Gary Yowell

summary

After being interviewed by CSX Corp. (NASDAQ:CSX), I recommended a Buy rating given its strong business moat and positive volume outlook through 2024, but this post Business and stocks. The Q1 2024 results validated my view that volume is trending in the right direction, so I reiterate my buy rating on CSX. The impact of the Baltimore Bridge Incident is lower than expected and could be even smaller due to management’s conservative assumptions.

investment thesis

CSX reported its first quarter 2024 results yesterday, with revenue and EPS in line with consensus estimates. CSX’s total revenue for the quarter decreased 0.7% to $3.69 billion, matching the consensus estimate of $3.66 billion. EPS was $0.46, also in line with the consensus estimate of $0.45. His 3% increase in total payload is positive and confirms our previous view that January’s weak sales were simply due. For the weather. The occupancy rate improved by 90 bps compared to Q4 2023 to 63.2%. Overall, the results are positive and the valuation remains cheap, so I continue to rate the stock a Buy. Below are some of my key takeaways and perspectives on CSX.

I think the obvious concern most investors have is the impact of the Baltimore Bridge scandal and whether it will impact CSX’s 2024 outlook. Encouragingly, the impact on Baltimore has been less than feared, and the Army Corps of Engineers expects to reopen the Port of Baltimore by the end of May. I think the bigger point here is how great CSX’s operational capabilities are (shifting volumes to other export terminals). That’s because, from $25 million a month, he’s only expected to have $30 million in headwinds (from mid-April to mid-April, he equates to about $41 million in headwinds). until the end of May).

This compares very favorably with Norfolk Southern Corporation, which said it would have a $50 million to $100 million impact on its second quarter 2024 revenue. CSX believes the impact may be even smaller, as it does not anticipate the benefit of increased coal mine availability during typical summer power outages.

In terms of pent-up demand, it’s going to be a summer of power outages for coal miners, but we’ll see how they deal with that, given the obvious slowdown that we’ve seen. . Is there an opportunity to make up some of this amount in Q3 and Q4? Yes, but it’s not in our plans right now. Financial results announcement for the first quarter of 2024

Returning to volumes, the growth trend in rail traffic in Q1 2024 shows an improvement from Q4 2023, with a weather-impacted January followed by a decline in volumes in February and March. Growth has rebounded, further supporting my view that shipping volumes will turn around. The first trendline for Q2 2024 shows CSX total carload growth of 5% year-over-year, indicating further acceleration.

There was some drag from intermodal volume growth of 2% versus 7% (which is accelerating, so that’s very encouraging), but again, this is I don’t think it indicates a decline in trading volume. Functions of disruption associated with the Baltimore Bridge collapse. Over time, the former intermodal carrier should return to growth mode, with negative impacts being actively managed by management as they divert volume to other terminals.

Regarding intermodal, I remain very optimistic about the outlook as international intermodal is seeing strong consumer demand and more stable inventory levels. Domestic intermodal transportation business grew at a slower pace compared to recent quarters, but the constraint on growth is not with CSX (as commented by JB Hunt (JBHT) management on the latest conference call) This is due to the competitive price environment in truck transportation. Due to overcapacity situations of more than 20%.

In my view, the price situation should only recover once the capacity oversupply is alleviated and as consumer spending picks up with further rate cuts. CSX’s domestic intermodal transportation revenues should increase if price competitiveness decreases compared to domestic intermodal transportation. I believe that rail remains the better logistics option from a cost-cutting perspective.

Looking down on P&L, there should be a tailwind for margin improvement due to faster revenue growth (operating margins will decline). The argument here is that CSX retains a strong employee base built post-COVID-19, but for reference, CSX currently has approximately 23,000 employees and FY19 employees. 21,000 people, but the cargo volume handled is almost the same (6.14 million pieces in FY23 vs. 6.22 million pieces in FY19). This determines how much your margins can grow. However, my counter-argument is that it provides CSX with more capacity to drive growth and should still lead to margin expansion.

Update model

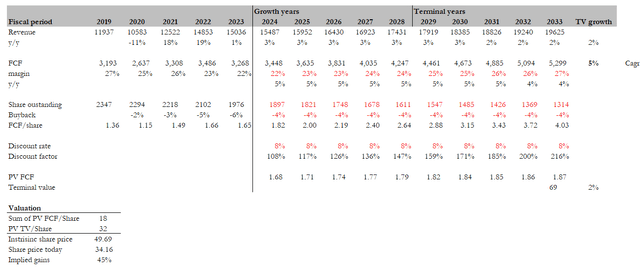

own calculations

I still think CSX stock has attractive upside potential, and my latest price target reflects 45% upside (previously my target was 33% upside). In my previous post, I explained in detail how the model works, so I encourage readers to check it out to see how the model works. What I’ve changed in this current model is to flesh out the expectations for revenue growth and FCF margin expansion, leading to his 5% CAGR growth in his FCF over the long term. Our first quarter 2024 results showed very strong evidence that volumes are on track to recover after adjusting for the Baltimore Bridge incident. This trend continues, with CSX’s revenue growth returning to historical (past 10 year) levels of ~3% before gradually slowing to 2% in the final exit year.

My FCF margin is probably conservative as I expect CSX to return to pre-COVID margin levels in 10 years. Translating these assumptions, FCF would increase to $5.3 billion in his 33rd fiscal year. If you discount the cash flows and terminal value by today’s values, the real stock price is about $50.

danger

I already talked about macro risks in a previous post, so I won’t repeat them here, but keep in mind that if coal prices continue to fall, CSX’s short-term performance could be more volatile than expected. Given that this is a product that is primarily driven by macro events outside of CSX’s control, it is possible that CSX will miss out on growth expectations.

conclusion

In conclusion, my evaluation of CSX is “buy”. The impact of the Baltimore Bridge incident was lower than expected, demonstrating CSX’s operational strength. Importantly, volume trends are positive and intermodal momentum is strong. The number of employees continues to increase, which gives us the ability to grow. The Q1 2024 results reinforced my belief that growth is back on the right track with historic levels and that CSX’s margins should improve accordingly given operating leverage.