Detection technology Oyj (HEL:DETEC) shareholders should be happy to see the share price up 30% in the last month. However, that doesn’t change the fact that the returns over the past three years have been less than satisfactory – after all, the share price is down 35% in the past three years, significantly underperforming the market.

The recent 11% rally could be a positive sign of things to come, so let’s take a look at the historical fundamentals.

View our latest analysis for Detection Technologies Oyj.

In Buffett’s words, “Ships will sail around the world, but a flat-Earth society will thrive.” There will continue to be a wide discrepancy between prices and market values. ..” By comparing earnings per share (EPS) and share price changes over time, we can see how investor attitudes to a company have changed over time.

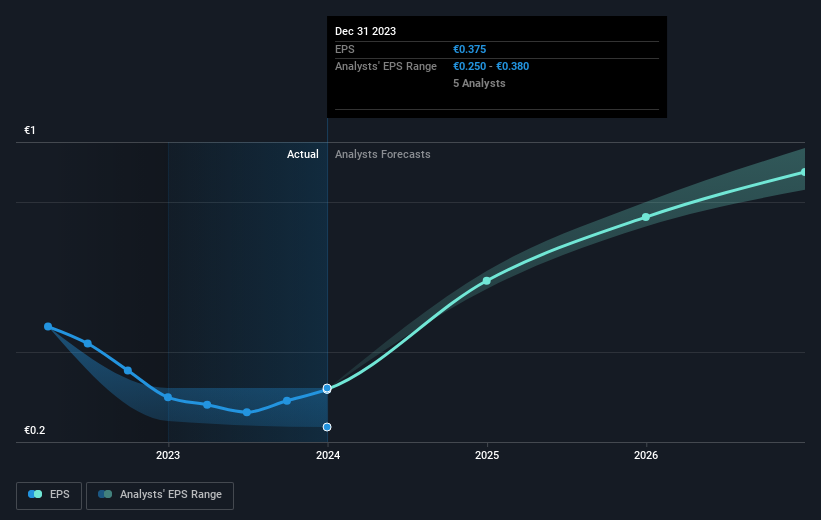

Detection Technology Oyj’s EPS decreased at a compound annual rate of 7.1% over the past three years. The 13% decline in share price is actually more steep than the decline in EPS. So it seems like the market has been overconfident about this business in the past.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

this free This interactive report on Detection Technology Oyj’s earnings, revenue and cash flow is a great starting point, if you want to investigate the stock further.

What happens to the dividend?

It’s important to consider not only the share price return, but also the total shareholder return for a particular stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital increases and spin-offs. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. For Detection Technology Oyj, the TSR for the last 3 years was -32%. This exceeds the stock return mentioned earlier. And there’s no kudos to speculating that dividend payments are the main explanation for the divergence.

A different perspective

Detection Technology Oyj shareholders have lost 5.4% (including dividends) in the last year, while the broader market has gained about 0.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year’s performance ended on a down note, with shareholders facing a total annual loss of 2% over five years. Generally speaking, long-term stock price weakness can be a bad sign, but contrarian investors may want to research the stock in hopes of a turnaround. See how Detection Technology Oyj scores on these 3 of his valuation metrics before deciding whether the current stock price is good.

For people who like searching succeed in investing this free This list of undervalued companies that insiders have recently bought could be just the thing for you.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Finnish exchanges.

Valuation is complex, but we help make it simple.

Please check it out Detection Technology Co., Ltd. By checking our comprehensive analysis, you can see if it is overvalued or undervalued. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Interested in its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodology, based on historical data and analyst forecasts, and our articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.