invest in research and development, as well as develop a skilled workforce that can support advanced manufacturing activities.

Dandi of the Center for Strategic and International Studies warned that Indonesia’s inflexible business regulatory environment could hinder the country’s goal of moving up the semiconductor value chain.

“Indonesia has fairly restrictive trade policies, including local content requirements, import restrictions and inconsistent regulations,” he said.

Legal expert Ronald agreed, saying regulatory uncertainty would discourage foreign semiconductor companies from considering Indonesia as a base for their regional expansion plans.

“Due to political instability and governance challenges, Indonesia’s economy has historically been biased towards natural resource exports and low-value manufacturing, limiting the capacity of its workforce in advanced technology sectors,” Ronald said.

“Indonesia must address bureaucratic inefficiencies, policy inconsistencies and corruption to effectively implement its industrial policy and attract high-value investment.”