(Bloomberg) — Goldman Sachs Group Inc. led major investment banks as bond trading boomed, posting higher profits in Japan and cushioning last year’s tough global environment.

Most Read Articles on Bloomberg

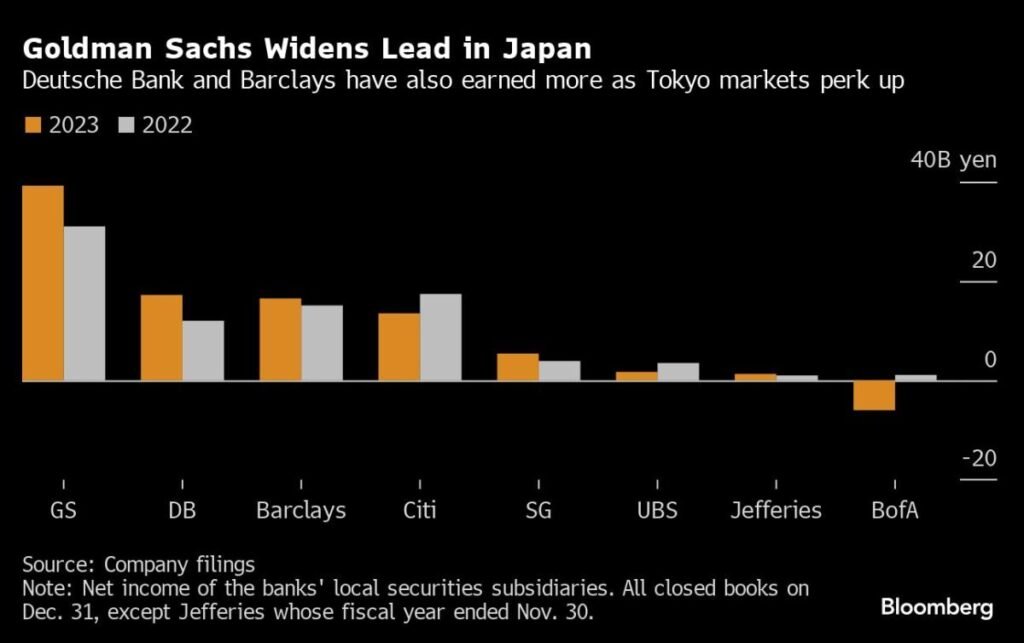

Net income at the Wall Street firm’s local securities division rose from last year’s quarter to 39.2 billion yen ($251 million) as fixed income trading profits doubled, according to annual disclosures filed in recent weeks. It became. This was Goldman’s highest profit in 14 years. The company was the most profitable global bank to close its books domestically on Dec. 31.

Deutsche Bank’s securities business’ bottom line rose 43% to 17.2 billion yen, the Frankfurt-based lender’s best performance in at least six years. Barclays has posted record profits for the London-based bank’s Asian securities arm.

The Bank of Japan’s historic monetary policy shift has revived volatility in Japan’s roughly $7 trillion government bond market, creating more money-making opportunities for traders. Tokyo banks often earn a fraction of what they pay in other financial hubs, and there is already competition for talent from hedge funds.

“2023 was the year that Japan’s business took center stage for global banks,” said Hideyasu Ban, an analyst at Bloomberg Intelligence, as other banks struggled with lackluster deal-making and other headwinds. As a result, they faced a relatively difficult situation.

Bank of America’s securities division, the only company on the list to report a loss, said in addition to higher trading costs, profits from bond trading also declined, according to the filing. Other major world banks, including Morgan Stanley and JPMorgan Chase & Co., are scheduled to release their financial results in the coming days, as their securities subsidiaries close their fiscal year on March 31st.

–Thanks to Masaki Kondo for his assistance.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP