Main item

Hello, I’m Madeline.

The AI boom once promised to be a boon for chip startups, but that wasn’t the case last year.US chip startup just raised funding $881 million Revenue for the first nine months of 2023 was down from $1.79 billion in the year-ago period.

But in recent weeks, a flurry of funding rounds for venture capital-backed semiconductor companies suggests renewed enthusiasm from investors. Israeli startup Hailo has made an additional announcement. $120 million The company is working to raise money to take on NVIDIA in terms of putting chips on the “edge,” meaning devices that don’t have continuous access to the cloud, such as robots, cars, and smart cameras. Hailo says the company’s chips require less memory and much less power than his Nvidia AI processors running in data centers, and at a much lower cost, allowing him to run AI workloads on such devices. It is said that it can be executed.

Announced SiMa.ai $70 million With new funding led by Maverick Capital, the company is eyeing the cutting edge of chips that can similarly speed up AI performance in devices like cameras and cars.

MatX focuses solely on LLM functionality, as opposed to many of the tasks performed by Nvidia GPUs, and hopes to directly compete for Nvidia’s AI customers. The team raised $25 million in funding at the end of March. Nat Friedman and Daniel Gross, bloomberg report. recognizeThe company, which raised $102 million in February, is also among the candidates for AI accelerator chips.

And chipmaker Cerebras Systems plans to go public as early as the second half of this year. bloomberg report.

U.S. venture funding for semiconductor companies, like everything else, surged during boom times; $2.4 billion increasing from just $700 million in 2019 to 2021, crunch base news Reported before falling to Earth in 2023.

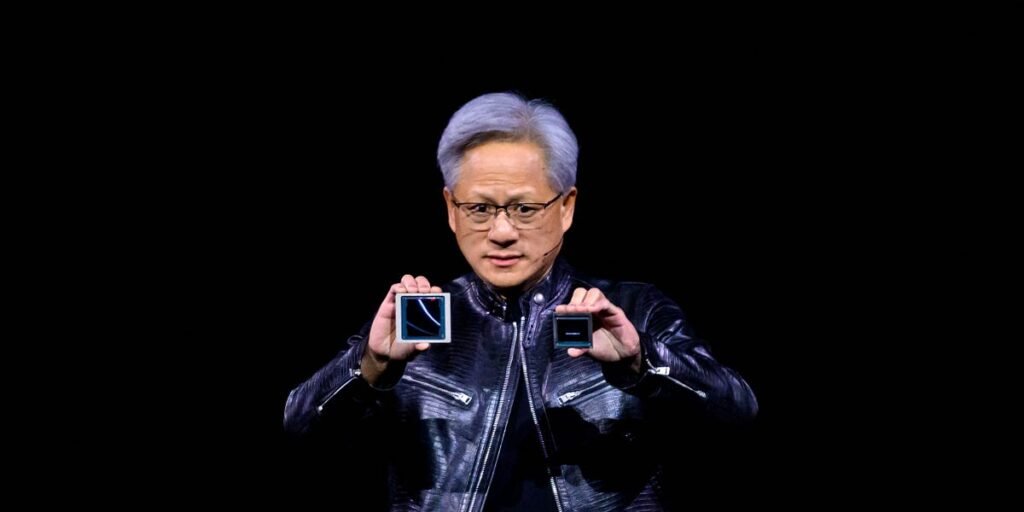

Chips can be a particularly tough business at the best of times, with long and expensive development schedules and notoriously cyclical demand. When it comes to AI chips, the startup must also confront the specter of his Nvidia. Beyond the chips themselves, Nvidia has built an ecosystem of software and components that provide significant advantages in building successive generations of market-leading products.

“NVIDIA has done a great job with the execution, not just the chips, but the software and model adoption,” he said. Rajiv Khemani He is the CEO of Auradine and a prolific AI startup investor who has put money into MatX. “The only way new chip startups can get funding and deliver 5-10x more value is by focusing on specific applications and segments, rather than competing broadly with 10,000-pound gorillas like Nvidia. I think it’s a guess.”

david mcqueenEditor-in-chief. microprocessor reportHe said edge computing technology could eventually become an even bigger market than GPUs and CPUs for data centers.

“NVIDIA hardware may support these devices by providing cloud computing capabilities, but inference at the edge is essential for many practical applications of AI,” MacQueen said. I am. This sums up Hailo and his SiMa.ai’s strategy at the moment.

MacQueen says there are also many areas where hardware startups can build their own software components for specific industries. For example, automobiles, healthcare, smart city infrastructure, etc.

“You can’t just plug in an Nvidia rack and go. It requires a supporting cast, from advanced purpose-built AI accelerator chips to network switching and memory, which are needed today for generative AI models. are becoming increasingly powerful devices to process huge amounts of data.”

This “supporting role” on the hardware side can be big business. Astera Institute IPO It was shown last month. The company makes connectivity hardware for data centers, a tool that AI companies rely on to move large amounts of data. The company’s stock price has fallen slightly in recent days, but it still trades at nearly double its March offering price, giving the company a market capitalization of more than $17 billion.

Another connection startup, Celestial AIThe company, which specializes in optical components, recently completed a $175 million Series C.

Not everyone has given up on going head to head with Nvidia.I wrote about Sam AltmanAn announcement that they are looking for “.trillions of dollars” was announced for new chip ventures in February, with Microsoft, Meta, and Amazon all developing their own chips. AMD is also making great strides.and grox An “LPU” or “language processing unit” is specifically designed to process sequences of data, such as code or natural language, and provides LLM output faster than GPUs, which were originally designed for graphics processing. To do.

But in the age of big AI, the best opportunity for nifty chip founders may be to go small.

Eric’s take

I felt embarrassed after hearing about Silicon Valley. Chamath Palihapitiya and david sax bending over backwards to defend Donald Trump’s Truth Social all in podcast.

I had to double check that it wasn’t an April Fool’s episode.

All-in staff have become experts in twisted intellectual exercises that may sound clever but fall apart upon serious analysis.

“I think this is a really watershed moment and it reminds me of 1997,” Palihapitiya said of Donald Trump’s social media company. lost $58.2 million compared to last year’s revenue of $4.1 million. Palihapitiya likened Truth Social to David Bowie’s successful experiment in selling royalty-backed bonds to investors.

“What’s happening now is a more sophisticated version of that movement, but on a much larger scale,” Palihapitiya said. He compared the company to a “trading card” and said its shares trade based on Donald Trump’s valuation.

Of course, as Palihapitiya eventually acknowledged towards the end of this corner, Truth Social is not backed by President Trump’s personal royalties. The company, a small social media company powered by President Trump’s posts, bears no resemblance to the legendary music catalog loved by millions.

The staff called GameStop several times and explained the characteristics of the meme stock in the friendliest way imaginable. Forget that GameStop stock has been steadily declining since Mania. While it’s true that markets can be driven by hype and enthusiasm in the short term, ultimately stock prices tend to reflect a company’s actual financial performance.

However, this is different if the stock is not related to the company. You would be foolish to expect All In staff to be bothered by the fact that they were celebrating a Republican presidential candidate’s circumvention of campaign finance rules.

Top commenters on the All-In subreddit total Segments rise properly:

The Trump Meme Stocks segment perfectly sums up this pod.

Billionaire TikTok investor visits President Trump to help raise Truth Social’s valuation to something like 200 times what it would be worth at other companies with no voice.

They’re all justifying it as if it’s a normal thing and not some huge feud and corruption going on in public.

host Jason Calacanis At least it directly stated the obvious fact that Truth Social is extremely overrated. “If you buy this, you’ll lose a lot of money.”