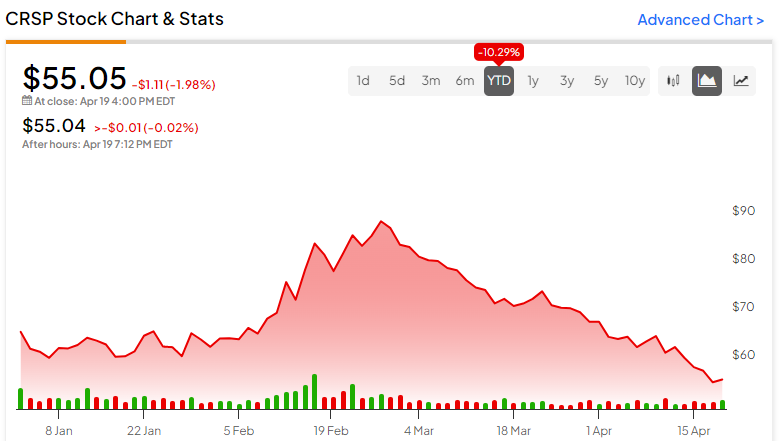

CRISPR Therapeutics (NASDAQ:CRSP) The stock price has been slowly trending down in recent months, which I think is unfair. The stock reached a high of nearly $90 per share, but is currently trading near $55. But rather than being bad news, the stock price decline reflects the company’s lack of major updates after it received regulatory approval for a novel gene-editing therapy in the UK and US in November and December.

Considering the potential market value of Greenlight processing and the potential of the company’s pipeline, I think CRISPR is significantly undervalued. I’m bullish on CRSP stock.

What is CRISPR Therapeutics?

CRISPR Therapeutics is a Swiss company at the forefront of gene editing. The company leverages his CRISPR-Cas9, a tool inspired by bacterial defense systems and co-invented with Dr. Emmanuel Charpentier, one of the founders of CRISPR Therapeutics. This technology can be understood by looking at his three components:

- CRISPR: This stands for “Clustered Regularly Interspaced Short Palindromicrepeats”, a collection of genetic information that some bacteria use as part of their antiviral systems.

- Cas9: CRISPR-associated (Cas) endonucleases or enzymes that act as “molecular scissors” to cut DNA;

- Guide RNA (gRNA): A type of ribonucleic acid (RNA) molecule that binds to Cas9 and directs it to where it needs to cut DNA.

This technology offers the potential to treat a variety of previously untreatable diseases, including sickle cell disease (SCD) and certain cancers. CRISPR Therapeutics has built a diverse treatment portfolio across a wide range of disease areas, including hemoglobinopathies (e.g., SCD), oncology, diabetes, and cardiovascular disease.

Partnership with Vertex Pharmaceuticals (NASDAQ:VRTX) led to the development of CASSGEVY, the first CRISPR-based therapy for a specific blood disease. This was not only the first CRISPR approval for a specific blood disease, but also the world’s first gene editing approval. CRISPR Therapeutics is at the forefront of this technology, bringing the potential of gene editing therapies across multiple research fields closer to reality.

Is CRISPR Therapeutics commercially viable?

So far, the Swiss company has only made money by achieving milestone payments from Vertex. However, with CASGEVY receiving regulatory approval in the UK, US, EU, Saudi Arabia and elsewhere as a treatment for his SCD and transfusion-dependent beta-thalassemia, CRISPR Therapeutics is on track to generate revenue from commercial activities. Masu.

Recent potential positive developments suggest that the Centers for Medicare and Medicaid Services (CMS) is proposing a 75% New Technology Supplemental Payment (NTAP) for CRISPR SCD and beta thalassemia treatments. . This is an increase from the typical 65% for NTAP products.

This high payment reflects a strategy CMS has previously used to incentivize the development of new treatments and drugs. CMS and other experts believe that offering higher reimbursement will make these innovative but expensive treatments more accessible to both hospitals and patients.

How much is CRISPR Therapeutics stock worth?

Valuing CRISPR Therapeutics is difficult because CRISPR Therapeutics does not yet generate revenue through typical revenue-generating activities. Therefore, its market value reflects its expected revenue from approved products and the strength of its pipeline.

Estimates vary widely regarding the size of the initial patient cohort. CRISPR’s CASSGEVY is one of two treatments approved for use in SCD and transfusion-dependent beta thalassemia, but at $2.2 million per treatment, it costs much more than the two treatments. It’s cheap. Additionally, two Wall Street analysts said that shortly after the treatment was given the go-ahead, Bluebird Bio (NASDAQ:Blue) Higher price and safety warnings may hinder sales compared to CASGEVY.

As mentioned in a previous article, conservative estimates suggest that CASGEVY’s potential market could include approximately 32,000 patients. Considering the $2.2 million price tag, this could create a market opportunity worth approximately $70.4 billion. The crux of the issue lies in how future health care providers will deliver care and whether insurance companies will cover it. This is why the recently reported proposal from CMS is so promising.

Finally, CRISPR Therapeutics boasts a strong balance sheet with $1.7 billion in cash, cash equivalents, and marketable securities. However, while revenue generation from commercial activities may not be far off, the company is not expected to become profitable until 2027. This may be off-putting to some investors. According to forecasts, CRISPR currently trades at 34.4 times expected 2027 earnings.

Is CRISPR Therapeutics stock a buy, according to analysts?

Analysts rate Crispr stock as a “moderate buy,” with 10 buys, 5 holds, and 2 sells over the past three months. CRSP’s average price target is $80.47, with a high estimate of $112 and a low estimate of $30. The average price target represents a 46.2% change from the previous price.

CRISPR Therapeutics Stock Final Results

CRISPR Therapeutics has not yet generated any revenue from commercial activities and is not expected to be profitable until 2027, so it’s hard to understand what its fair value will be. However, given the market size of SCD and beta-thalassemia drugs and CRISPR’s dominant position in the market, I am bullish on the company’s prospects.

disclosure

Source link