When we invest, we typically look for stocks that outperform the market average. And the truth is, if you buy a quality business at the right price, you can make big profits. That said, Masterflex’s stock price rose 83% in his five years, easily outperforming his 7.6% market return (ignoring dividends).

With that in mind, it’s worth checking whether a company’s underlying fundamentals are driving its long-term performance, or if there are any discrepancies.

Check out our latest analysis for Masterflex.

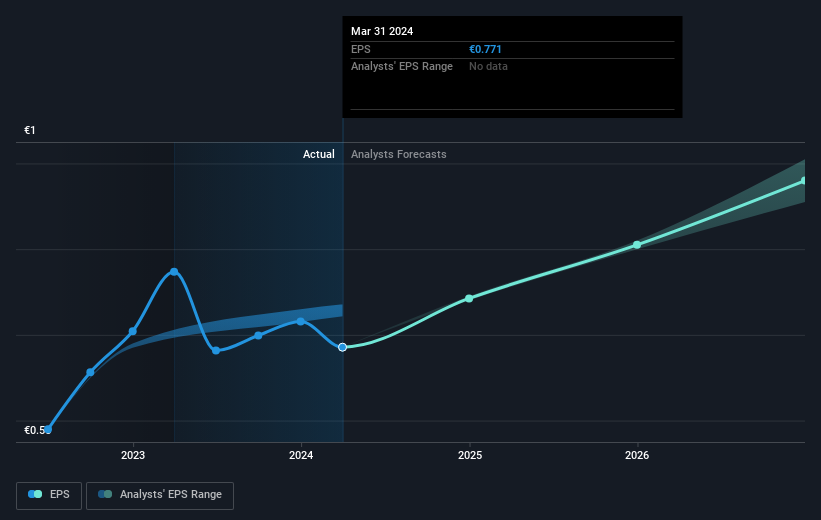

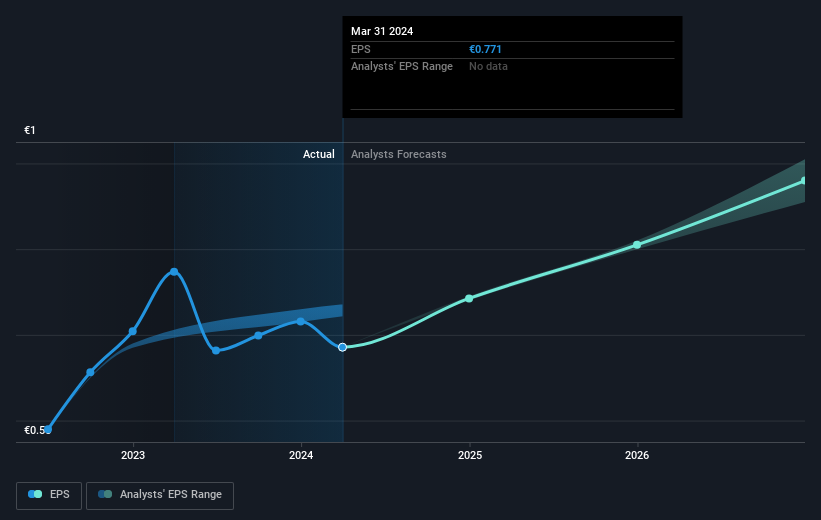

in his essay Graham & Doddsville SuperInvestors Warren Buffett has said that share prices do not always rationally reflect a company’s value, and one way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

Masterflex has grown its earnings per share at 17% per year over five years. This EPS growth is more impressive than the 13% annual rise in the share price over the same period. As a result, the market appears to be relatively pessimistic about the company.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Of course, it’s great to see how Masterflex has grown its profits over the years, but the future is more important to shareholders. If you’re looking to buy or sell Masterflex stock, check this out. free Detailed report on balance sheet.

What will happen to the dividend?

It’s important to consider not only the share price return, but also the total shareholder return for a particular stock. Whereas the price/earnings ratio only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. For Masterflex, the TSR for the last 5 years is 98%. This exceeds the stock return mentioned earlier. And there’s no kudos to speculating that dividend payments are the main explanation for the divergence.

different perspective

Investors in MasterFlex have had a rough year, with a total loss of 5.9% (including dividends) compared to a market gain of about 7.4%. Even blue-chip stocks can see their share prices drop from time to time, and we like to see improvement in a company’s fundamental metrics before we get too interested. On the bright side, long term shareholders have made money, with a return of 15% per year over 50 years. The recent selloff could be an opportunity, so it might be worth checking the fundamental data for signs of a long-term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we identified 2 warning signs for Masterflex What you need to know.

If you’re like me, you will. do not have I want to miss this free A list of undervalued small-cap stocks that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Have feedback on this article? Interested in its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.