(Bloomberg) — Initial forecasts showed a victory for a left-wing coalition in France’s parliamentary elections, spreading concerns about the country’s finances and sending the euro lower. Asian stocks also fell.

Most read articles on Bloomberg

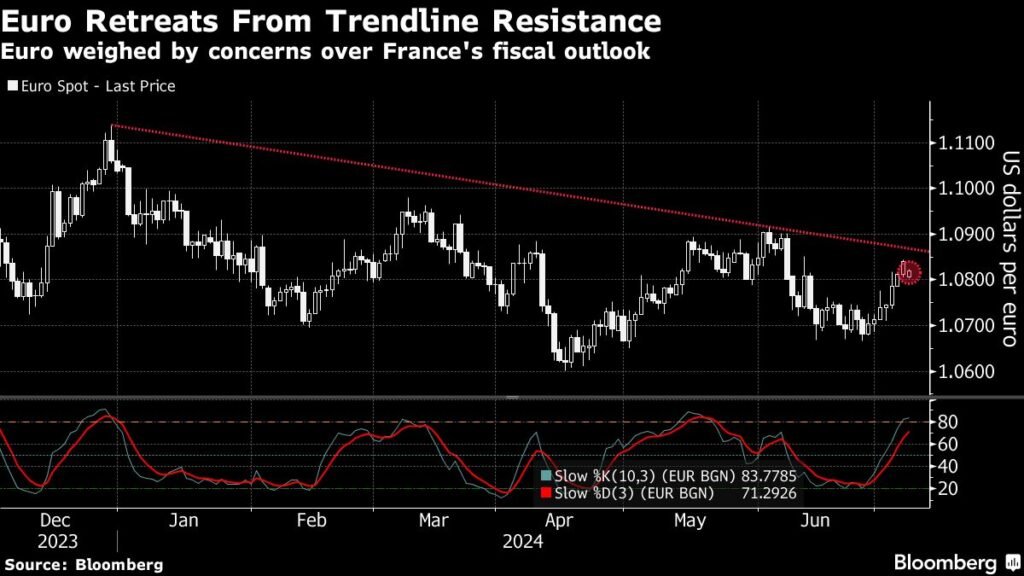

The common currency fell 0.4% at the open after the left-leaning New Popular Front was expected to win the most seats in parliament. Marine Le Pen’s far-right National Rally was widely expected to win the most seats but is now seen coming in third behind President Emmanuel Macron’s centrist coalition. French bond futures fell below German bunds.

One of the NPF leaders, Jean-Luc Mélenchon, has vowed that the group will refuse to negotiate a government with other parties and will not compromise on a plan that includes a huge increase in public spending that could spark a major clash with the European Union.

“The declaration of support for the left/far left and calls from far-left leader Melenchon for the full implementation of the far-left NFP will unsettle some investors,” Krishna Guha, strategist at Evercore ISI, wrote in a client note. “However, with the risks associated with the National Rally receding for now and the left/far-left NFP falling well short of a majority and virtually no chance of implementing any agreed coalition policies, we see the outcome as mostly market-friendly.”

Asian stocks fell. South Korea’s three-year government bond futures rose to their highest in nearly two years. Samsung Electronics workers are expected to strike from production lines on Monday, starting the biggest organized labor dispute in the South Korean conglomerate’s half-century history.

To maintain rational and sufficient liquidity in the banking system, the People’s Bank of China said in a statement on Monday that it will carry out ad-hoc bond buybacks or reverse buybacks depending on market conditions between 4 p.m. and 4:20 p.m. on weekdays.

Federal Reserve Chairman Jerome Powell’s congressional testimony and US inflation data are due to be released later this week. Traders will be watching the two events to solidify their view that policy easing could begin as early as September as the US economy shows signs of collapse following weak employment data.

LONDON (Reuters) – Prospects that the Federal Reserve will cut interest rates in the coming months strengthened on Friday after nonfarm payroll data showed U.S. job and wage growth slowed in June and the unemployment rate rose to its highest level since late 2021.

