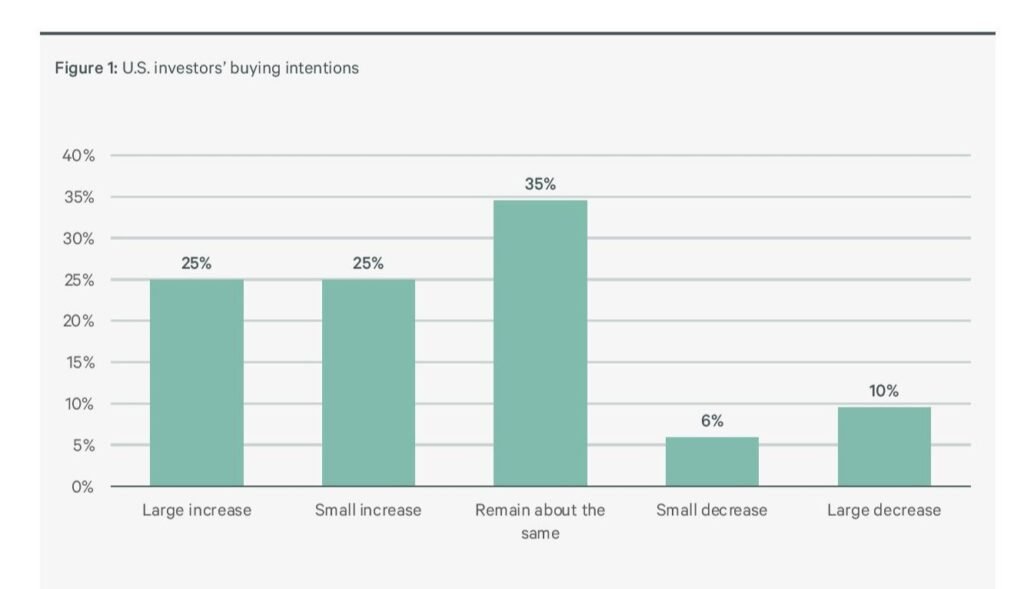

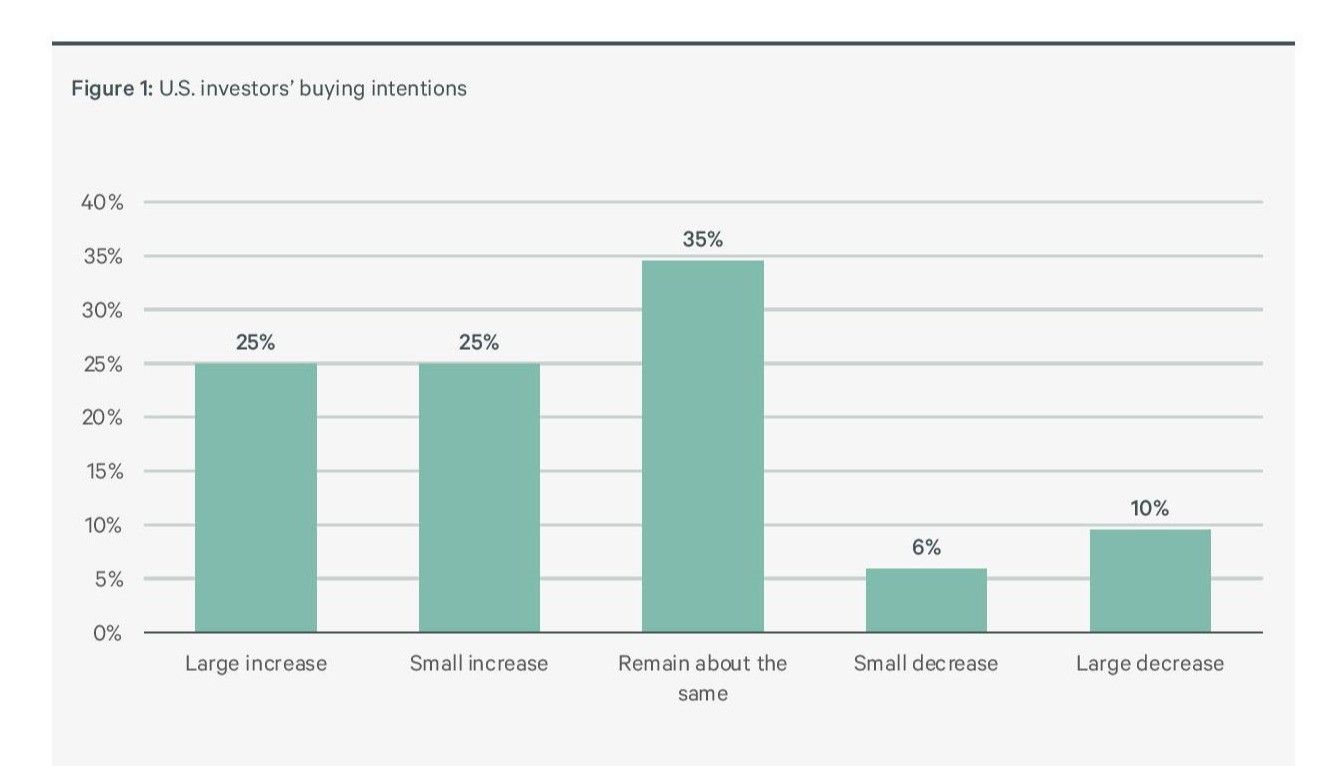

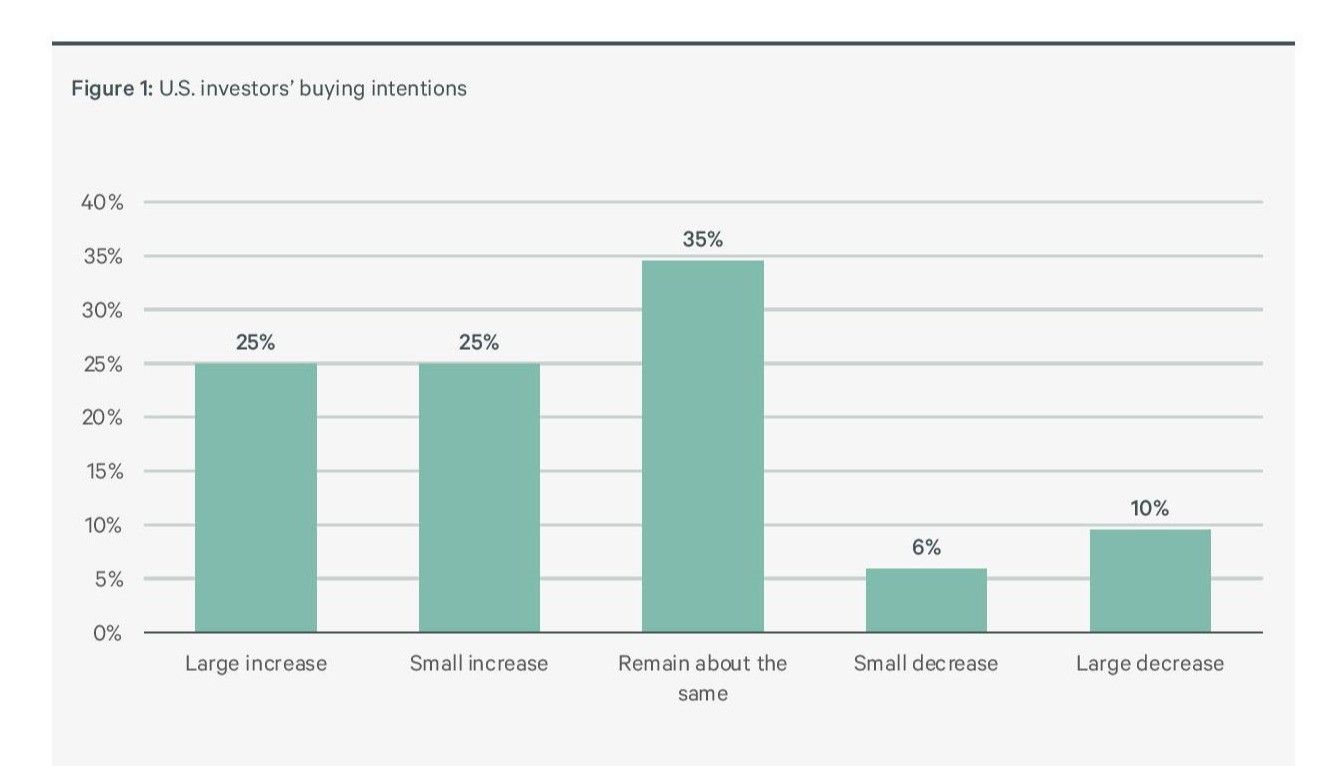

According to a recent survey by CBRE Hotels Research, U.S. hotel investor sentiment remains strong, with investors predicting an increase in hotel acquisitions in 2024. About 35% of survey respondents expect acquisition activity to remain the same as in 2023, while less than 16% expect a decrease.

Despite high interest rates, over 70% are targeting hotel investments to capitalize on the high value-added opportunities.

CBRE’s Global Hotel Investor Intentions Survey, which involved more than 130 U.S. investment executives, found that value-add acquisitions provide an opportunity to reposition assets to increase revenue and long-term value by adding rooms, redesigning interiors and adding amenities.

According to CBRE, of investors who plan to increase their hotel acquisitions this year, about 40% cited lower prices and improved total revenue outlooks as their main reasons. More than a third cited increased opportunities for distressed asset sales and lower debt costs as reasons for increasing acquisitions. Of investors who plan to reduce their hotel allocations this year, 64% cited strengthening balance sheets and difficulties securing and paying down debt as their main reasons.

The survey found that rising borrowing and labor costs are the biggest challenges for hotel investors this year, followed by rising insurance costs, both of which are expected to reduce profit margins. Least of concern for investors is competitive pressure from alternative sectors such as cruise lines, short-term rentals and glamping.

