John M Lund Photography Inc/DigitalVision via Getty Images

A recent insight from Boya Investment Management has postponed the rate cut to Q2 2024, but not cancelled. Many income investors like me are wondering whether the rate cut will be postponed. How will “higher interest rates for longer” affect investments in credit funds that offer senior secured loans, corporate bonds and related securities that generate high-yield income?

Last month, we highlighted a silver lining for fixed income investors in this environment: For those who worried they missed their opportunity to allocate to bonds late last year (before interest rates last fell), this market realignment offers a second chance.

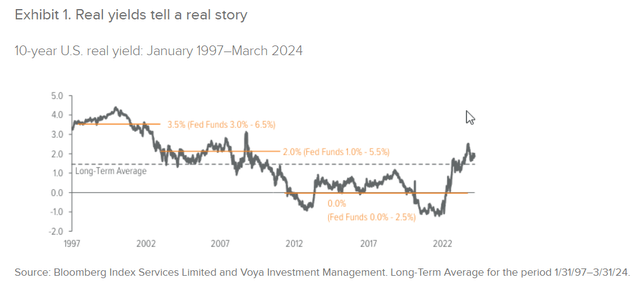

It’s also worth reminding investors that the whims of monetary policy are no longer the only measure of opportunity and risk. We’ve entered a new era of interest rates. A regime where real yields are not only positive but above their long-term historical averages (Figure 1). This creates attractive carry opportunities and also makes bonds well-positioned to provide the broad-based portfolio stability that many investors desire. In other words, for the first time in 15 years, bonds are once again a competitive asset class.

Boya Investment Management

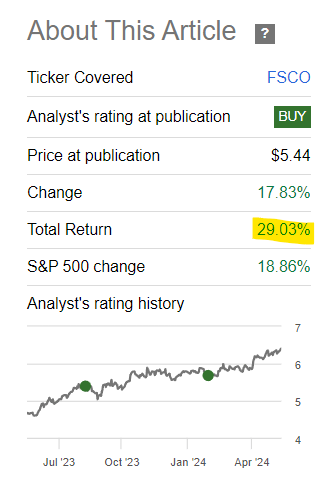

When I first got the FS Credit Opportunities fund (NYSE:FSCO) It was in September 2023 that I suggested, “Take advantage of this opportunity to add some safe, high-yield income to your retirement.” At the time, FSCO had only been public for about 10 months, having just gone public in November 2022. At the time, I summarized the opportunity as follows:

My assessment of FSCO is that the fund manager appears to have his finger on the pulse of the credit markets and his ability to dynamically allocate between private and public credit investments allows the fund to generate solid income to support high yield distributions. While the fund continues to trade at a significant discount to its NAV, the NAV is trending higher and monthly distributions have increased recently, so for income-focused investors looking for a relatively safe high yield investment, I rate FSCO a Buy.

Since this article was published, FSCO has generated approximately 30% total revenue.

Find Alpha

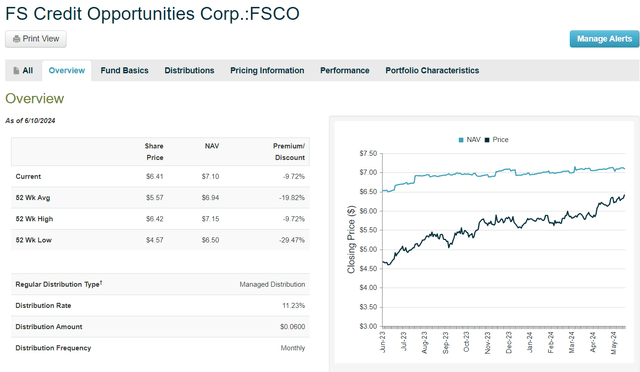

Back in February of this year, I wrote an update on FSCO, suggesting that investors could ride the corporate credit wave and earn a 12% yield in the process. At the time, the fund was priced at $5.67, trading at about a -18% discount to NAV, but paid a monthly dividend of $0.0570 and had an annualized yield of about 12%. In the months since this article was published, the price has skyrocketed to $6.41 as of market close on June 10, 2024. The monthly dividend has also increased to $0.060 since March (shortened my article was published suggesting the fund was a buy).

Currently, FSCO is trading at a narrow discount of about -10% and offering income investors monthly dividends that equate to a yield of about 11.2% annually going forward: This chart from CEFConnect shows how the discount to NAV has steadily narrowed over the past year.

