These days, you can easily buy an index fund and (more or less) match the market, but you can significantly boost your returns by picking above-average stocks. DCC Corporation The (LON:DCC) share price is up 22% since a year ago, far better than the market return of around 7.4% (excluding dividends) over the same period. This is a strong performance by our standards. However, it’s been tough for longer term shareholders, with the share price down 6.8% in three years.

With that in mind, it’s worth looking into whether a company’s underlying fundamentals are driving its long-term performance, or if there are any inconsistencies.

Check out our latest analysis for DCC

To paraphrase Benjamin Graham, “In the short run, the market is a voting machine, but in the long run it’s a weighing machine.” One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Indeed, over the last 12 months DCC’s EPS fell 2.4%.

The gradual decline in EPS could be due to the company currently focusing on other aspects of its business. Since the change in EPS doesn’t seem to correlate with the change in share price, it’s worth looking at other metrics.

DCC’s revenue is actually down 11% over the last year, so a snapshot of the key business metrics doesn’t really paint a clear picture of why the market is pumping the share price so high.

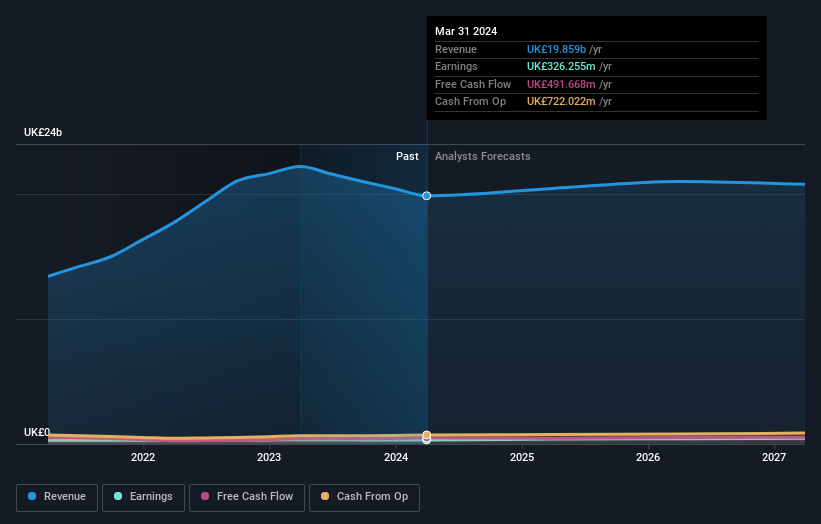

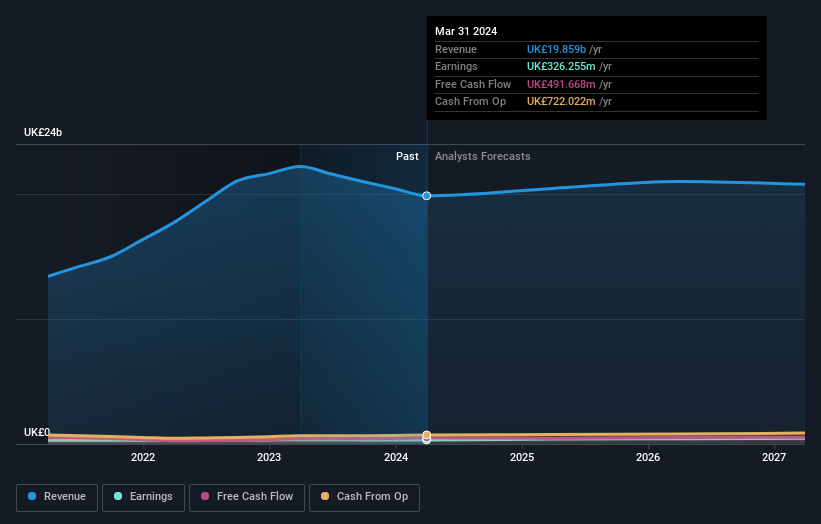

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

DCC is well known to investors, and many smart analysts have attempted to predict its future earnings levels. See here for what analysts are predicting for DCC. Interaction Future profit forecast graph.

What about dividends?

It is important to consider the total shareholder return, as well as the price return, for a given stock. While the price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the gains of any discounted capital raising or spin-off. It can be said that the TSR gives a more comprehensive picture of the return generated by a stock. Note that in the case of DCC, the TSR for the past year was 26%, which is better than the price return shown above. The dividends paid by the company have thus boosted the share price. total Shareholder returns.

A different perspective

It’s good to see that DCC has delivered a total shareholder return of 26% to shareholders in the last twelve months, which includes dividends. There’s no doubt that the recent yield is much better than the TSR loss of 0.1% per annum over five years. This is a bit alarming, but the business may have turned its fortunes around. Importantly, we haven’t analysed DCC’s dividend history. free If you’re considering buying, the dividend visual report is a must-read.

If you want to check out another company that may be financially superior, don’t miss this one. free A list of companies that have proven they can grow revenue.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on UK exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.