- U.S. stocks fell as traders awaited Nvidia’s first quarter results.

- The hurdles are high as Wall Street analysts look for hard indicators that the AI market is booming.

- Investors also looked to the minutes of the Fed’s latest meeting, which suggested a rate cut was not imminent.

U.S. stocks fell on Wednesday as traders focused on Nvidia’s first-quarter earnings report and the latest Fed minutes.

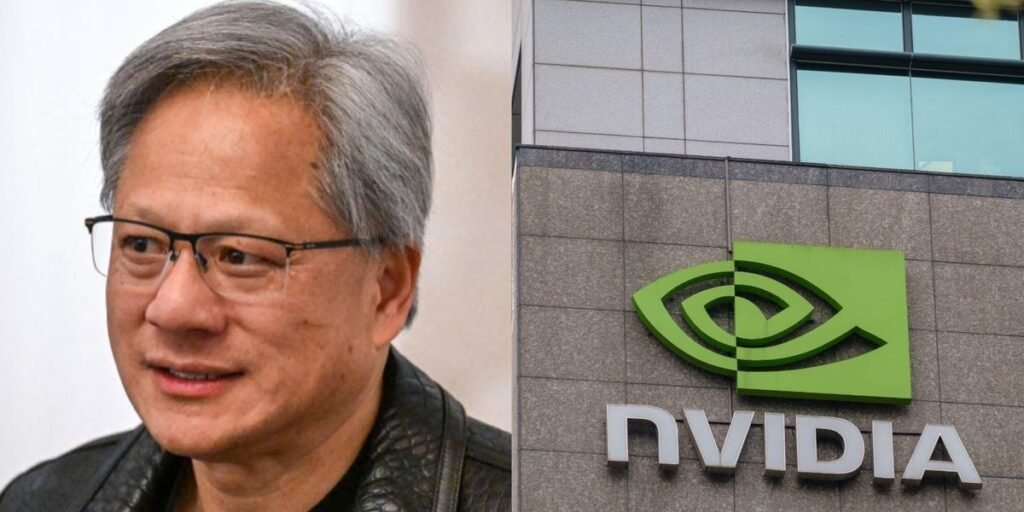

Major stock averages fell, with Nvidia shares down more than 1% ahead of its much-anticipated earnings report.

Investors are hoping for another strong quarter for Nvidia, which has been the biggest beneficiary of Wall Street’s artificial intelligence frenzy. Analysts expect the company to report revenue of $24.6 billion and earnings per share of $5.34 in the first three months of 2024, according to Bloomberg data, which are down from the numbers both metrics reported last year. That’s more than double.

Nvidia’s first-quarter results came at a critical moment for investors looking for a new catalyst to propel the next left of its recent stock rally. The company is valued at more than $2 trillion, NVDA shares have helped power the market rally throughout the year, and shares are now up 94% from their January levels.

“This may sound overly enthusiastic, but if NVDA comes off another strong quarter, the market is currently at a new all-time high, and there is no resistance to the left, we could see parabolic mode again. “Nvidia will definitely involve the entire semiconductor industry,” Ken Mahoney, CEO of Mahoney Asset Management, said in a note this week.

Investors on Wednesday also got minutes from the Federal Reserve’s May policy meeting, which noted that short-term inflation expectations were “somewhat elevated” and that recent inflation records did not boost the central bank’s confidence that inflation is certainly heading in the right direction.

The minutes put pressure on stocks heading into the close, with major indexes posting notable declines in late afternoon trading. Some market participants were quick to point out that the latest minutes reflected the Fed’s mood before April’s consumer price index showed easing inflation from the previous month.

“While markets may be nervous about committee members accepting tightening policy, it is important to remember that the committee does not yet have April CPI data,” said LPL Financial Chief Economist. Jeffrey Roach said in a memo Wednesday.

“Although inflation eased slightly in April, Fed officials need further confirmation that they are on track to reach their 2% target. “The Fed’s next move is likely to be a rate cut this year,” Roach added.

Here are the U.S. indexes as of Wednesday’s 4 p.m. close:

Here’s what else happened today:

Commodities, Bonds and Cryptocurrencies:

- West Texas Intermediate crude oil fell 1.14% to $77.76 a barrel. The international benchmark Brent crude oil fell 0.28% to $81.67 per barrel.

- Gold fell 1.82% to $2,377.86 per ounce.

- The yield on the 10-year U.S. Treasury rose 1 basis point to 4.426%.

- Bitcoin rose slightly to $69,631.