When things inflate like this, it should come as no surprise to anyone that they should deflate.

From WOLF STREET by Wolf Richter.

Indeed, France faces a complex political situation that could change the political landscape, including a sudden general election. That’s what elections are for.

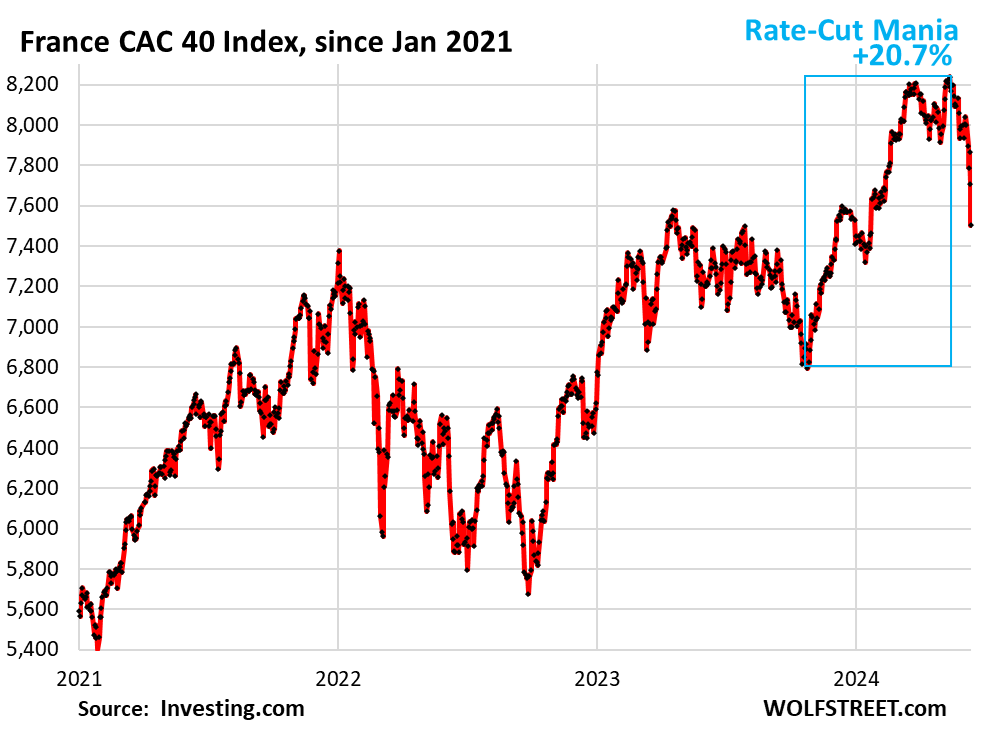

But why did French stock prices soar by 20.7% during a seven-month rate-cutting frenzy? What kind of madness was this? And it’s not just France.

France’s blue-chip index, the CAC 40, fell 2.7% today and 4.6% over the past two days. Over the past six trading days, the index has fallen 6.7%, and is down a staggering 8.9% from its all-time high on May 15th.

I mean, how can you allow a stock price to fall???

And there were a lot of headlines today. The Guardian: “French stock market plummets on fears of far-right election victory.” The Financial Times: “French stock market experiences worst week since 2022 on fears of populist victory.” Bloomberg reported today: “French stock market suffers $200 billion loss…”

Stock prices are falling, even though everyone knew that in France stock prices do not fall in times of inflation, stock prices are the best hedge against inflation etc, interest rates are due to be cut and have already been cut by the ECB on June 6th, and therefore stock prices will continue to rise as interest rates are cut, inflation etc.

So now that events have disproved the theory, is the shock wave spreading through the media that has been reporting this extensively for so long?

But wait a minute: The CAC 40 has soared 20.7% (1,415 points) in less than seven months, from the end of October to an all-time high of 8,240 on May 15th, as a result of this epic rate-cutting mania that has also engulfed Europe. So the ECB cut rates once, and stocks are falling.

But wait a moment. French stocks “plummet”:

- This year’s gains are almost gone! CAC is down just 0.5% year to date.

- It wiped out only half (737 points) of the seven-month surge in rate-cutting mania, rather than all of it (1,415 points) plus some.

- Rather than hitting a multi-year low, the index only recovered to levels first recorded in April 2023.

In other words, this isn’t a true sell-off yet – it’s only down 8.9% from its all-time high.This seems like a big deal because during the rate-cutting frenzy, and even before, investor and media brains were muddled with the illusion that stocks would never fall.

And now, with French shares down 8.9% from their rate-cutting frenzy all-time highs, it’s frightening to see the reality of things leaking below the surface. ECB, do something about this fiasco.

The stock market in general, and the US in particular, has been in complete frenzy over the last few years, especially during the rate-cutting frenzy, which the media hyped and promoted, and now that the surge has subsided a bit, are people worrying? No kidding. When you get into inflationary situations like this, it shouldn’t surprise anyone if you get deflationary.

Enjoy reading WOLF STREET and want to support us? You can donate, we’d be so grateful! Click on Beer and Iced Tea Mugs to find out how.

Want to be notified by email when WOLF STREET publishes a new article? Sign up here.

![]()