“The good news for risk management is that growth, consumption and labor indicators are still at levels that broadly suggest that if the Fed eases, it is for risk management purposes,” Chris Weston, head of research at Pepperstone Group, wrote in a client note. “When the market senses that the Fed needs to ease beyond neutral levels to stimulate the economy, earnings expectations are cut and stocks typically enter a prolonged sell-off.”

In the United States, President Joe Biden is facing fresh attacks from members of his party as he tries to salvage his struggling reelection and fend off calls from Democratic lawmakers to step down. Biden posted his best showing yet in a Bloomberg News/Morning Consult tracking of battleground states, but voters gave him a harsh rating for his performance in the debates.

Volatility on Election Day in the U.S. has decreased since the debate between Biden and rival Donald Trump, according to RBC strategist Amy Wu Silverman.

“One interpretation is that markets (and polls) are pricing in a decisive victory for Trump, which, applying our 2016 playbook, would be a pure positive for markets,” she wrote in a note on Sunday. “However, when we look at Trump’s policy statements on tariffs, immigration, and possibly Federal Reserve independence, all of which would undoubtedly create volatility.”

Traders will be keeping an eye on interest rate decisions in New Zealand and South Korea this week. Earnings reports are due from major U.S. banks including JPMorgan Chase & Co., while Chairman Powell is due to give his semi-annual testimony to Congress on Tuesday, followed by a host of Fed speakers.

In commodities, oil rose ahead of a report this week from the Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA) detailing global oil inventories, while traders were keeping a close eye on the path of Tropical Storm Beryl as it approaches Texas. Gold slid from a six-week high hit last week.

Major events this week include:

-

Indian Prime Minister Narendra Modi visits Moscow on Monday

-

Federal Reserve Chairman Jerome Powell gave his semi-annual testimony before the Senate Banking Committee on Tuesday.

-

U.S. Treasury Secretary Janet Yellen testified before the House Financial Services Committee on Tuesday.

-

Federal Reserve Vice Chairman for Supervision Michael Barr and Governor Michelle Bowman to speak Tuesday

-

China producer price index, consumer price index, Wednesday

-

Japan Producer Price Index, Wednesday

-

Fed Chairman Jerome Powell will testify before the House Financial Services Committee on Wednesday.

-

Chicago Fed President Austin Goolsbee and Fed Governor Michelle Bowman to speak Wednesday

-

Bank of England Chief Economist Hugh Pill and Bank of England Policy Maker Catherine Mann will speak on Wednesday.

-

U.S. Consumer Price Index, Initial Jobless Claims, Thursday

-

Atlanta Fed President Raphael Bostic and St. Louis Fed President Alberto Mussallem deliver speeches

-

Japan Industrial Production, Friday

-

China trade, Friday

-

University of Michigan Consumer Sentiment Index, PPI, Friday

-

Citigroup, JPMorgan, Wells Fargo and Bank of New York Mellon report quarterly results on Friday

Some of the key market developments:

stock

-

S&P 500 futures were down 0.2% as of 10:09 a.m. Tokyo time.

-

Japan’s TOPIX falls 0.5%

-

Australia’s S&P/ASX 200 fell 0.4%

-

Euro Stoxx 50 futures little changed

currency

-

The Bloomberg Dollar Spot Index was little changed.

-

The euro fell 0.2% to $1.0823.

-

The Japanese yen was almost unchanged at 160.68 yen to the dollar.

-

The offshore yuan was little changed at 7.2917 to the dollar.

Cryptocurrency

-

Bitcoin fell 4.6% to $54,617.72.

-

Ether fell 5.1% to $2,847.03.

Bonds

merchandise

-

West Texas Intermediate crude fell 0.3% to $82.93 a barrel.

-

Spot gold fell 0.2% to $2,388.11 an ounce.

This story was produced with assistance from Bloomberg Automation.

–With assistance from Michael G. Wilson and Matthew Burgess.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP