The easiest way to profit from a rising market is to buy an index fund. Active investors aim to buy stocks that will significantly outperform the market, but in the process run the risk of underperforming. Iruka Resources Limited (ASX:ILU) suffered a bitter sell-off last year, with its share price falling 37%. This compares with a market return of 13%. At least the damage is less when you consider that the share price is down 8.8% over the past three years.

Given that last week was a tough one for shareholders, let’s examine the fundamentals to see what we can learn.

Check out our latest analysis for Iluka Resources

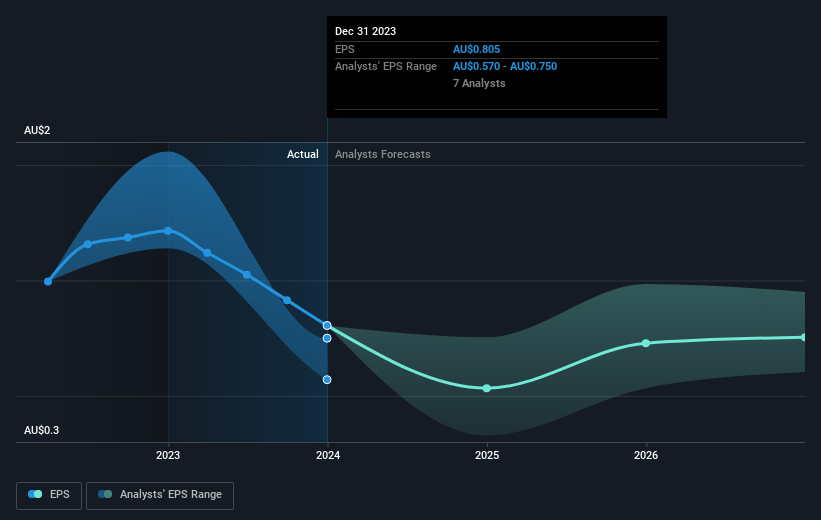

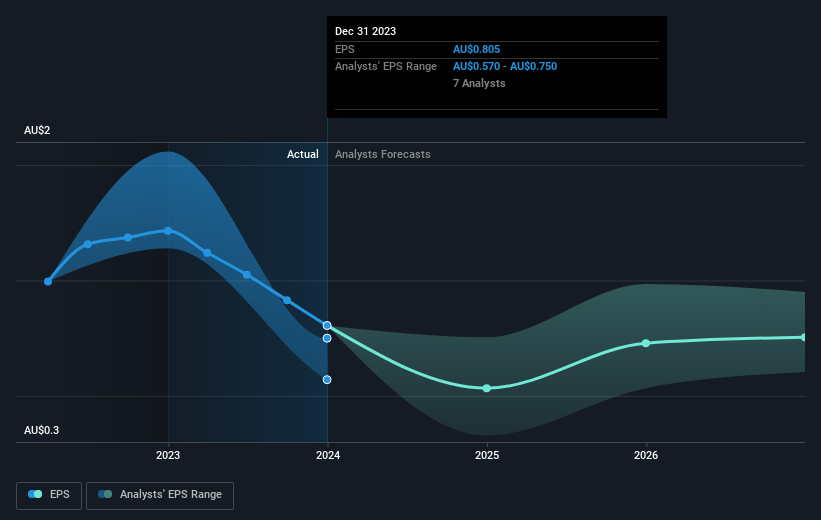

While the efficient market hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems and investors are not always rational.One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Unfortunately, Iluka Resources reported a 34% decrease in EPS last year. Note that the 37% decrease in the share price is very close to the decrease in EPS. Therefore, we can infer that the market is not growing more concerned about the company despite the EPS decline. Rather, the share price remains at a similar multiple of EPS, indicating that the outlook remains unchanged.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Iruka Resources has improved its earnings over the past three years, but what does the future hold? free Report how your financial situation has changed over time.

A different perspective

It’s been a tough year for Iruka Resources investors, with a total loss of 37% (including dividends) compared to a market gain of around 13%. But remember that even the best stocks can underperform the market over a twelve month period. Longer term investors won’t be as upset, as the stock has returned 11% annually over five years. If the fundamental data continues to point to sustainable growth over the long term, the current sell-off could be an opportunity worth considering. While it’s well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important, such as: 1 warning sign for Iluka Resources Here’s what you need to know before investing.

If you like buying stocks with management teams, you might like this free A list of companies. (Hint: many of these are under the radar and have attractive valuations.)

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.