CEF Connect

FSCO Q1 2024 Financial Results Overview and Summary

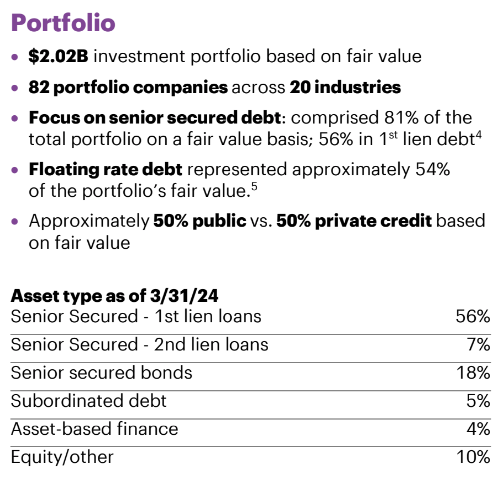

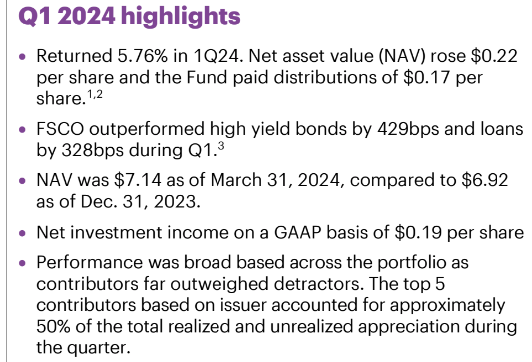

According to the fund’s website, the quarterly update for Q1 2024 includes a fact sheet with statistics about the fund and highlights from the earnings report for Q1 2024. As of March 31, 2024, the fund had total assets of approximately $2.15 billion, making it one of the largest publicly traded credit-focused closed-end funds.

A management team under FS Investments assumed management of the fund in 2018. FSCO’s common shares were listed on the New York Stock Exchange in November 2022. The fund’s strategy and portfolio positioning are described in quarterly updates.

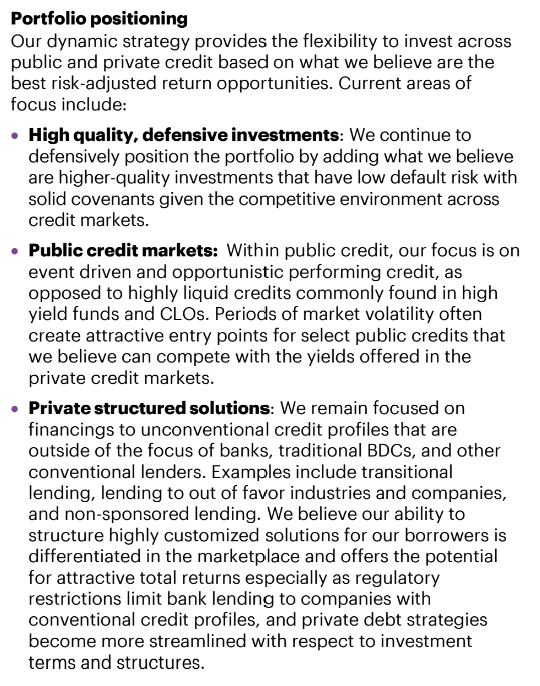

A diversified credit strategy that invests in public and private credit, as well as fixed and floating rate assets in loans, bonds, structured credit or highly structured equity investments.

FSCO Q1 2024 Report

The fund’s portfolio currently has approximately $2 billion in total assets under management focused on senior secured debt.

FSCO Q1 2024 Report

With over half of its investments in floating rate bonds, the fund has benefited from the rising interest rate environment experienced over the past 18-24 months. The portfolio positioning includes a dynamic allocation to public and private credit markets. With recent strong returns from private credit, approximately 75% of new investments in the first quarter came from the private credit market, as explained by Nick Heilbut, Director of Research and Portfolio Manager, in a transcript of the first quarter earnings call.

About 75% of new investment activity was privately funded, with nearly all purchases being first lien secured loans. Public credit investments across first lien and senior unsecured debt made up about 25% of purchases overall in the quarter.

First quarter highlights are detailed further in the Q1 2024 quarterly report.

