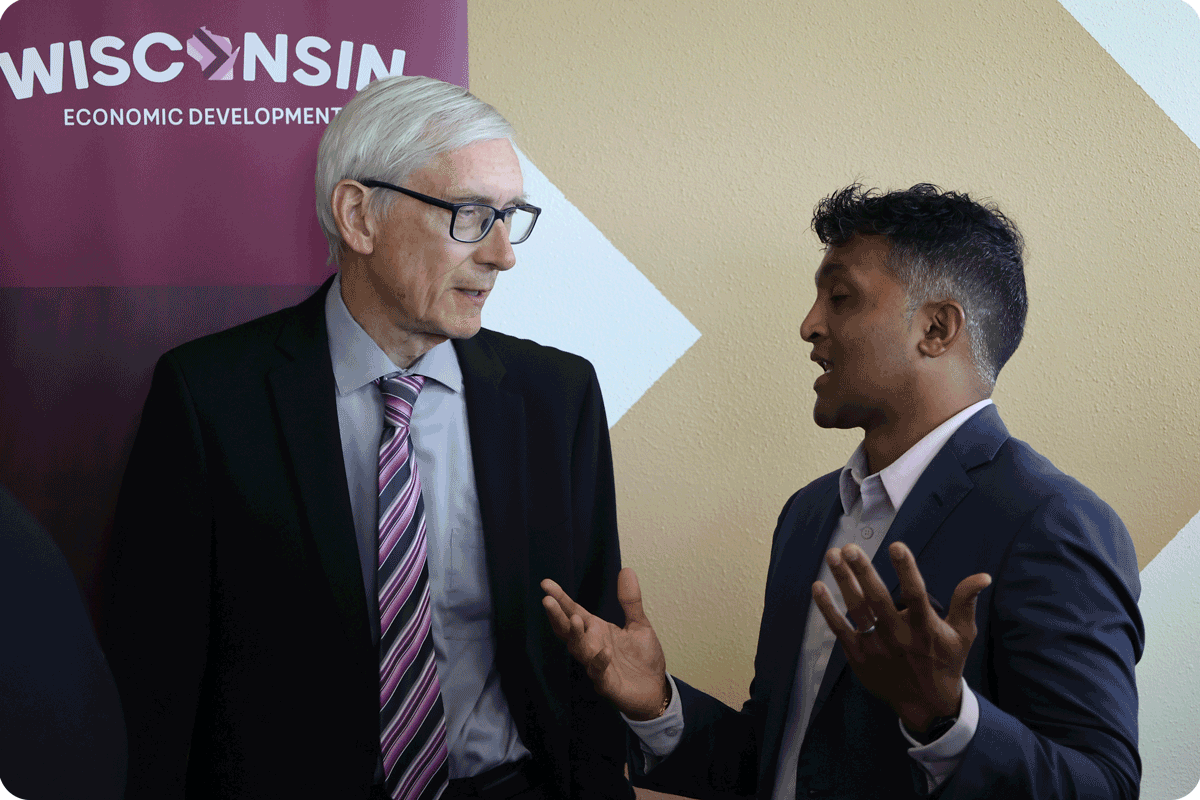

Governor Tony Evers and Cardamom Health CEO Vivek Swaminathan

Wisconsin Investment Fund partnerships include a focus on technology, agriculture, manufacturing and biohealth.

MADISON — Governor Tony Evers, along with Wisconsin Economic Development Corporation (WEDC) Secretary and CEO Missy Hughes, announced the creation of the Wisconsin Investment Fund, a major step in supporting Wisconsin entrepreneurs. This public-private venture capital initiative will initially invest $100 million in startups across the state. During an event at Madison nonprofit Forward BIOLABS, Governor Evers and Secretary Hughes met with executives from five venture capital management firms that will manage the fund’s first round of investments. A sixth capital management firm will be announced shortly.

“The Wisconsin Investment Fund will be the largest public-private investment in Wisconsin startups and entrepreneurs in our state’s history. As these companies begin to grow, the value of the fund will grow with them, creating new opportunities to help even more companies expand,” said Governor Evers. “Over time, we expect the value of this fund to grow exponentially, resulting in a public-private investment ratio of 10 to 1. This fund is a win for the companies that will receive support to take their ideas to new heights, and a win for Wisconsin, which will ensure we maintain our position as a competitive leader in business innovation.”

“This partnership will help more entrepreneurs expand their businesses, create jobs in emerging sectors, and enable Wisconsin to continue its long tradition of innovators and pioneers,” said U.S. Senator Tammy Baldwin (D-Wis.). “I’m proud to support this effort and do my part to create opportunity for more Wisconsinites and grow the next generation of Wisconsin-made economies.”

“Wisconsin has always been a pioneer in bringing great innovative ideas to the world,” said WEDC Executive Director and CEO Hughes. “To bring these ideas to life and drive our state’s economy forward, innovators need capital. This public-private partnership demonstrates Wisconsin’s commitment to entrepreneurship and innovation.”

