Stock investors are generally looking for stocks that will outperform the overall market. And in our experience, buying the right stocks can significantly increase your wealth. For example: SFC Energy AG (ETR:F3C)’s share price is up 96% over the past five years, obviously beating the market return of around 9.2% (not taking dividends into account).However, more recent returns have not been as impressive, with the share price returning just 5.0% over the past year.

It’s also worth looking at the company’s fundamentals here, because it can help determine whether long-term shareholder interests are aligned with the performance of the underlying business.

View our latest analysis for SFC Energy

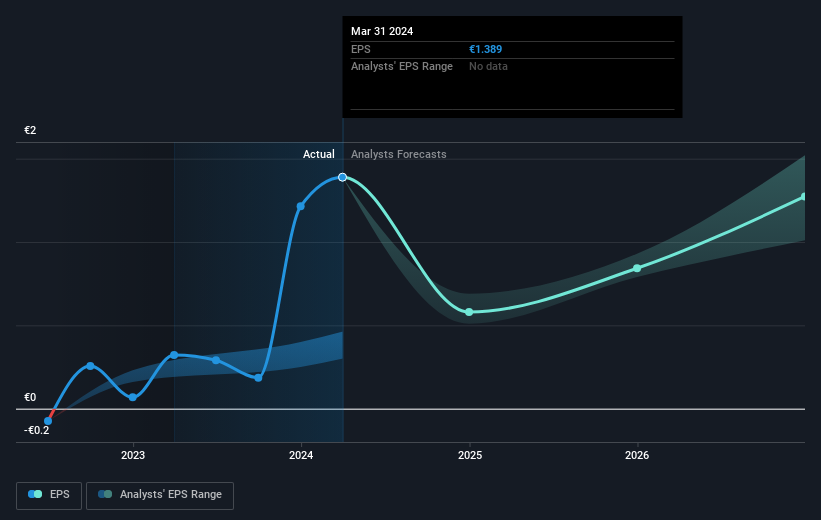

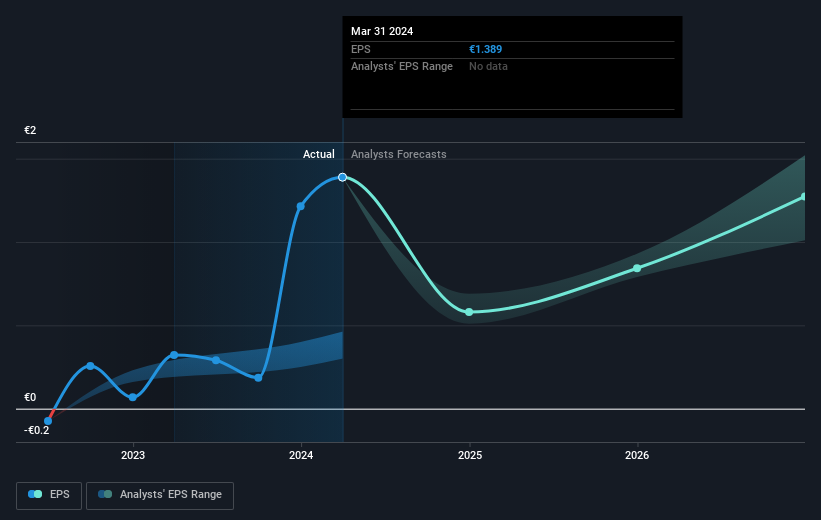

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance.One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last five years, SFC Energy has made a profit, which is generally considered a real positive and investors should be expecting the share price to rise.

The image below shows how EPS has changed over time (if you click on the image you can see greater detail).

It’s of course great that SFC Energy has grown its profits over the years, but the future is more important to shareholders. If you’re thinking about buying or selling SFC Energy shares, check this out. free A detailed balance sheet report.

What about the total shareholder return (TSR)?

SFC Energy’s Total shareholder return (TSR) and its Price Earnings RatioThe TSR is a return calculation which accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Although SFC Energy doesn’t pay a dividend, its TSR of 113% exceeds the share price return of 96%, implying that it has either spun off businesses or raised discounted capital, thereby providing additional value to shareholders.

A different perspective

SFC Energy delivered a TSR of 5.0% over the last 12 months; however, this is below the market average. The company has provided shareholders with a TSR of 16% per annum over five years, which is probably a good sign that it could perform even better over the longer term. Given that it has enjoyed a long-term period of favourable valuation from the market, this business could be worth keeping an eye on. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important, such as: 2 warning signs for SFC Energy Something you should know.

of course SFC Energy may not be the best stock to buySo you might want to take a look at this free A collection of growing stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.