Indian Equity Market: Domestic equity indexes Sensex and Nifty 50 are expected to open lower on Thursday following weakness in other Asian equity markets.

Asian markets fell but U.S. stock indexes ended a volatile overnight session with modest gains ahead of the presidential debate and an inflation report that will be closely watched by Federal Reserve policymakers.

Market participants are awaiting Friday’s release of the key personal consumption expenditures (PCE) price index, the Fed’s preferred inflation gauge for determining the direction of monetary policy.

Investors see a 56.3% chance of a 25 basis point cut in September, with roughly two rate cuts expected by the end of the year, according to LSEG data.

Read also: Buy or Sell: Vaishali Parekh Recommends 3 Stocks to Buy Today — June 27

Indian equity market benchmark indices closed at record highs on Wednesday, with the Nifty 50 crossing 23,850 for the first time ever, led by banks and large corporates.

The Sensex index rose 620.73 points or 0.80 percent to close at 78,674.25, while the Nifty 50 index rose 147.50 points or 0.62 percent to close at 23,868.80.

“General optimism around the Union Budget, increased inflows from foreign institutional investors and robust domestic economic data contributed to the positive market movement. We expect the ongoing upward trend to continue further,” said Siddhartha Khemka, senior group vice president and head of research, broking and distribution at Motilal Oswal Financial Services Ltd.

Key global market indications on Sensex today include:

Give the gift of Nifty today

GIFT Nifty is trading around 23,800 levels, down about 70 points from the previous day’s closing price of Nifty futures, indicating a negative start for Indian stock market indices.

Read also: Stock Market Today: 5 Stocks on F&O Prohibited List on June 27th

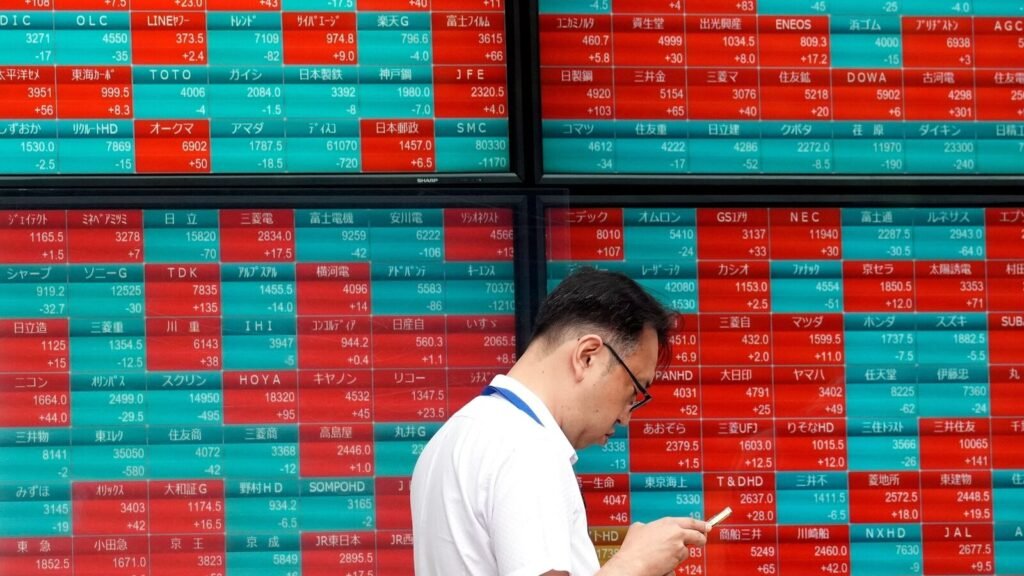

Asian Market

Asian markets fell on Thursday as the Japanese yen fell to a 38-year low ahead of the release of regional economic data.

Japan’s Nikkei fell 0.93% and the TOPIX dropped 0.36%. South Korea’s KOSPI fell 1% and the KOSDAQ rose 0.24%. Hong Kong’s Hang Seng Index futures opened lower.

Wall Street

U.S. stock indexes closed modestly higher on Wednesday ahead of the release of the inflation report.

The Dow Jones Industrial Average rose 16.10 points, or 0.04%, to 39,128.26, the S&P 500 added 8.61 points, or 0.16%, to 5,477.91 and the Nasdaq Composite Index added 87.50 points, or 0.49%, to close at 17,805.16.

Nvidia shares rose 0.25%, Apple shares rose nearly 2%, Tesla shares rose 4.81% and Amazon shares rose 3.90%.

Whirlpool shares rose 17.1%, FedEx shares rose 15.53%, Rivian shares rose 23.24% and General Mills shares fell 4.59%.

Please read this: Wall Street ends slightly higher, trade choppy ahead of inflation data release

Dollar, government bond yields

Reuters reported that the dollar index, a gauge of the greenback’s value against six major currencies, stabilized at 106.05, hovering near its highest level in nearly two months, supported by rising U.S. Treasury yields.

The Japanese yen was nearing its lowest level in 38 years, rising 0.1 percent to 160.63 yen per dollar in early Asian trading, just off Wednesday’s lowest level since 1986 of 160.88 yen.

The yield on the benchmark 10-year Treasury note rose 2 basis points to 4.3392% on Thursday, while the yield on the two-year note was steady at 4.7576%.

Please read this: Dollar hits 38-year high against yen

Oil prices

Oil prices fell on Thursday after an unexpected rise in U.S. crude inventories raised concerns about weak demand from the biggest oil consumer.

Brent crude futures fell 0.38% to $84.93 a barrel, while US West Texas Intermediate crude futures fell 0.41% to $80.57 a barrel.

Japan Retail Sales

Japan’s retail sales rose 3.0% year-on-year in May, beating the median market forecast of a 2.0% increase. The data compares with a revised 2% increase in April.

(Quoted from Reuters)

Disclaimer: The views and recommendations expressed above are those of the individual analysts or brokerage firms and not that of Mint. We recommend checking with a certified professional before making any investment decisions.

3.6 Million Indians visited us in a single day and chose us as their platform for Indian general election results. Check out the latest updates here!