Stefan Tomic/E+ via Getty Images

GEN Restaurant Group (NASDAQ:GENKSouth Korean barbecue restaurant chain () continues to grow revenue through new store openings, and saw very healthy growth in the first quarter. At the same time, however, cost inflation and sluggish same-store sales are weighing on the company’s performance. This will hurt GEN’s margins and make its current revenue incredibly thin.

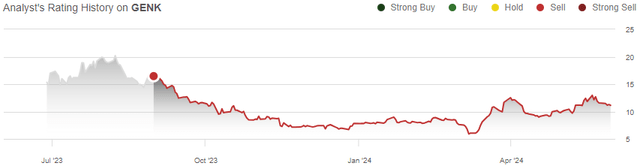

I previously wrote an article about GEN titled “No Interest in GEN Restaurant Group Stock” and rated the stock as a sell because growth is overvalued. This article was published on the 31st.st Since August 2023, GEN shares have fallen -33% compared to the S&P 500’s return of 17% over the same period. Since March, shares have begun to double from their bottom. I still consider the risk/reward of this investment weak. Profitability is declining, and the balance sheet may have little room left for future investment.

My rating history on GENK (Seeking Alpha)

Unstable financial performance

Since our last article, GEN has reported three quarters of financials spanning Q3 2023 to Q1 2024. The company finished 2023 with 10.6% total revenue growth for the full year. Despite the revenue growth, margins were much worse than I previously expected, with comparable restaurant sales down -1.2% in Q3 and -1.7% in Q4, impacting margins with significant inverse operating leverage. Food cost as a percentage of revenue remained fairly stable at 32.6% in Q4, but operating margins declined from 7.5% in 2022 to 4.5% in 2023 due to increases in payroll and benefits, occupancy costs, and other operating expenses.

The first quarter report showed revenue growth accelerating 15.7% as restaurant count increased from 31 at the end of Q1 2023 to 39 at the end of Q1 2024, with two new restaurants added during the quarter. Revenue growth significantly surprised analysts, with reported revenue coming in at $50.8 million versus forecasts of $47.5 million. Reported EPS was $0.11, beating forecasts by $0.10.

However, GEN’s profitability was not as strong in the first quarter. Food costs increased 0.8 percentage points year-over-year, and other operating expenses also increased significantly, causing operating income to decrease from $3.2 million to $100,000 in Q1 2023. A large factor in the decrease in profits was an increase in pre-opening expenses from $0.5 million to $1.9 million year-over-year, which investors could view as a non-recurring growth investment.

In summary, GEN reported strong growth and accelerating revenue in the first quarter. This growth was achieved through continued investment in new restaurants, while existing restaurant sales were weak. As a result of weak existing restaurant sales and increased pre-opening costs, GEN’s revenues deteriorated significantly in the most recent quarter. While the reported quarter was overall strong, there is a clear need for profitability improvement.

Healthy cash flow needed in the medium term

GEN’s new restaurants require significant capital. To achieve revenue growth, the company has invested $17.2 million in capex in 2023, compared with just $4.9 million in D&A. The pace of investment is only accelerating, with first quarter investments up $1.3 million year over year. However, on the company’s behalf, GEN’s working capital management is strong and the need for additional working capital is extremely minimal.

To achieve the future growth that the investment case relies on, GEN needs to be able to fund continued investment. The company’s current cash balance is $28.1 million, down from $55 million at the time of last writing, and it has $8.5 million in long-term debt since the first quarter. At this investment pace, cash will not be able to fund future growth for an extended period of time, making positive operating cash flow crucial.

GEN’s operating cash flow has been positive for the past 12 months at $22.9 million, improving slightly due to a reduction in working capital. Current cash flow will allow us to sustain current investment levels, but there are concerns that this leaves very little headroom for a financial downturn or an increase in working capital.

Profit margins expected to recover

For the long-term investment case to be viable, GEN needs to achieve sustainably favorable margins: The company’s operating margins have steadily declined from 11.9% in 2021 to now sit at 2.7%.

