(Bloomberg) — Global stocks are climbing to record highs as traders focus on Friday’s key U.S. jobs report.

Most read articles on Bloomberg

In Japan, the Topix index briefly hit a new record early Friday, surpassing its previous record set in 1989 in Thursday trading. South Korean stocks surged after Samsung reported profits that beat expectations, while UK stock index futures signaled gains after exit poll data showed the Labour Party won a landslide victory in Thursday’s general election.

The People’s Bank of China took new steps to sell government bonds to tame record bond prices, saying it now holds “several hundred billion yuan” worth of bonds through agreements with lenders.

Global stock indexes are on track to post their longest weekly gain since March as a series of weak U.S. economic data rekindled hopes that the Federal Reserve will start cutting interest rates as early as September.

“Given other evidence of a cooling economic environment, including weak ISM manufacturing PMI and ISM services PMI, the jobs data could become increasingly decisive for the Fed as it searches for a basis to ease rates,” said Quincy Krosby, chief global strategist at LPL Financial.

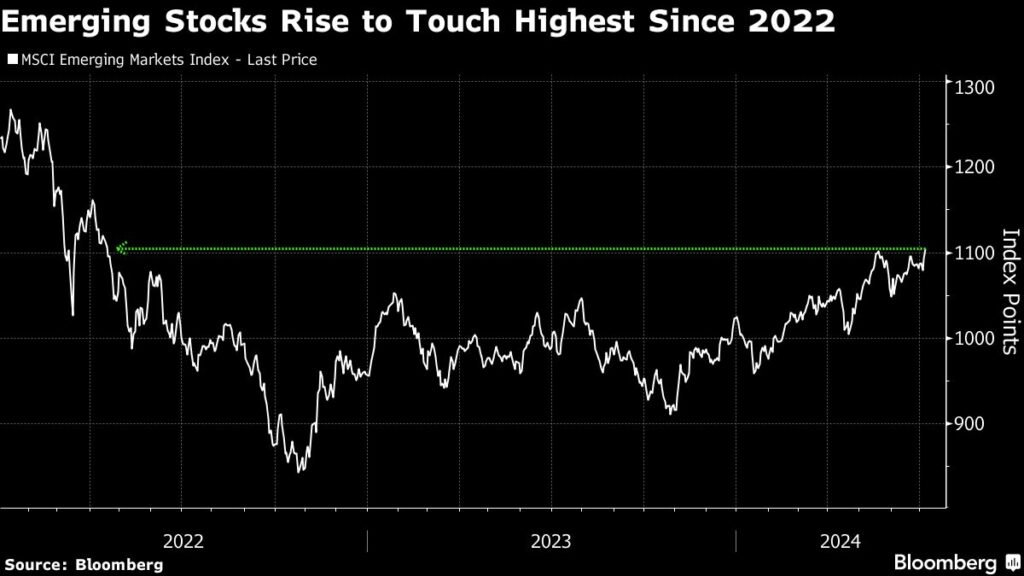

Emerging market stocks also benefited, with the MSCI Emerging Markets Index rising to a two-year high on Thursday. European shares were led by France as Marine Le Pen’s National Rally party looked likely to fall short of a majority in a second round of elections this weekend.

The yen rose against the dollar for a second straight day on Friday, rebounding from Wednesday’s lowest level since 1986. The dollar index steadied after falling for three straight days on Thursday as developing country currencies strengthened broadly, led by the Brazilian real.

The pound had been trending higher since last week but was little changed since then as investors priced in the prospect of a Labour victory in Thursday’s general election.

Exit polls suggest Keir Starmer’s Labour party is expected to win a landslide victory, while Rishi Sunak’s ruling Conservative party is on track to post its worst ever performance and is likely to see some of its most senior figures expelled from Parliament.

France’s CAC 40 index rose for a second day ahead of the final vote in the country’s general election scheduled for this weekend, extending its gains as opinion polls suggested Marine Le Pen’s Rally National party and its allies would fall well short of a majority.

Treasury yields were little changed after trading resumed in Asia after the U.S. Fourth of July holiday. Yields in Australia and New Zealand were similarly flat.

The U.S. services sector contracted at its fastest pace in four years, while the labor market showed signs of further weakening ahead of Friday’s key jobs report, reports said on Wednesday.

“Yesterday the ISM services index hit a post-pandemic low of 48.8 and job claims are worsening, but ultimately the negative data is being viewed as positive for the market,” said Justin Onuekusi, chief investment officer at St. James’s Place. “Everyone seems to be focused on September now.”

U.S. crude oil prices, including West Texas Intermediate, traded flat after rising earlier this week. Bitcoin fell, trading around the $57,000 mark.

Major events this week:

-

Eurozone retail sales on Friday

-

US jobs report, Friday

-

Fed President John Williams to speak Friday

Some of the key market developments:

stock

-

S&P 500 futures were little changed as of 11:15 a.m. Tokyo time.

-

Nikkei 225 futures (OSE) rose 0.4%

-

Japan’s TOPIX was little changed

-

Australia’s S&P/ASX 200 was little changed

-

Hong Kong’s Hang Seng Index fell 0.4%

-

The Shanghai Composite Index fell 0.8%

-

Euro Stoxx 50 futures little changed

currency

-

The Bloomberg Dollar Spot Index was little changed.

-

The euro was little changed at $1.0816

-

The Japanese yen rose 0.1% to 161.04 yen to the dollar.

-

The offshore yuan was little changed at 7.2910 to the dollar.

Cryptocurrency

-

Bitcoin fell 2.5% to $56,862.69.

-

Ether fell 2.2% to $3,072.28.

Bonds

merchandise

-

West Texas Intermediate crude fell 0.2% to $83.74 a barrel.

-

Spot gold rose 0.2% to $2,360.45 an ounce.

This story was produced with assistance from Bloomberg Automation.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP