For many people, the main purpose of investing in the stock market is to achieve impressive profits. Not all stocks perform well, but investors can make big profits if they win. Can’t believe it?then take a look Moderna Inc. (NASDAQ:MRNA) stock price. That’s an increase of 367% compared to 5 years ago. This is just one example of the spectacular gains some long-term investors have achieved. We note that the stock price has increased by 2.2% for him over the past 7 days.

So let’s do some research and see if the company’s long-term performance is in line with the progress of its underlying business.

See our latest analysis for Moderna

Moderna isn’t currently profitable, so most analysts will focus on revenue growth to get a sense of how fast the underlying business is growing. Generally speaking, unprofitable companies are expected to have steady revenue growth every year. That’s because rapid growth in revenue can often be easily extrapolated to predict profits of considerable size.

Over the past five years, Moderna has enjoyed 49% annual revenue growth. This is a good result compared to other revenue-focused companies. Perhaps this is well reflected in his massive 36% (annual) share price increase over the same period. Some long-term winners continue to win for decades, so it’s never too late to start chasing blue-chip stocks like Moderna. So we recommend taking a closer look at this, but keep in mind that the market appears to be optimistic.

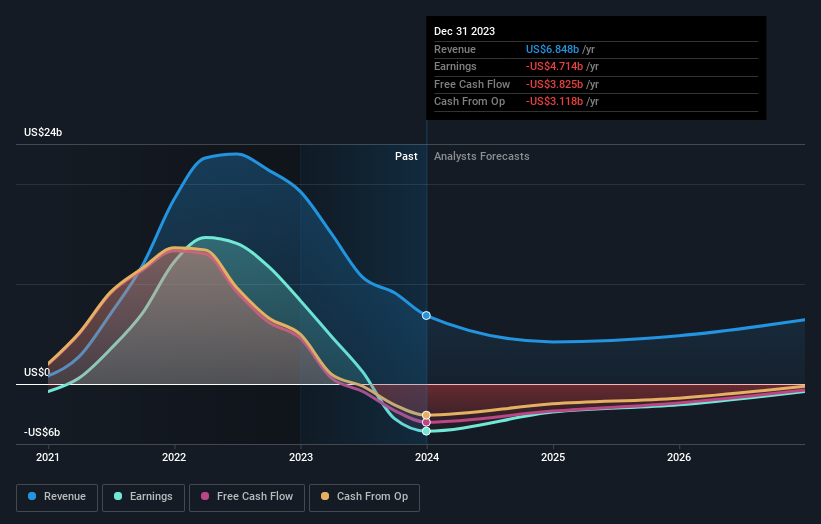

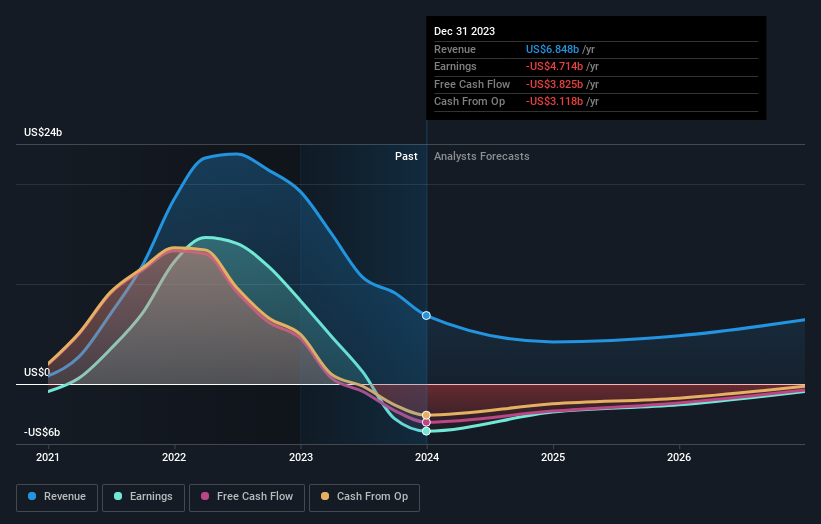

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Moderna is well known to investors, and many smart analysts have attempted to predict future profit levels.Given that there are quite a few analyst forecasts, it might be well worth checking this out free Graph showing consensus estimates.

different perspective

Moderna shareholders are down 33% for the year, while the market itself is up 25%. Even blue-chip stocks can see their share prices drop from time to time, and we like to see improvement in a company’s fundamental metrics before we get too interested. On the bright side, long term shareholders have made money, with a return of 36% per year over 50 years. The recent selloff could be an opportunity, so it might be worth checking the fundamental data for signs of a long-term growth trend. I think it’s very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well.For example, taking risks – Moderna is 1 warning sign I think you should know.

If you want to buy stocks with management, you might like this free List of companies. (Hint: Insiders are buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.