For shareholders, The RealReal Co., Ltd. (NASDAQ:REAL) shares have fallen 24% in the last month. Despite this, the stock has performed well over the past year, there’s no doubt about that. In that time, the stock has surged 122%. So, the stock may simply be settling down after a steep rise. Only time will tell if the current stock price still reflects excessive optimism.

With that in mind, it’s worth looking at whether a company’s underlying fundamentals are driving its long-term performance, or if there are any inconsistencies.

Check out our latest analysis for RealReal

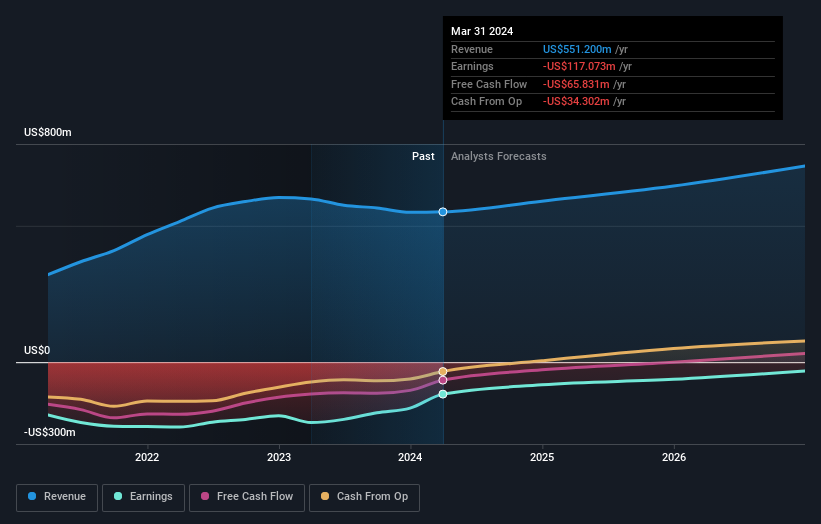

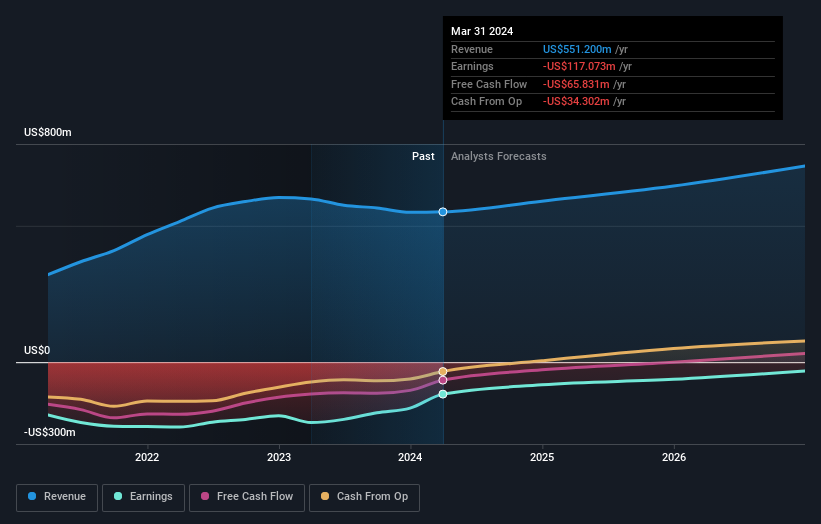

Because The RealReal hasn’t made a profit in the last twelve months, we’ll look at revenue growth as a quick way to gauge how the business is developing. Shareholders of unprofitable companies will usually want to see strong revenue growth, as it’s hard to be convinced that a company is sustainable when revenue growth is negligible and there’s no profit growth at all.

Last year, The RealReal’s revenue fell 7.9%. Therefore, we didn’t expect the stock to rise 122%. This is a good example of how buyers can drive up the price before fundamental indicators show significant growth. In any case, the revenue decline was likely already priced into the price.

The graph below depicts how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It’s good to see that insiders have been buying shares in the last twelve months, but most people consider earnings and revenue growth trends to be more meaningful measures of the business, so it makes a lot of sense to see if analysts are forecasting RealReal’s future earnings (free profit forecasts).

A different perspective

We’re pleased to report that RealReal shareholders have received a total shareholder return of 122% over one year. These recent returns are arguably much better than the five-year annual TSR loss of 14%. While we typically emphasize long-term performance over the short term, the recent improvement could suggest a (positive) inflection point in the business. We find it very interesting to look at share price over the long term as a proxy for business performance. But to gain true insight, other information should also be considered. For example, we’ve identified the following: 4 warning signs for RealReal (Number 1 should not be ignored) Something to be aware of.

The RealReal isn’t the only stock insiders are buying, so take a look at this free A list of attractively valuated small-cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Please contact us directly. Or email us at editorial-team@simplywallst.com