market:

- Gold falls $14 to $2,285

- US 10-year bond yield fell 4bps to 4.31%

- S&P 500 fell 1.2%

- WTI crude oil rose $1.17 to $86.60

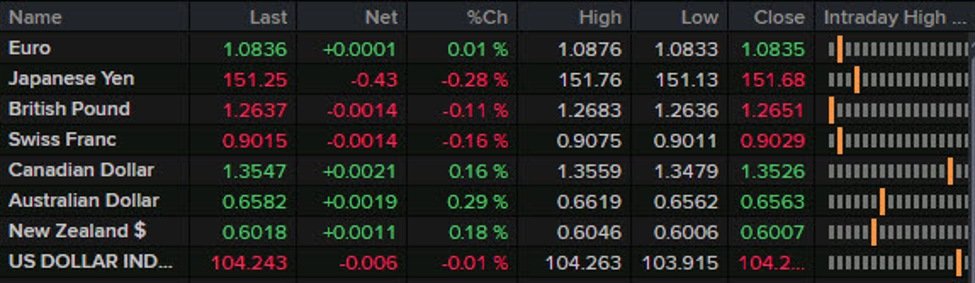

- Australian dollar leads, pound lags

The day has changed in the last three hours as talk of Iran’s retaliatory strikes against Israel begins to take control of the market. There was no real trigger behind the fear, apart from poorly sourced reporting by Lebanese television and the British lower press. Nevertheless, following Israel’s attack on the Syrian embassy, markets became concerned that Iran would strike back.

The first move was a rise in oil prices, with Brent reaching $90 and ultimately hitting a high of $91.30. I also started selling stocks. Bond and foreign exchange markets were more skeptical, but eventually recovered as the US dollar and yen attracted enough bids to nearly erase some losses.

Gold faced some crosswinds later in the day, hitting a new record of $2,305, but has since fallen to $2,280. Bitcoin rose 3%, but the move was slowed by heavy selling in the past few minutes.

It’s a highly uncertain market as few believe an Iran-Israel war is coming, but no one wants to dampen prices ahead of Friday’s non-farm jobs report and the weekend.

Before the Middle East was occupied, there was a great flood of Fedospeak. There were some increasingly hawkish comments, but it was all contingent on what would happen with the data and inflation. Goolsby pointed to inflation in housing services as something to watch. Some have pointed to Mr. Kashkari’s talk of the possibility of no interest rate cuts as a catalyst for the stock market decline, but that doesn’t make sense given the drop in Treasury yields and the increased probability of a Fed rate cut.

FX News Wrap