American business owner and author of the bestselling “Rich Dad Poor Dad” series, Robert Kiyosaki, has criticised successful investor Warren Buffett for refraining from investing in gold.

Like politics, the world of finance is not without its dramas, and Kiyosaki has been in the media spotlight for his harsh criticism of Buffett’s stance on gold investments, which the founder of multinational conglomerate Berkshire Hathaway has frequently said he believes are unwise investments.

do not miss it:

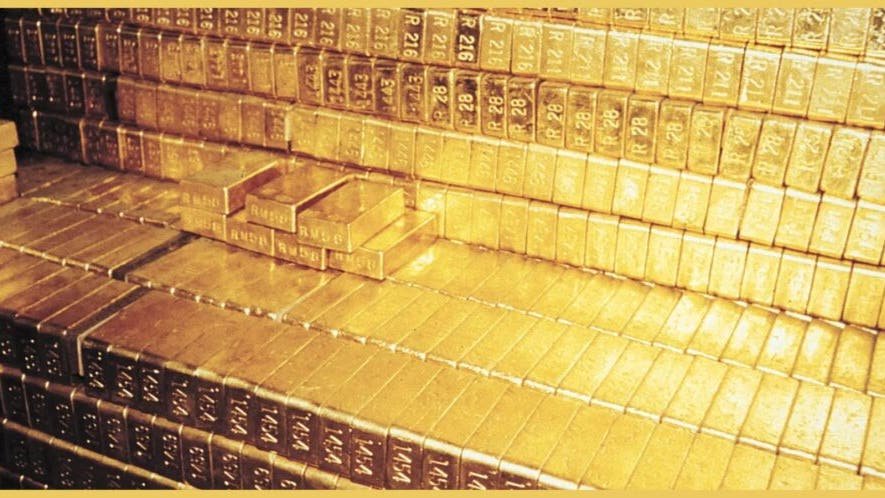

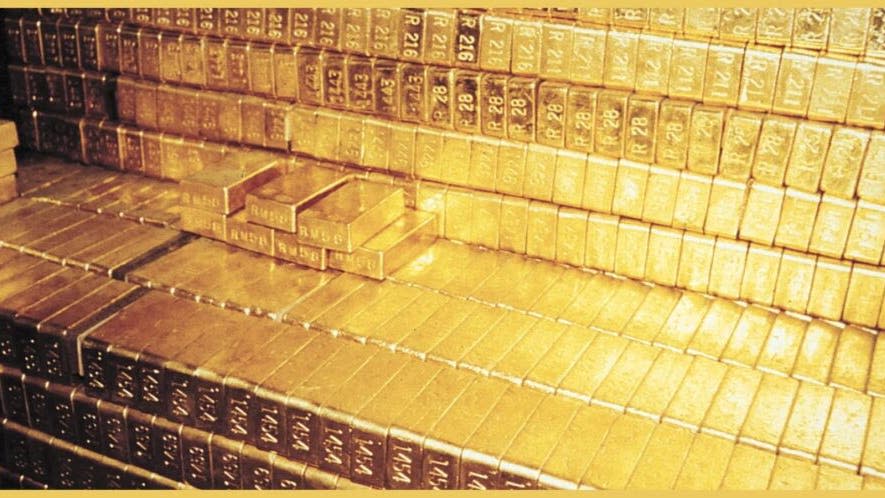

“Gold has two great drawbacks: it is not very useful and it is not fertile. You could own an ounce of gold forever, and in the end you would only have one ounce,” Buffett wrote in a 2011 letter to shareholders. Instead, Buffett emphasizes investing in productive assets that generate income, such as real estate, stocks and bonds.

However, Kiyosaki is strongly opposed to the Oracle of Omaha and criticized the investor in an interview with Vladislav Lyubovny, during which Kiyosaki held up a silver coin and said, “This is a 1964 silver coin. So this little silver coin is worth $10 today. You can go to any coin dealer and get $10 for it. So, fuck you, Buffett.”

Unlike Buffett, Kiyosaki is a self-proclaimed gold nut and is well-known for recommending gold investments. Kiyosaki frequently recommends the use of gold investments as a hedge against inflation and economic uncertainty. In April of this year, Kiyosaki warned of a financial crisis hitting the country, posting on social media platform X, “Every bubble, stock, bond, real estate is on the verge of collapse. US debt is growing $1 trillion every 90 days. America is bankrupt. Fend for yourself. Buy more real gold, silver, Bitcoin.”

trend: The average millionaire has seven sources of income. Here are 3 passive income opportunities you can start today.

Buffett once said, “The idea of digging up something in South Africa or wherever, and bringing it to the United States and burying it at the Federal Reserve Bank of New York, doesn’t seem to me to be a great asset.” To Buffett, gold’s biggest drawback is that it’s not fertile, in the sense that it doesn’t produce income. During a 2011 appearance on CNBC’s Squawk Box, Buffett explained that if he had a choice between a “67-foot cube of gold” and farmland all over the country, he’d choose the farmland.

Kiyosaki acknowledged that Buffett has been very successful, saying, “He’s good at stocks, he’s very smart, he’s a billionaire,” but there’s a reason why Kiyosaki doesn’t listen to the advice of this investor. The reason Kiyosaki doesn’t trust Buffett is because, according to Buffett, unlike Kiyosaki, Buffett doesn’t put his own personal money into investments. “He’s not investing his own money, he’s investing your money,” Kiyosaki said. However, the validity of Kiyosaki’s statement is questionable, considering that in a letter to shareholders in 2011, Buffett said that more than 98% of his net worth is currently invested in Berkshire Hathaway shares.

Gold has historically been considered a safe investment. Even Buffett acknowledges this. James Rickards, a former national security advisor to the Department of Defense and the CIA, revealed that he predicts that gold prices will continue to rise 1,400% between 2015 and 2025, reaching $15,000 per pound. With gold prices rising and gold reserves dwindling, Rickards is encouraging people to buy gold before 2025 to profit when prices rise.

Read next:

Up your stock market game with Benzinga Pro, the #1 “News and Everything Else” trading tool in the “Active Investor’s Secret Weapon” – Start your 14-day trial now by clicking here.

Want the latest stock analysis from Benzinga?

The article “Robert Kiyosaki and Warren Buffett clash over gold investing: ‘He’s not investing his own money, he’s investing yours'” originally appeared on Benzinga.com.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.