Indian Equity Market: Domestic equity indexes Sensex and Nifty 50 are expected to open higher on Tuesday, following positive momentum from their global peers.

Asian markets rose, while the U.S. stock market notched a record gain overnight, driven by a rally in tech stocks on the rise of artificial intelligence (AI).

Indian equity market benchmark indices rose on Friday, with the Nifty 50 hitting a record high during the session.

The Sensex index rose 181.87 points or 0.24 percent to close at 76,992.77, while the Nifty 50 index rose 66.70 points or 0.29 percent to close at 23,465.60.

Indian stock markets were closed on Monday, June 17, due to Eid-ul-Adha 2024.

This week, investors will be focusing on the upcoming Union Budget and other government policy announcements that may impact the stock market, domestic and global macroeconomic indicators, developments in international capital flows, oil prices, central bank policy decisions, and other global signals that may drive the market going forward.

Please read this: Key market triggers this week include macro data, BoE and Chinese policy decisions, foreign investor activity and global signals.

“Positive market undertones have seen Nifty scale new highs and inching closer to the 23,500 mark as cautious investors continue to take a selective buying approach in key staples. However, small and midcap stocks are showing fresh buying appetite while largecaps face higher valuation hurdles. As expectations start building from the government ahead of the budget announcement next month, the market may face a surge in intraday volatility in the coming days,” said Prashanth Tapse, senior VP (research), Mehta Equities Ltd.

Here are some key indices of domestic and global markets on Sensex today:

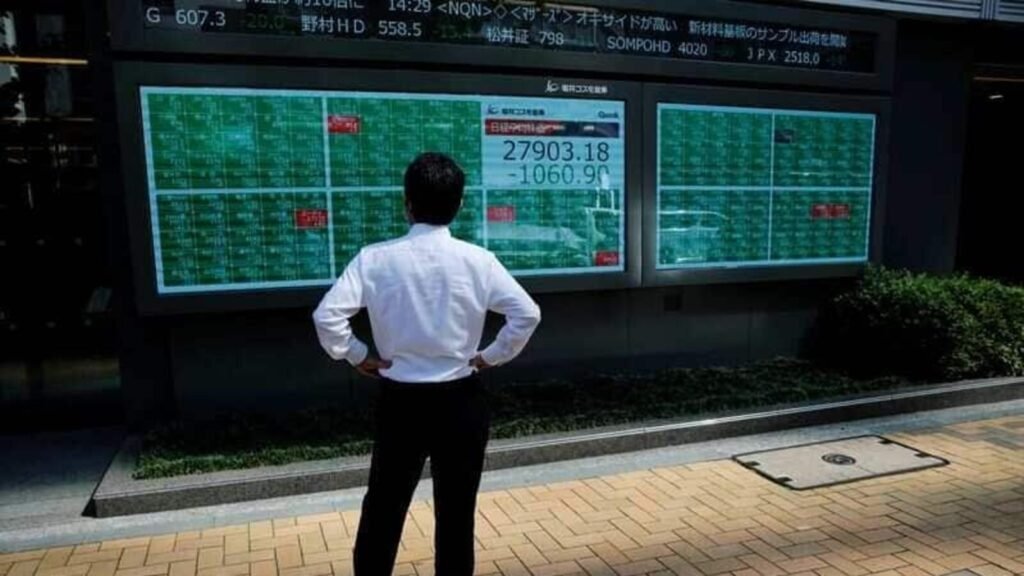

Asian Market

Asian markets rose following a record gain on Wall Street overnight, led by technology stocks.

Japan’s Nikkei rose 0.84% and the Topix added 0.64%. South Korea’s KOSPI rose 0.9%. Hong Kong’s Hang Seng Index futures opened higher.

Read also: Dividend stocks: 4 stocks trading ex-dividend on June 18th

Give the gift of Nifty today

The GIFT Nifty was trading near the 23,590 level, up nearly 130 points from Friday’s closing price of Nifty futures, indicating a strong start for the Indian stock market index.

Wall Street

U.S. stocks closed significantly higher on Monday, with the S&P 500 and Nasdaq closing at record highs as tech stocks surged on enthusiasm for artificial intelligence.

The Dow Jones Industrial Average rose 188.94 points, or 0.49%, to 38,778.10, while the S&P 500 added 41.63 points, or 0.77%, to 5,473.23. The Nasdaq Composite Index added 168.14 points, or 0.95%, to close at 17,857.02.

On the stock market, Apple shares rose 1.97%, Microsoft shares rose 1.31%, Broadcom shares surged 5.41%, Taiwan Semiconductor Manufacturing shares rose 2.74%, Micron Technology shares rose 4.58%, and Autodesk shares surged 6.48%.

Read also: Stocks, bonds, gold: Axis recommends diversified multi-asset portfolios for optimal risk management

Federal Reserve Board (FRB) officials

Philadelphia Federal Reserve President Patrick Harker said the Federal Reserve could cut interest rates once this year if his economic forecasts come true.

According to Reuters, Harker laid out his base case of slowing but above-trend economic growth, a moderate rise in the unemployment rate and a “prolonged recovery” of inflation to target. He then said, “If all goes as expected, one rate cut by the end of the year would be appropriate.”

Trade Deficit

India’s trade deficit widened to a seven-month high of $23.78 billion in May, according to government data. Merchandise exports rose 9.1% year-on-year to $38.13 billion last month, while imports rose 7.7% to $61.91 billion from $57.48 billion a year earlier.

Read also: Stock Market News: When will Nifty 50 index rise to 30K peak?

Oil prices

Crude oil prices continued to rise on Tuesday, trading higher on the back of a strengthening demand outlook.

Brent crude futures, the global benchmark, rose 0.25% to $84.46 a barrel, while U.S. West Texas Intermediate crude futures rose 0.2% to $80.49 a barrel. Both benchmarks rose about 2% on Monday to close at their highest since April.

Dollar

The US Dollar Index, measuring the greenback against the euro, pound and four other major currencies, was down slightly to 105.26 in early Asian trading.

(Quoted from Reuters)

Disclaimer: The views and recommendations expressed above are those of the individual analysts or brokerage firms and not that of Mint. We recommend checking with a certified professional before making any investment decisions.

3.6 Million Indians visited us in a single day and chose us as their platform for Indian General Election Results. Check out the latest updates here!