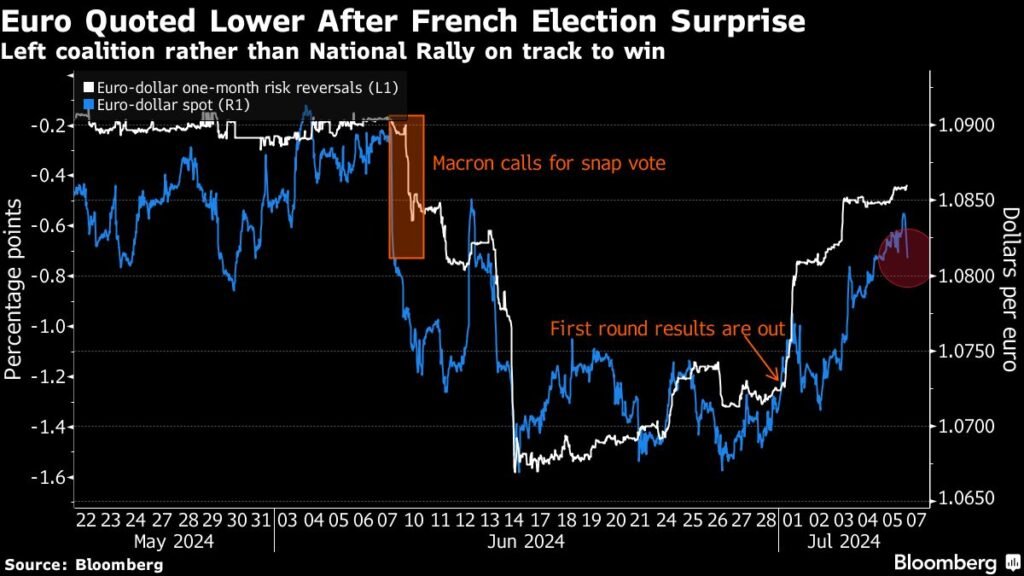

(Bloomberg) — French markets erased initial losses as investors bet the country’s failure to win a majority in elections will force the next government to make compromises and back off its most extreme policies.

Most read articles on Bloomberg

The CAC 40 index (^FCHI) rose 0.2% after dropping 0.6% at the open. French government bonds were little changed, with 10-year bond yields at 3.2%, and the euro was stable.

“This is a double-edged sword for markets,” wrote RBC analysts including Peter Schafflick. “The left-wing coalition is not seen as business-friendly and confidence in prudent budget management should decline. But the lack of a clear parliamentary majority should slow spending plans for the time being and act as a buffer against wider spreads.”

Money managers have been worrying about a Le Pen-led government for the past week or so, but a left-wing victory remains a concern for investors as it brings new uncertainty to the euro zone’s second-largest economy and signals more political infighting to come.

Still, the left-wing coalition lacks an absolute majority and is limited in what it can do, and some strategists have suggested the parliamentary limbo could be a positive outcome for investors.

The spread between French and German 10-year government bond yields, a gauge of credit risk, is about 70 basis points, below the peak of last month’s market crash.

Investors may be pleased with French election results after initial nervous reaction

“French politics is once again in turmoil,” said Jeffrey Yu, senior strategist at Bank of New York Mellon & Co. “Judging by the results, the risks to expansionary fiscal policy remain, and perhaps marginally elevated.”

The New Popular Front, which includes the Socialists and the far-left France Invincible party, won 178 seats in the National Assembly, according to data compiled by the Interior Ministry. Marine Le Pen’s National Rally, which was predicted to win in an opinion poll last week, came in third with 143 seats, while President Emmanuel Macron’s centrist bloc won 156 seats.

French markets plummeted in June, wiping billions of euros from stocks and bonds as fears stoked that Macron’s early elections would bring the far-right to power. But traders have pared back much of their losses over the past week as opinion polls showed his National Rally falling short of a majority. France’s CAC 40 index last week recouped about half the losses it suffered after Macron’s election announcement.

The results are very different: Mr Macron’s investor-backed centrist party came in second after performing poorly in the first round, potentially putting the president in a position to cobble together a centrist coalition government.

What our strategists are saying…

“France’s far-left leader has already said he will implement all his policies and will not make any deals with Macron. That defiant attitude is not going to go down well with French bond investors.”

— Ben Lamb, Cross-Asset Strategist

A left-wing majority was the scenario investors feared most in the days leading up to the first round of voting, but that possibility faded after the landslide first-round victory of Le Pen’s National Rally, which has pledged to reverse seven years of pro-business reforms and raise the minimum wage.

The Institut Montaigne estimates that the New Popular Front’s election pledges would require around 179 billion euros ($194 billion) in additional funding per year.

France is already struggling with a budget deficit of 5.5% of GDP, well above the 3% allowed under European Union rules. Without further action, the International Monetary Fund projects that debt will rise to 112% of GDP in 2024, rising by about 1.5 percentage points per year over the medium term.

S&P Global Ratings downgraded France’s credit rating in late May, highlighting the French government’s failure to meet targets in a plan to curb the budget deficit after huge spending due to the coronavirus pandemic and energy crisis.

Vincent Juvins, global market strategist at JPMorgan Asset Management, said with Macron-led reforms now in doubt, tensions were likely to rise and the value of French bonds could fall relative to other countries.

“Unless the new government provides clarity on the fiscal situation, the market may demand a higher spread,” he said. “The European Commission and the rating agencies are expecting cuts of 20-30 billion, but the government will have to negotiate with a party that actually wants a 120 billion spending increase.”

—With assistance from Vassilis Karamanis.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP