Indian startups witnessed a steady increase in capital inflows in the first quarter of 2023, with funding topping $2.75 billion. Importantly, March’s funding stood out as being the first to cross the $1 billion threshold in 2024. But even as funding recovers, layoffs, closures and top-level executive departures still loom.

Indian startups raised $2.77 billion in 326 deals in the March quarter or first quarter of 2024, according to data compiled by . The Credible. This includes 74 growth-stage deals (valued at $1.87 billion) and 213 early-stage deals (valued at $898 million). There were 39 undisclosed rounds.

Two startups, Krutrim SI Designs and Perfios, joined the unicorn club after their latest funding in the first quarter of 2024, as opposed to the first quarter of 2023.

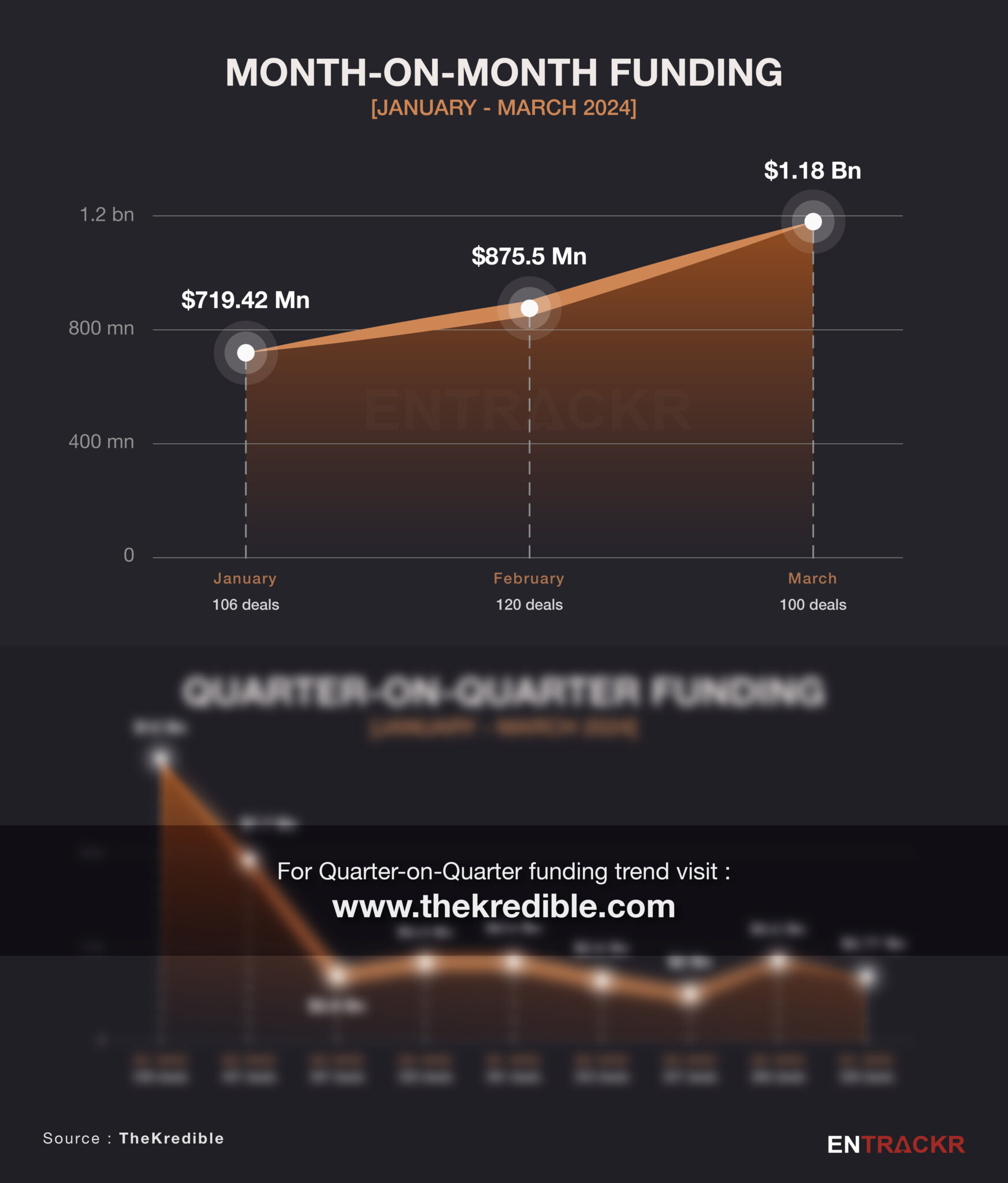

[Month-on-Month and Year-on-Year trend]

In March, funding increased significantly from $875 million since February to $1.18 billion. $700 million in January. However, on a year-over-year basis, Q1 2024 was down from his $12 billion in Q1 2022 and $3.4 billion in Q1 2023.

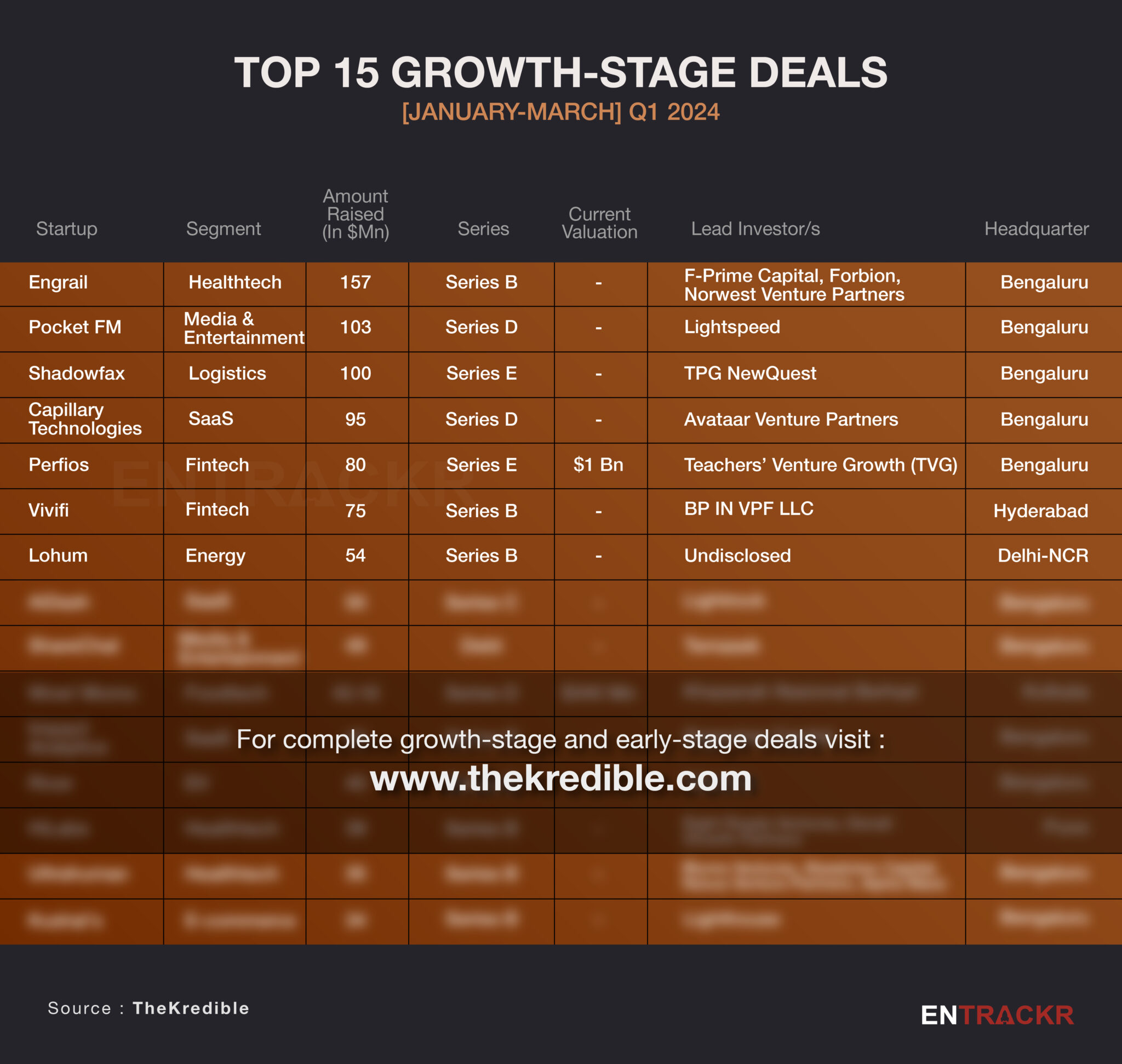

[Top growth stage deals]

Biotech startup Engrail has raised $157 million in a Series B funding round, becoming the most funded growth-stage company in Q1 2024. Audio series platform Pocket FM and logistics company Shadowfax managed to breach his $100 million funding mark in the first quarter of 2024. .

capillary technologies, perphiosBibifi, RofumiDash, share chat And wow! Momo was in the top 10 growth stage deals.

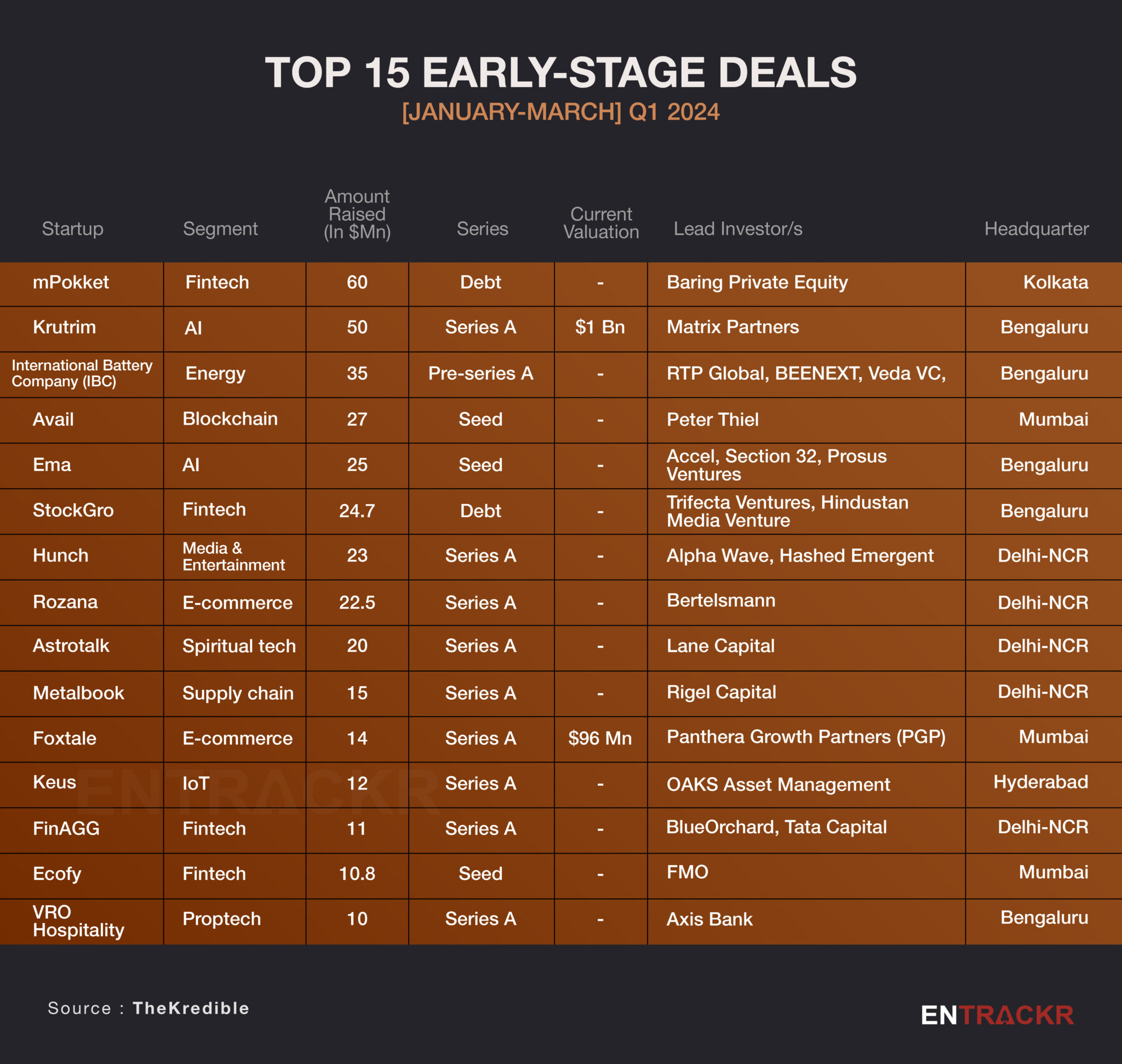

[Top early-stage deals]