The decline appears to be due in part to the industry currently weakening due to macroeconomic pressures, with competitors such as Dine Brands (DIN), Denny’s (DENN), and Yum Brands (YUM) reporting revenue declines in the first quarter in line with GEN’s weak same-store sales. We should see some recovery in the medium term as restaurant traffic begins to recover.

Another factor weighing on earnings is rising pre-opening expenses. Currently, pre-opening expenses are $5.1 million, which represents approximately 2.7% of historical earnings. For example, in 2022, pre-opening expenses were only $1.5 million. I view this expense as an investment and roughly comparable to capital expenditures. While GEN’s underlying profitability is higher than its GAAP financial statements indicate, it is still fairly thin and requires operating leverage provided by future growth.

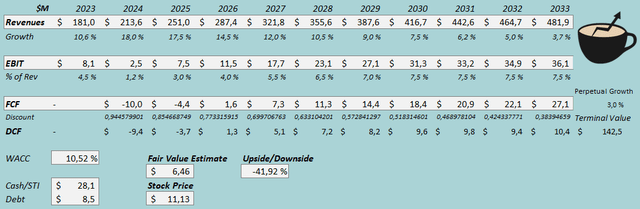

Latest assessment: Recent gains are unjustified

We have updated our discounted cash flow model to take into account the company’s recent performance. For 2024, we now forecast 18% growth as GEN opens new restaurants but struggles to maintain same-store sales. This forecast is down from 28% previously. After that, we forecast a slightly lower growth rate than previously, but have raised our perpetual growth rate to 3% from 2%. We now forecast revenue CAGR from 2023 to 2032 to be 11.0%, up from 11.2% previously.

Due to lower than expected margins, we have also revised down our near-term and long-term margin levels. We expect the company to achieve operating leverage through lower pre-opening costs, improved same-store sales and growth, ultimately boosting GEN’s EBIT margin to 7.5%, down from our previous forecast of 13.0%. Cash flow is also expected to weaken significantly due to lower revenues and increased capital expenditures.

The DCF model estimates GEN’s fair value at $6.46, 42% lower than the stock price at the time of writing and 46% lower than the previous estimate of $11.89. A deterioration in the company’s margins would have a significant impact on the fair value, as this change would have a significant impact on cash flows. Free cash flow in 2033 is now estimated at $27.1 million, compared to $44.5 million estimated in the previous DCF model. Absent significant margin improvement, the growth story still appears overvalued.

DCF model (Author’s calculations)

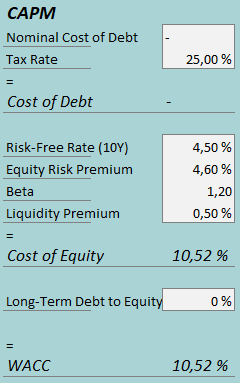

The DCF model uses a weighted average cost of capital of 10.52%. The WACC used is derived from the capital asset pricing model.

cap (Author’s calculations)

GEN has debt, but the amount is negligible. Therefore, I estimate that the company will not use any debt as a financing mechanism, especially since debt financing is risky for GEN given its current low profits. To estimate the cost of equity, I use the 10-year US Treasury yield of 4.50% as the risk-free rate. The equity risk premium of 4.60% is the latest estimate by US Professor Aswath Damodaran, updated on the 5th.Number We use the January beta estimate of 1.20. Finally, we add a liquidity premium of 0.5% to bring the cost of equity capital and WACC to 10.52%. The WACC has decreased from our previous estimate of 11.09% due to lower liquidity and equity risk premiums, partially offset by higher risk-free rates and lower debt-to-equity ratio estimates.

remove

GEN is reporting strong growth as it continues to open new restaurants. However, at the same time, the financial report for the most recent quarter has not been great overall. GEN’s cash is down since my last article as weak same-store sales and increased other SG&A have squeezed margins to incredibly low levels and required significant capital for investment. I still expect margins to recover as same-store sales recover and pre-opening costs eventually decline, but overall financial performance has resulted in margin expectations being lower than before. I maintain my sell rating as this stock once again appears to be overvaluing its growth story.