Markets opened Wednesday in the red after the Consumer Price Index (CPI), a key measure of inflation, rose more than expected.

According to the U.S. Bureau of Labor Statistics (BLS), the CPI rose 0.4% in March compared to the 0.3% increase that economists compiled by Dow Jones had originally expected.

The better-than-expected inflation numbers dampened investors’ hopes that a rate cut would occur at the same time as the Fed’s June monetary policy meeting. The market probability of a June rate cut has plummeted to about 20%, down from more than 50% probability last week, according to the CME Federal Watch tool.

As the market fell, index ETFs also lost money. spy, SPDR S&P 500 ETF Trust DIA fell more than 1%, but SPDR Dow Jones Industrial Average ETF Trust It fell by 1.25%.

U.S. Treasury yields, particularly the 10-year Treasury note, a popular benchmark for mortgages and other loans, soared on the inflation report. TLT, iShares 20+ Years Government Bond ETF, which has fallen more than 1% since the market opened due to falling bond prices. Yield and price are inversely related.

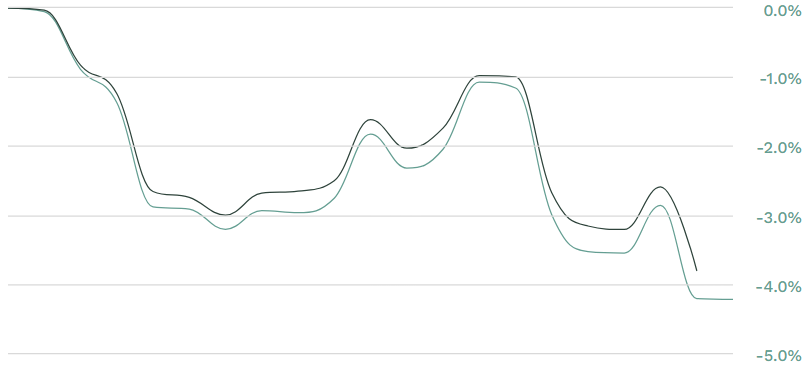

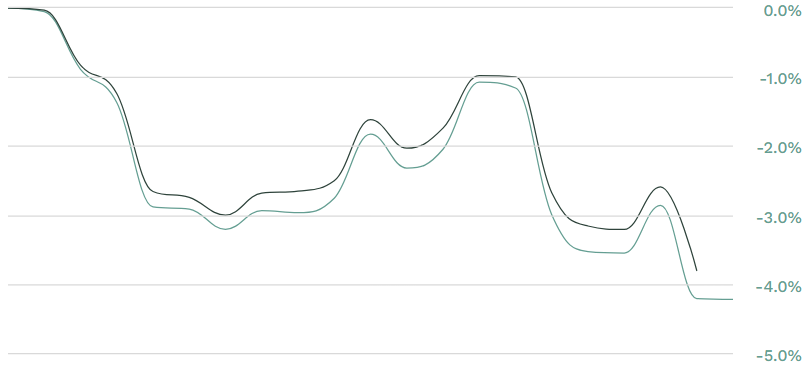

Bond ETFs have been on a roller coaster this year as investors wonder if and when the Fed will cut interest rates.

TLT 1 month total revenue

Currently, TLT’s price is hovering just above $91, near this year’s low.

Inflation reports also affected the prices of real estate and technology stocks. As mortgage and loan prices soar, the high interest rate environment continues to put pressure on real estate, leaving buyers on the sidelines. VNQ, Vanguard Real Estate ETF The index fell nearly 3.5% following the inflation report.

And for growth stocks like technology, rising interest rates will weigh on future profits. Tech stocks have soared despite the high interest rate environment over the past year, but tech ETFs fell sharply on today’s inflation report. QQQ, high-tech focus Invesco QQQ Trust It fell nearly 1%.

Permalink | © Copyright 2024 etf.com.All rights reserved