FSCO Q1 2024 Report

Benefiting from a burgeoning private credit market

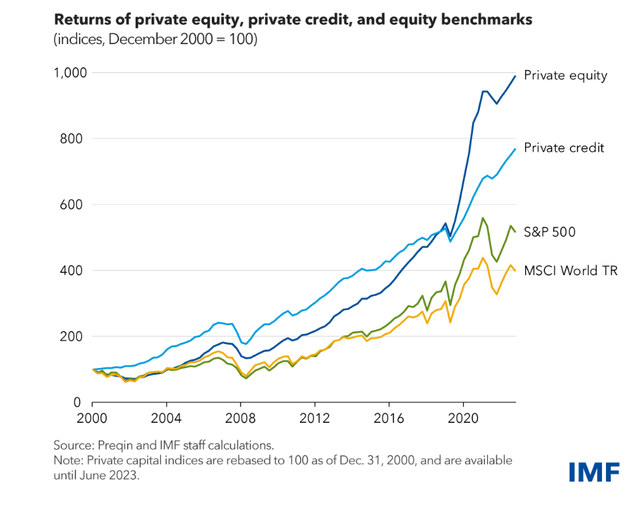

According to a recent blog post from the IMF, rapidly growing private credit markets require closer oversight.

Private credit market assets and commitments, where investment funds and other specialized nonbank financial institutions lend to companies, exceeded $2.1 trillion worldwide last year, with about three-quarters of that in the United States, a market share approaching that of syndicated loans and high-yield bonds.

IMF

Recently, financial experts like JPMorgan Chase’s (JPM) Jamie Dimon have warned about the growing risks of a sudden increase in private investment. Despite the risks, JPM says there are still plenty of opportunities in private credit despite the headlines.

With this record growth in mind, Dimon wasn’t entirely pessimistic when talking about the private credit sector. The CEO said private lending has clear advantages, such as private lenders being able to offer loan modifications and streamlined agreements that allow companies to access cash quickly. Dimon also noted that the private credit sector attracts mostly long-term investors, which means they “are not going to ask companies to do stupid short-term things to meet certain repayment obligations.”

During the Q3 2024 earnings call Q&A, FSCO was asked about its significant increase in private credit investments. Head Portfolio Manager Andrew Beckman responded:

Q. You mentioned that 75% of new investment this quarter was privately led. Can you talk about why this opportunity is so compelling today?

A. …Then you look at private credit, private credit is definitely more disciplined from a dock perspective, spreads are still higher in private credit, but the top end of the private credit market is competing with the broadly syndicated loan market as sponsors typically consider what route to take.

So as spreads have tightened and broadly syndicated credit and structural terms have loosened, traditional private credit has had to follow suit to some extent.You’re also seeing a lot of new entrants in traditional private credit, with banks entering the market and various companies raising large amounts of assets.

So we’re focused on areas that others aren’t focusing on — areas where the capital isn’t flowing in — areas where the terms are more disciplined, and we’re focused on non-traditional areas of the private credit market where we’re not pricing out of or structuring out of the broadly syndicated market or competing with the capital flows into private credit that I mentioned.

With roughly half of the fund now invested in public credit investments and the other half in private credit, the balance of risk and reward has benefited shareholders who bought in early with both rising market prices for the fund and higher dividends.But the party isn’t over for FSCO.When asked about his thinking on the recent dividend increase, Beckman responded:

So, we continue to make more money than we pay out. As you can see when you look at our portfolio, we’ve been more cautious on interest rates going into the year, looking at the forward curve and the rate at which interest rates are falling. As you know, there’s been a slight shift in expectations for the Fed Funds rate, so the market has priced in the expectation that there will be less rate cuts. We continue to make more money than we pay out, and we thought it would be prudent to give those excess earnings back to our investors.

Comparison with peer credit funds

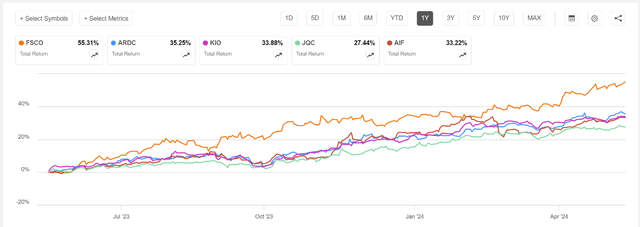

Several other CEFs that invest in fixed-income credit securities and bonds have performed well over the past year, and a quick comparison of total returns to some of its peer funds, including ARDC, KIO, JQC, and AIF (scheduled to merge with MFIC), shows that FSCO is the clear winner with a total return of over 55%.

Find Alpha

FSCO does not have a long history as an exchange-traded fund, so some investors may be hesitant to invest after such strong performance. However, the discount is sizeable at around -10% and the dividend yield remains attractive at around 11% with strong coverage. I am again rating this fund a Buy, especially if the market experiences a correction and the price drops further off the discount. I hold shares of FSCO in my Income Compounder portfolio.