Digital lending platform mPokket, AI company Krutrim, energy technology company International Battery Company (IBC), blockchain company Avail, and generative AI startup Ema topped the list of early-stage startups.check The Credible For a complete list.

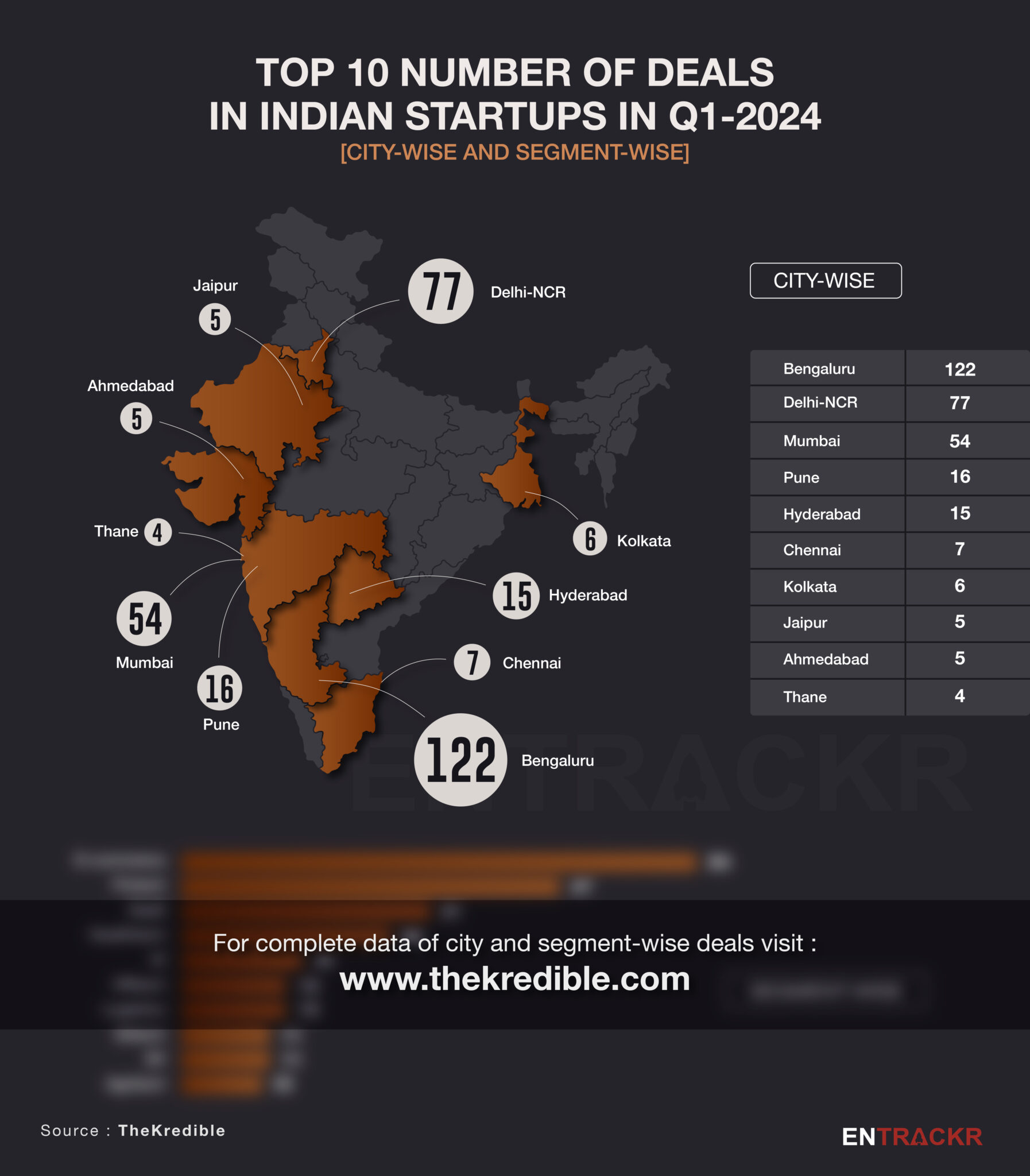

[City and segment-wise deals]

By city, Bengaluru-based startups maintained the lead with 122 deals, contributing around 54% of total funding in Q1 2024. Delhi-NCR and Mumbai followed with 77 and 54 deals respectively. The list further includes Pune, Hyderabad, Chennai, Kolkata, Jaipur, Ahmedabad, Thane, etc.

By segment, e-commerce startups (including D2C brands) topped the list with 64 deals, followed by fintech (47), healthtech (31), SaaS (26), EV (15), and AI. (13 cases), followed by edtech (13 cases). ) Startup. A complete breakdown of cities and segments can be found here: The Credible.

[Stage-wise deals]

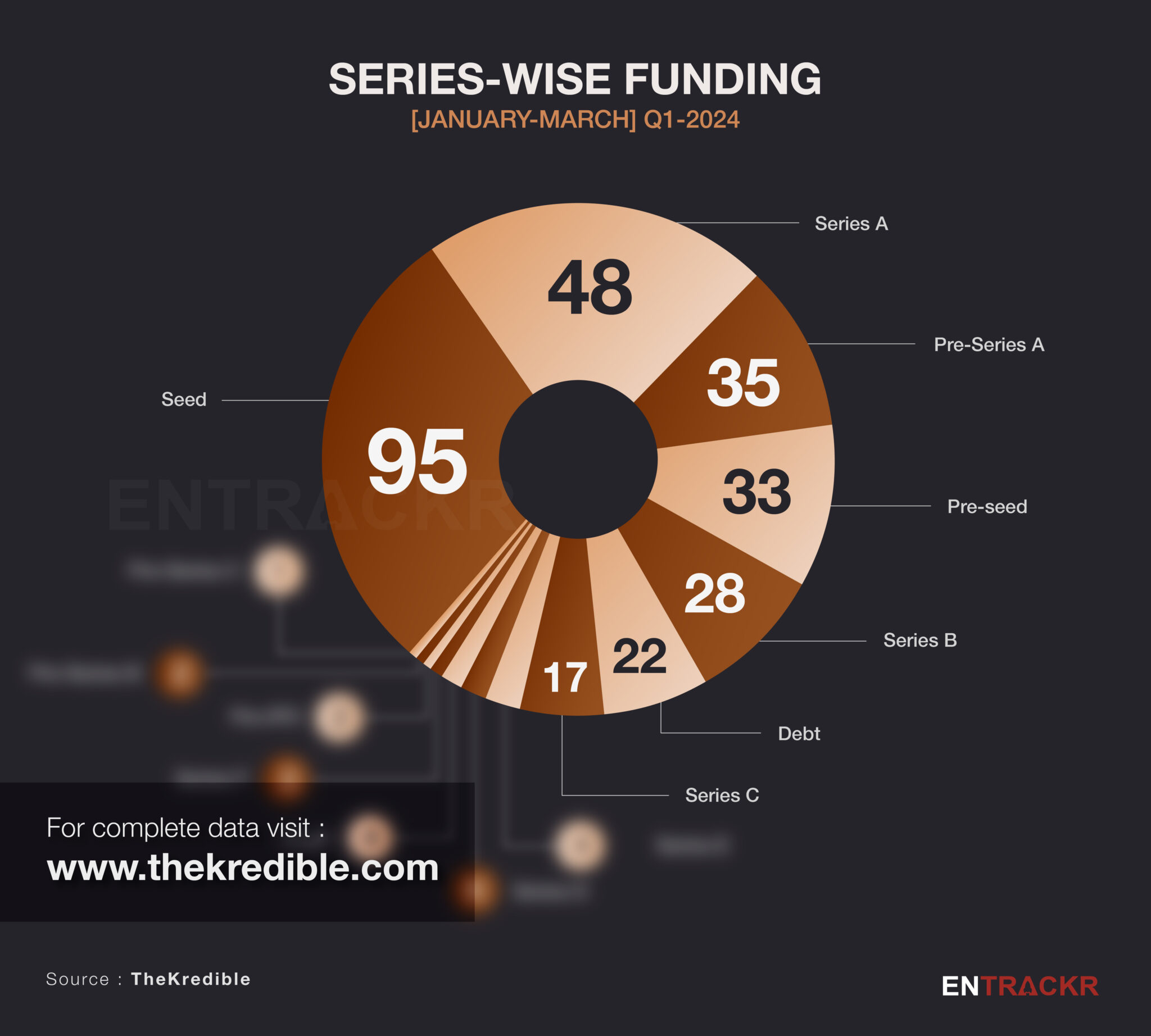

By series, 95 startups raised seed rounds, followed by 71 series A, 35 pre-series A, and 33 pre-seed deals. Among early-stage startups, there were four that raised angel funding. Meanwhile, 22 startups raised $276.65 million worth of debt funding during the same period.

[Most active investors]

Early-stage venture capital firms Inflection Point Ventures and Blume Ventures emerged as the most active investors in Q1 2024, with 11 and 10 investments, respectively. Venture Catalysts was next on the list with nine of his deals. Fireside Ventures, Anicut, Accel, Stride Ventures. The complete list can be found here: The Credible.

[Mergers and acquisitions]

In the first quarter of 2024, 26 merger and acquisition transactions were registered.acquisition of tapasya educational institution By the veranda Insemi Written by Infosys, Q digi service The top three merger and acquisition transactions disclosed by Onsitego made the list. During this period, Nodwin, a subsidiary of publicly traded gaming company Nazara, acquired two of his startups: Comic Con India and Ninja Global FZCO.

Among the undisclosed deals: Kuvera was acquired by fintech unicorn CRED, Captain Fresh acquired CenSea, and OneVerse acquired three startups including Spartan Poker, BatBall11, and Calling Station. Check the complete list here.

[Layoffs, shutdowns and departures]

Job cuts continued in the March quarter, with more than 1,100 employees receiving pink slips. Among them, food tech company Swiggy tops the list by laying off his 350 employees, followed by Cult.fit, InMobi and Pristyn Care, which laid off 150, 125 and 120 employees respectively. I was fired.

