Indian Equity Market: Domestic equity benchmark indices Sensex and Nifty 50 are expected to open flat on Monday, taking a breather from last month’s sharp gains following mixed signals from their global peers.

Asian markets were mixed while US stocks closed lower last week after data showed US inflation remained flat in May as expected.

According to data from LSEG FedWatch, following the release of the US Personal Consumption Expenditures Price (PCE) index, expectations that the Federal Reserve will cut interest rates in September rose to 66%.

India’s major stock indexes ended lower on Friday, snapping a four-day winning streak as investors continued to take profits at record levels.

The Sensex index fell 210.45 points or 0.27 percent to close at 79,032.73, while the Nifty 50 index rose 33.90 points or 0.14 percent to close at 24,010.60.

Read also: Buy or Sell: Vaishali Parekh recommends 3 stocks to buy today — July 1

“We expect the positive momentum to continue steadily through individual stock movements. However, economic data due next week will likely keep the market a little volatility. Sectors like auto are expected to be in focus as auto manufacturers are set to announce their monthly vehicle sales figures,” said Siddhartha Khemka, senior group vice president and head of research, broking and distribution at Motilal Oswal Financial Services.

Investors will be keeping a close eye on several factors that may impact the markets in the next week, including the Union Budget and government policy announcements, domestic and global macroeconomic indicators, foreign fund inflows, crude oil prices and other key global indicators.

Please read this: Bear market outlook: Fed speech, US and India manufacturing PMI data, global indicators among key market triggers next week

Here are some key indices of domestic and global markets on Sensex today:

Today’s Gift

Indian equity market indices saw a flat start with Gift Nifty trading near the 24,135 level.

Asian Market

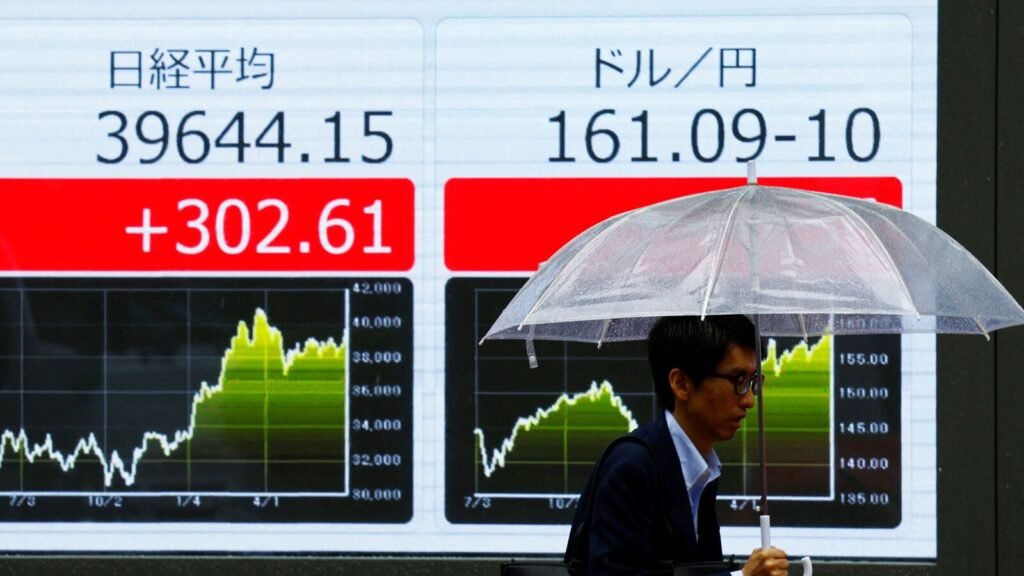

Asian markets were mixed on Monday as investors assessed key economic data from China and Japan.

Japan’s Nikkei rose 0.8% and the Topix added 0.94%. South Korea’s KOSPI fell 0.16% while the Kosdaq rose 0.55%. Hong Kong was closed for a public holiday.

Read also: The Sensex index recorded its biggest monthly gain since December in June.

Wall Street

Reuters reported that US stocks closed lower on Friday as investors digested expected inflation data and factored in political uncertainty following the US presidential debate.

The Dow Jones Industrial Average fell 41.12 points, or 0.11%, to 39,122.94, while the S&P 500 lost 22.57 points, or 0.41%, to 5,460.30. The Nasdaq Composite Index lost 126.08 points, or 0.71%, to close at 17,732.60.

Nike shares plunged 19.98%, their biggest one-day drop in the past two decades, after the company forecast an unexpected decline in revenue for fiscal 2025.

Infinera shares rose 15.78% after Nokia announced it would acquire the company for $2.3 billion.

Read also: Wall Street outlook for the week: Jobs, inflation data could pull Treasury market out of tight range

US Inflation

U.S. monthly inflation remained unchanged in May, with the personal consumption expenditures (PCE) price index remaining flat last month after rising 0.3% (unrevised) in April. Over the 12 months to May, the PCE price index rose 2.6% after rising 2.7% in April. Last month’s inflation rate was in line with economists’ expectations.

FPI Purchases

Foreign portfolio investors (FPIs) turned net buyers in June after two months of net sellers. In June, FPIs bought Indian equities worth $100 a share. ₹26,565 crore. FPI inflows into Indian equities in the first half of 2024 are relatively modest. ₹3,201 crore due to a large inflow of over Rs. ₹The previous year it was Rs 17,000 crore.

Please read this: FPI inflows are expected to pick up sharply after modest growth in H1 2024, with a strong recovery seen in June

China released its official PMI over the weekend, with the manufacturing PMI coming in at 49.5, unchanged from May and marking a second consecutive month of contraction.

China PMI

China’s manufacturing activity contracted for a second straight month in June. The official manufacturing purchasing managers’ index (PMI) was 49.5 last month, unchanged from May, according to the National Bureau of Statistics.

Japanese Corporate Outlook

Business confidence among Japan’s largest manufacturers improved to a two-month high in the second quarter. The Bank of Japan’s quarterly Tankan survey showed the business confidence index for the country’s largest manufacturers rose to 13 in June from 11 in March. Economists polled by Reuters had expected +12. Business confidence for large non-manufacturers fell slightly to 33 from 34.

(Quoted from Reuters)

Disclaimer: The views and recommendations expressed above are those of the individual analysts or brokerage firms and not those of Mint. We recommend checking with a qualified professional before making any investment decisions.

3.6 Million Indians visited us in a single day and chose us as their platform for Indian General Election Results. Check out the latest updates here!