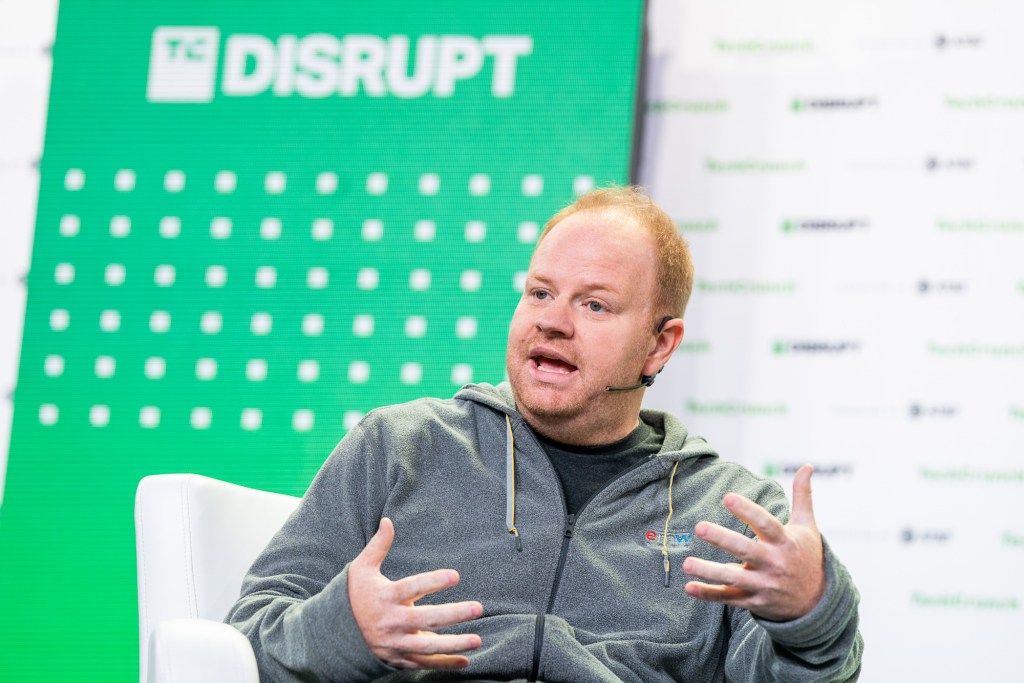

Image credits: Haje Kamps/TechCrunch

Late-stage HRtech startup Ripped is raising new funding. The company’s new round, which has not yet been completed, will inject $200 million into Rippling, with an additional $670 million worth of shares sold by existing shareholders, according to two people familiar with the deal. It’s planned.

This marks Rippling’s Series F, and its valuation could rise to $13.4 billion on a post-money basis. Valuation of $11.25 billion It last raised a $500 million Series E just a year ago.ripples rose The total funding up to this round was $1.2 billion. A Rippling spokesperson declined to comment.

That last round was put together during the Silicon Valley banking crisis, when Rippling’s funds were abruptly frozen. Rippling founder and CEO Parker Conrad embarked on his X, working on the phone with banks, investors, and his own customers to raise the cash needed to cover everyone’s salaries.

Sources familiar with the deal said Founders Fund’s existing investor Napolian Ta is willing to invest up to an additional $310 million, the most raised to date in a single company round. It could be one of the largest checks ever. Existing investor Cotu is actually leading the round, so how much of this cash will go toward new Series F shares, and how much will be used to buy stock from other investors. It is unknown whether Existing investor Greenoaks is also participating.

It’s no shock that Rippling has raised even more money in a year. The HRtech market for payroll services and remote labor management is growing significantly, with many well-funded late-stage startups. Competitor Gusto, which is making waves, told TechCrunch: reached We had $500 million in revenue last year and were cash flow positive. Earlier this year, Deel focused on payroll for cross-border teams. Said Annual recurring revenue has reached $500 million. Gusto is worth about $9.5 billion for each of his deals. Crunch-based datadeal worth $12 billion,remote over $3 billion, and Rippling is now $13.5 billion, and there is a tremendous amount of venture capital, founder, and employee capital in HRtech today. And new companies are being born one after another.limo first Recently raised $25 millionFor example, as we continue to work on low-cost recruitment products that compete with many of the companies mentioned above.

Similarly, as the IPO market remains depressed, existing shareholders, such as employees and existing investors, are also looking to sell shares in private companies to gain liquidity. Large-scale secondary transactions are in vogue.