Five companies ceased operations in the first quarter. The list includes Resso, Rario, OKX India, GoldPe and Muvin. But Lario added: We are launching a brand new platform that allows users to play a new and engaging cricket based game.

In addition to layoffs and closures, nearly 20 top-level executives have left their jobs. Paytm Payments Bank founder Vijay Shekhar Sharma has resigned as non-executive chairman and director of the company. Meanwhile, the CEO of Third Wave Coffee said, Sushant Goel He resigned from that position to become a director.The list also includes the CEO of Indus Appstore. Rakesh DeshmukhCo-founder of DealShare Surjendu Meddaand Jamil Ahmed, co-founder of Fashinza.

[ESOP buyback]

Amid all the ups and downs, the startup ecosystem has seen employee stock buybacks by growth and late-stage companies. For context, e-commerce company Meesho roll out The company’s largest ESOP buyback valued at $25 million for 1,700 employees.community management app my gate and edtech companies class plus announced an employee stock buyback program earlier this year. A complete list can be found here.

visit The Credible look Bargain items by series with Amount breakdowncomplete details Launching a fundyou can gain even more insight.

[Conclusion]

It’s safe to say that the layoff trend will subside in the coming months, if not weeks, as funding recovers. As fintech continues to do well and scale faster for many, the category will continue to seek more funding and launch the next big startup. New categories are likely to emerge soon due to market turnover, such as AI, chip design, or niche areas in health tech. There is great hope that the many corporate governance issues that have plagued the ecosystem over the past two years will also hopefully be put on the backburner thanks to the lessons learned. Especially when you look at the numbers for Q1 2022 ($12 billion), many would say it’s a wasted opportunity and capital. But that’s the nature of the startup world, and sometimes you can accomplish things with a little money and a little innovation that no amount of money you can throw at a problem can accomplish it. We are optimistic that by the fourth quarter of this year, the Indian startup ecosystem will be stronger and more diversified than ever before.