Venture capital firms are required to put in at least $1 in private capital for every dollar of public funding, which initially doubles the state’s investments. State earnings on those investments are then reinvested in the Wisconsin Investment Fund, generating more capital to fund even more promising Wisconsin companies.

The U.S. Treasury Department’s State Small Business Credit Initiative (SSBCI) is providing $50 million to fund the state’s share of the investment fund, and WEDC expects to generate an impact of at least $500 million in the fund’s first few years as the companies selected by the fund continue to grow.

Wisconsin’s funds will invest in innovative companies operating in sectors such as technology, healthcare, agriculture and manufacturing. In accordance with SSBCI program requirements, Wisconsin’s funds aim to provide significant support to diverse businesses and enterprises located in underinvested areas.

There will be a particular focus on biohealth, with at least $27 million of the state’s initial investment earmarked for that area. Last year, the U.S. Economic Development Administration designated Wisconsin a Regional Technology Hub for Precision Medicine and Biohealth Technologies, which will unlock up to $75 million in new federal funding to accelerate research and development of new treatments.

Members of the Wisconsin Investment Fund Commission reviewed applications from 31 fund managers in a competitive bidding process and selected the final investment company. The private fund partners and investment amounts are as follows:

HealthX Ventures | $15 million

Madison-based HealthX Ventures invests in innovative companies that make healthcare safer, more efficient and more affordable by bringing easy-to-use, cost-effective and scalable solutions to market. HealthX was founded by Mark Bakken and is led by experienced, successful entrepreneurs and investors. The team delivers exceptional value to its portfolio companies through extensive operational support, deep industry knowledge and executive-level networking.

“We are proud to join WEDC’s Wisconsin Investment Fund,” said Mark Bakken, founder and managing director of HealthX Ventures. “Wisconsin has a strong healthcare ecosystem and this fund provides a great opportunity for Wisconsin healthcare startups looking to leverage that ecosystem.”

Venture Investors Health Fund | $12 million

Based in Madison and Milwaukee, Venture Investors Health Fund is focused on commercializing early-stage healthcare innovations developed at world-class research universities in the Midwestern U.S., including the University of Wisconsin and the Medical College of Wisconsin. Areas of focus include medical devices, therapeutics, digital health and diagnostics.

“We are excited to work with the Wisconsin Investment Fund on this public-private partnership,” said David Arnstein, managing director of Venture Investors. “Our goal is to invest in the most promising health care opportunities in Wisconsin and make a significant impact on people’s health.”

Sera Ventures | $7 million

Based in Champaign, Illinois, Serra Ventures focuses on investing in early, emerging and growth stage technology companies in the Midwest. WEDC funds will be used exclusively in Wisconsin.

Serra Ventures invests in early-stage technology companies across the United States. Its current fund, Serra-Grondex Ag & Food Tech Fund II, launched in 2021 and is the sequel to the successful Serra Capital Ag Tech Fund. Serra provides venture funding to experienced startup teams offering novel solutions to the world’s biggest problems in agriculture and food. The managing partners are previously successful entrepreneurs who aim to bring real-world insight, hard work and valuable networks to their portfolio companies. In addition to capital, Serra works with entrepreneurs on all areas of growth, from strategic planning and partnerships to business development and capital formation.

“We are excited to partner with the Wisconsin Economic Development Corporation to deploy capital in Wisconsin-based startups,” said Tim Hoar, CEO and Managing Partner at Serra Ventures. “Wisconsin has a long and proud history in the agriculture and food sector, making it a great fit for Serra Ventures’ new fund. The Serra team looks forward to identifying and funding the best Wisconsin companies in the agriculture and food sector.”

NVNG Investment Advisors | $6 million

Based in Madison and Milwaukee, NVNG is committed to making Wisconsin’s startup ecosystem globally competitive.

NVNG was co-founded by Carrie Thome and Grady Buchanan, who combine institutional investing experience with a passion for entrepreneurship. The recently closed Fund I is a smart mix of fund of funds and direct investments in Wisconsin startups, all designed to leverage the power of networks to generate positive returns and strategic, powerful connections.

“WEDC’s Wisconsin Investment Fund aligns very well with our vision to make Wisconsin’s entrepreneurial ecosystem globally competitive, and we look forward to making meaningful investments in promising startups across the state,” said Carrie Thome, managing director and co-founder of NVNG.

Lacrosse Ideas Fund | $5 million

Idea Fund of La Crosse is a La Crosse-based venture capital firm focused on investing in pre-revenue and early stage technology companies in Wisconsin, Minnesota and Iowa. The firm focuses on software startups serving diverse markets reflecting the region’s employment base. Idea Fund has invested in 15 portfolio companies and currently manages $45 million on behalf of its limited partners.

“Founders in our region have proven that with the right resources and opportunities, they can succeed at the highest level,” said Jonathan Horn, managing director of the Idea Fund in La Crosse. “This investment will help further foster startup growth and success here in Wisconsin.”

WEDC is in negotiations with a sixth fund manager for the remaining allocation of $5 million in the Wisconsin Investment Fund.

An online version of this release can be found here.