Investors are divided on global brands

CBRE noted that investors are divided on global hotel brands, with more than half planning to sell such assets and more than a third looking to buy them. Similarly, there are more investors looking to sell independent hotels than are interested in buying them.

The survey revealed that a higher percentage of investors plan to buy or sell branded hotels this year compared to independent hotels, a trend that is expected given that branded properties account for more than 70% of total room supply.

Independent hotels, which account for 30% of room supply, saw a weaker sales-to-investment ratio of 186%, while global branded hotels saw a slightly lower ratio of 165%, according to CBRE.

The survey also found that despite limited supply, soft-branded hotels (those that are affiliated with a global brand but retain an independent name) or hotels that can be converted to another brand upon sale are more likely to be acquired than sold by investors: Soft-branded hotels were more than two-thirds more likely to be acquired than sold.

Featured Products

According to CBRE, over 40% of investors find resorts the most attractive location, followed by CBD locations at 26%. Investors expect urban areas to benefit from a recovery in international travel and active meetings and events. Resorts are expected to see stable leisure demand and modest ADR growth, supporting RevPAR growth of 1.6%.

According to the survey, 42% of investors prefer upper upscale assets, followed by upscale/upper midscale at 40%. Luxury assets are preferred by 31%, while midscale/economy properties are less popular due to a decline in RevPAR last year.

Despite increased interest in extended-stay hotels during the pandemic and recent expansion by major hotel brands, only 21% of investors consider these assets their first choice.

The survey found that growing concerns about labor costs and declining profit margins have led 40% of investors to prioritize the acquisition and development of limited-service hotels, compared with 32% of respondents who favored full-service hotels.

New York and Washington drive market sentiment

New York City and Washington, D.C. are expected to have the strongest hotel market fundamentals this year, followed by Austin, Charleston and Miami, according to the survey.

New York City stands out as a top market for hotel investment due to limited supply and strict short-term rental regulations. San Francisco, despite ongoing challenges, remains a promising investment destination in 2024. Additionally, leisure destinations such as Miami and Charleston are also attractive to investors.

CBRE recently reported that after a weak first quarter, U.S. hotels are expected to see strong RevPAR growth in the second half of 2024. RevPAR growth is forecast at 2% this year, down slightly from an initial estimate of 3% in February, though 3% growth is expected for the remainder of the year due to subdued international tourism, vacation travel and supply growth.